- Australia

- /

- Oil and Gas

- /

- ASX:NHC

3 ASX Dividend Stocks With Yields From 3% To Enhance Your Portfolio

Reviewed by Simply Wall St

The Australian market has been experiencing mixed performance with the ASX200 closing flat at 8,548 points, while sectors like Energy and Information Technology have shown notable gains. In this environment, selecting dividend stocks can be a strategic move to enhance your portfolio by providing steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 8.57% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.37% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.18% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.92% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.74% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.36% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.00% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.49% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.61% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 9.63% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

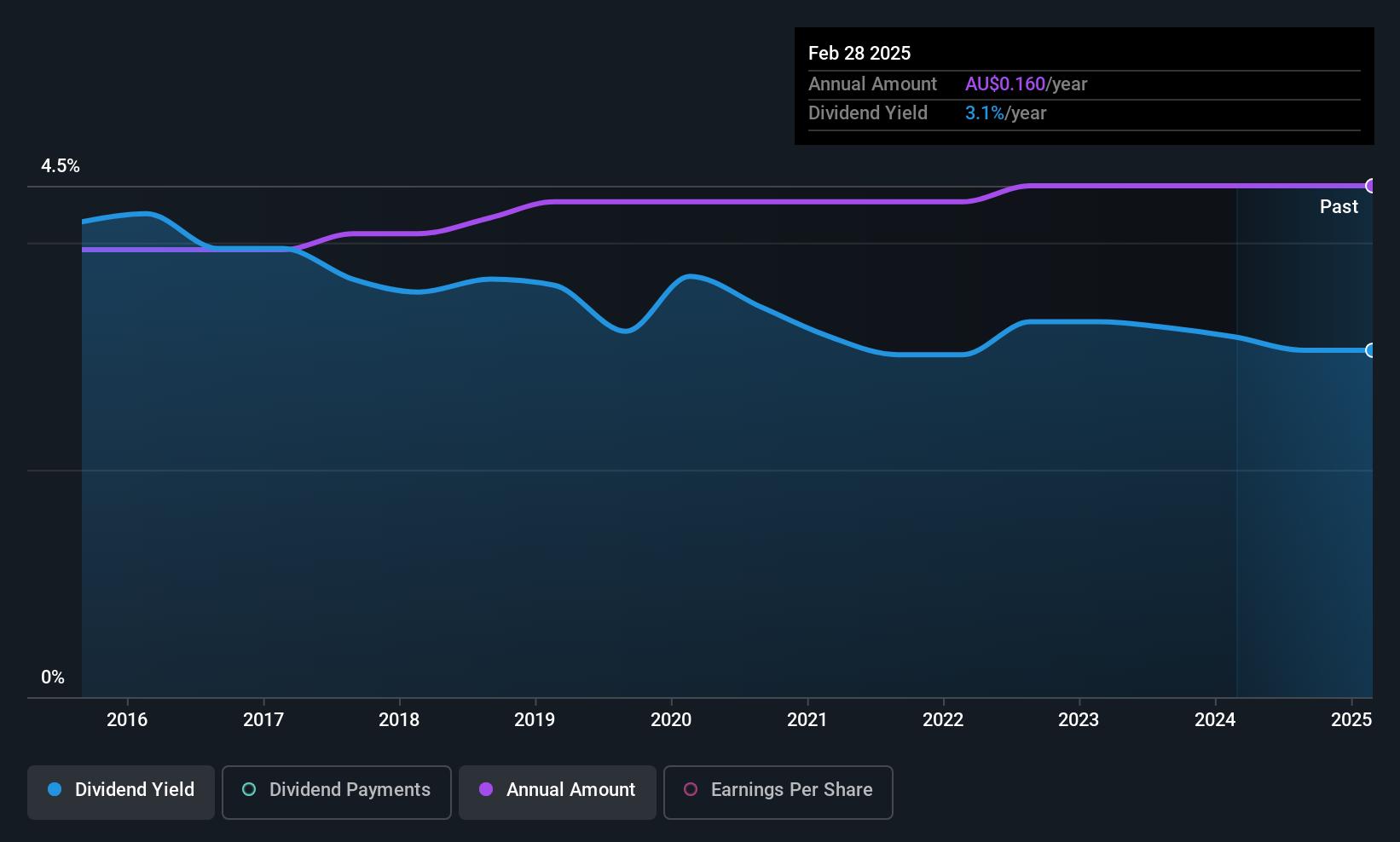

Diversified United Investment (ASX:DUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market cap of A$1.15 billion.

Operations: Diversified United Investment Limited generates revenue primarily from its investment company segment, amounting to A$46.41 million.

Dividend Yield: 3%

Diversified United Investment has delivered reliable and stable dividend payments over the past decade, with consistent growth. However, its current dividend yield of 3.01% is lower than top-tier Australian dividend stocks. The high payout ratio of 94.2% indicates dividends are not well covered by earnings, though they are supported by cash flows with a cash payout ratio of 89.4%. This suggests potential sustainability concerns despite historical stability and growth in payouts.

- Get an in-depth perspective on Diversified United Investment's performance by reading our dividend report here.

- Our valuation report unveils the possibility Diversified United Investment's shares may be trading at a premium.

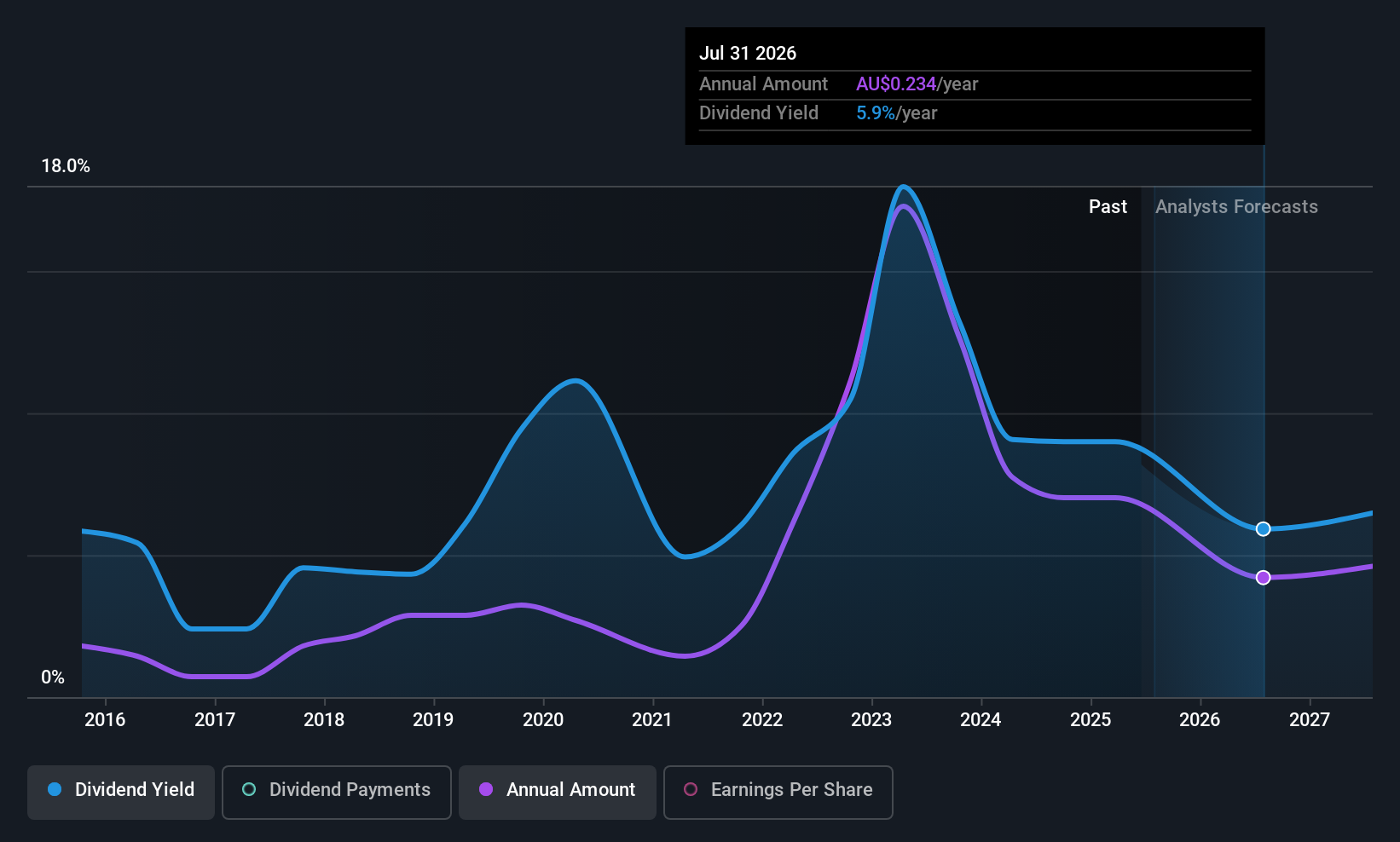

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: New Hope Corporation Limited is involved in the exploration, development, production, and processing of coal as well as oil and gas properties, with a market cap of A$3.31 billion.

Operations: New Hope Corporation Limited generates revenue primarily from its Coal Mining operations in NSW, contributing A$1.58 billion, and Coal Mining in QLD (including Treasury and Investments), adding A$315.68 million.

Dividend Yield: 9.9%

New Hope Corporation offers an attractive dividend yield, ranking in the top 25% of Australian dividend payers. Despite a volatile and unstable dividend history, recent increases suggest potential growth. The payout ratio of 61.4% indicates dividends are well-covered by earnings, while a cash payout ratio of 67% supports sustainability. A share buyback program worth A$100 million further enhances shareholder returns. However, anticipated earnings declines may impact future payouts and stability.

- Dive into the specifics of New Hope here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that New Hope is priced lower than what may be justified by its financials.

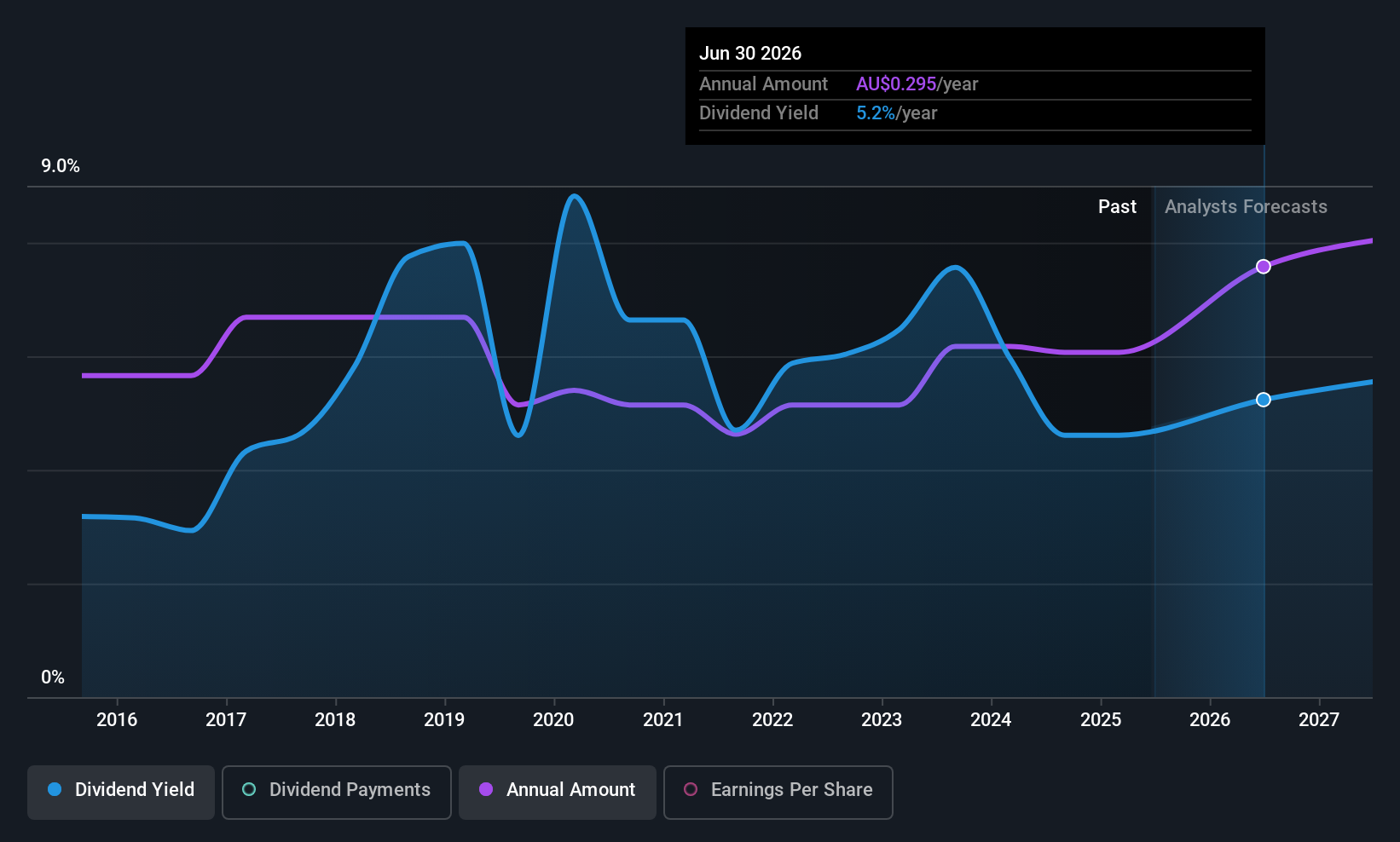

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$548.98 million.

Operations: Servcorp Limited generates revenue primarily from its Real Estate - Rental segment, amounting to A$326.36 million.

Dividend Yield: 4.3%

Servcorp's dividend yield of 4.25% is below the top tier in Australia, but dividends are well-covered by earnings and cash flows with payout ratios of 47.1% and 13.3%, respectively. Despite a history of volatility, dividends have grown over the past decade. The stock trades at a significant discount to its estimated fair value, indicating potential for capital appreciation alongside income generation from dividends, although its unstable track record warrants caution for reliability-focused investors.

- Take a closer look at Servcorp's potential here in our dividend report.

- Upon reviewing our latest valuation report, Servcorp's share price might be too pessimistic.

Turning Ideas Into Actions

- Navigate through the entire inventory of 29 Top ASX Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if New Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHC

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion