It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in New Hope (ASX:NHC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for New Hope

How Fast Is New Hope Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that New Hope grew its EPS from AU$0.095 to AU$1.13, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

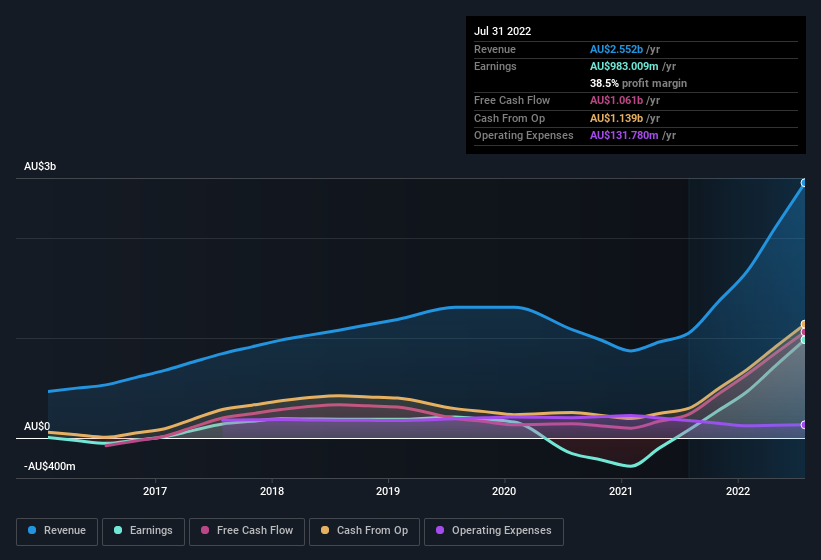

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that New Hope is growing revenues, and EBIT margins improved by 35.8 percentage points to 56%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for New Hope's future EPS 100% free.

Are New Hope Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The real kicker here is that New Hope insiders spent a staggering AU$7.0m on acquiring shares in just one year, without single share being sold in the meantime. Knowing this, New Hope will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Non-Executive Chairman, Robert Millner, who made the biggest single acquisition, paying AU$1.9m for shares at about AU$6.32 each.

Along with the insider buying, another encouraging sign for New Hope is that insiders, as a group, have a considerable shareholding. Holding AU$90m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This would indicate that the goals of shareholders and management are one and the same.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Rob Bishop is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between AU$3.0b and AU$9.5b, like New Hope, the median CEO pay is around AU$3.5m.

New Hope's CEO took home a total compensation package worth AU$1.8m in the year leading up to July 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is New Hope Worth Keeping An Eye On?

New Hope's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest New Hope belongs near the top of your watchlist. Even so, be aware that New Hope is showing 3 warning signs in our investment analysis , and 1 of those is potentially serious...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of New Hope, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if New Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NHC

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives