- Australia

- /

- Oil and Gas

- /

- ASX:NHC

How Declining Dividends and Rising Output at New Hope (ASX:NHC) May Reshape Its Capital Strategy

Reviewed by Simply Wall St

- New Hope Corporation Limited recently reported its full year 2025 results, announcing a final dividend of A$0.15 per share, a slight decrease in net income to A$439.37 million, and group coal production rising 18.1% to 10.7 Mt, all in line with guidance.

- While the company achieved higher production and met operational targets, the lower dividend and dip in earnings highlight the impact of market and regulatory challenges facing thermal coal producers.

- We’ll explore how meeting production guidance amidst a reduced dividend payment could influence New Hope’s investment narrative in the current market climate.

Find companies with promising cash flow potential yet trading below their fair value.

New Hope Investment Narrative Recap

To be a shareholder in New Hope right now, you need to believe that strong coal production growth and disciplined cost management can outweigh structural headwinds from decarbonization and policy risk. The recent drop in dividend and earnings is not a material surprise, but it refocuses attention on how easily external pressures can weigh on near-term returns, especially with coal prices and regulation driving much of the volatility.

Among recent updates, New Hope’s announcement of 18.1% year-on-year growth in saleable coal production stands out. With operational guidance met and capacity on the rise, investors may see this as support for the company’s ability to generate value amid fluctuating markets, even as declining dividends signal that ongoing market and regulatory risks can’t be ignored.

However, with margin pressure looming as remediation and regulatory costs rise, investors should not overlook the reality that...

Read the full narrative on New Hope (it's free!)

New Hope's narrative projects A$2.2 billion revenue and A$520.5 million earnings by 2028. This requires 3.2% yearly revenue growth and a A$44 million decrease in earnings from A$564.5 million today.

Uncover how New Hope's forecasts yield a A$4.14 fair value, in line with its current price.

Exploring Other Perspectives

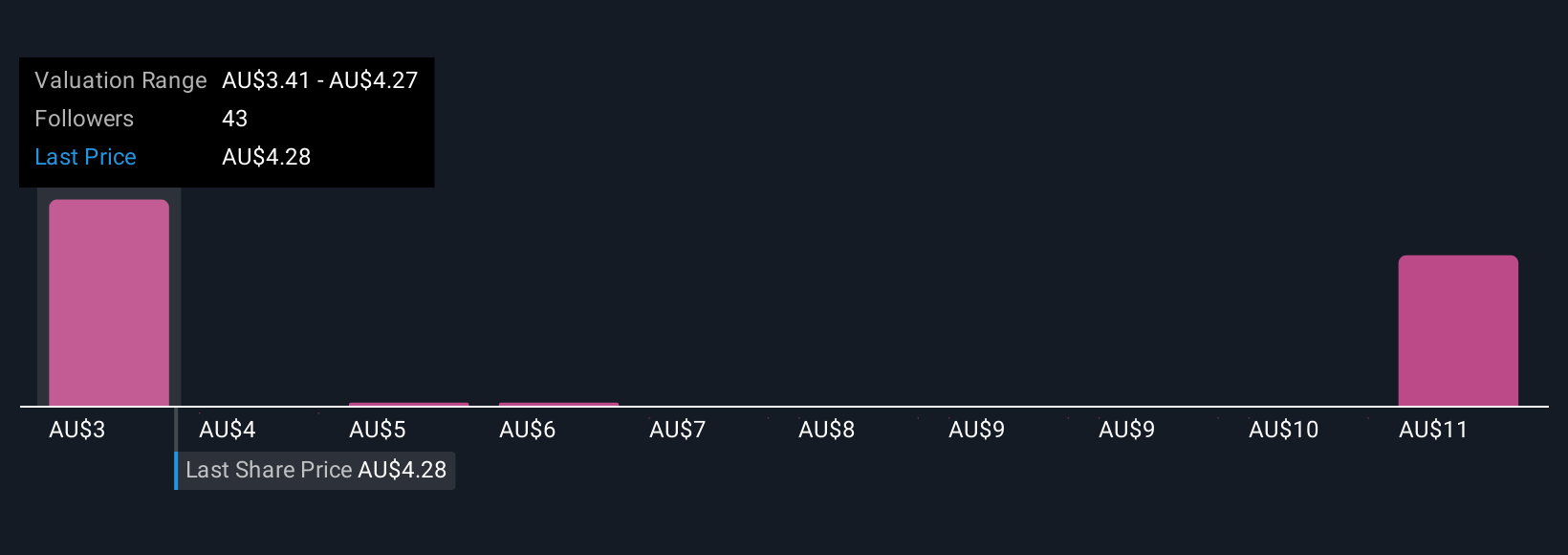

Simply Wall St Community members posted 12 fair value estimates for New Hope, stretching from A$2.85 up to A$13.40. Yet with ongoing policy pressure likely to curb coal demand, it’s easy to see why views on future performance diverge so widely, explore what others think and see how your outlook compares.

Explore 12 other fair value estimates on New Hope - why the stock might be worth 32% less than the current price!

Build Your Own New Hope Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Hope research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free New Hope research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Hope's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHC

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives