- Australia

- /

- Electrical

- /

- ASX:LIS

3 ASX Penny Stocks With Market Caps Under A$200M To Watch

Reviewed by Simply Wall St

As the Australian market navigates a period of correction, influenced by global economic factors and local financial dynamics, investors are keenly observing sectors like materials and IT for potential opportunities. Amidst these fluctuations, penny stocks—though an older term—remain a compelling area for exploration due to their capacity for surprising value. By focusing on companies with solid financials and growth potential, investors can uncover hidden gems within this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.44 | A$126.1M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.39 | A$112.74M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.82 | A$51.06M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$444.16M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.61 | A$266.44M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.49 | A$57.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.77 | A$368.39M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.13 | A$1.3B | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.38 | A$624.51M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 412 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Conrad Asia Energy (ASX:CRD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conrad Asia Energy Ltd., along with its subsidiaries, focuses on oil and gas exploration and development, with a market capitalization of A$152.56 million.

Operations: Conrad Asia Energy Ltd. has not reported any specific revenue segments.

Market Cap: A$152.56M

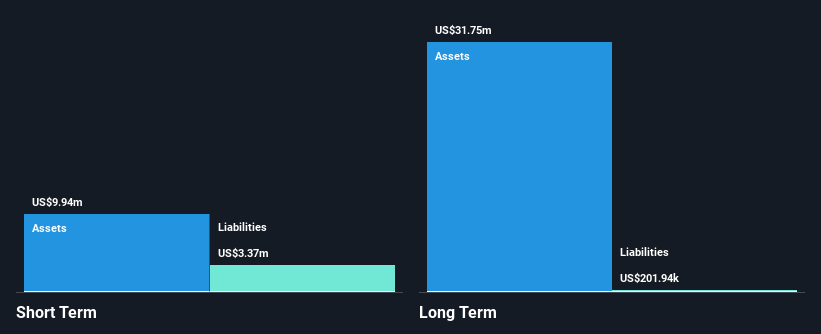

Conrad Asia Energy Ltd., with a market cap of A$152.56 million, is pre-revenue and currently unprofitable, with no significant revenue streams reported. The company has managed to reduce its losses over the past five years by 14% annually but remains forecasted for declining earnings at an average rate of 27.2% per year over the next three years. Despite stable weekly volatility and being debt-free, Conrad faces financial challenges with less than a year of cash runway based on current free cash flow. Recently, it reported a net loss reduction from US$3.5 million to US$2.4 million year-over-year for the half-year ended June 30, 2025, but was dropped from the S&P/ASX All Ordinaries Index in September 2025 due to performance concerns.

- Take a closer look at Conrad Asia Energy's potential here in our financial health report.

- Examine Conrad Asia Energy's earnings growth report to understand how analysts expect it to perform.

Cyclopharm (ASX:CYC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cyclopharm Limited manufactures and sells medical equipment and radiopharmaceuticals across the Asia Pacific, Europe, Canada, the United States, and internationally with a market cap of A$83.35 million.

Operations: The company generates revenue of A$30.72 million from its Medical Imaging Systems segment.

Market Cap: A$83.35M

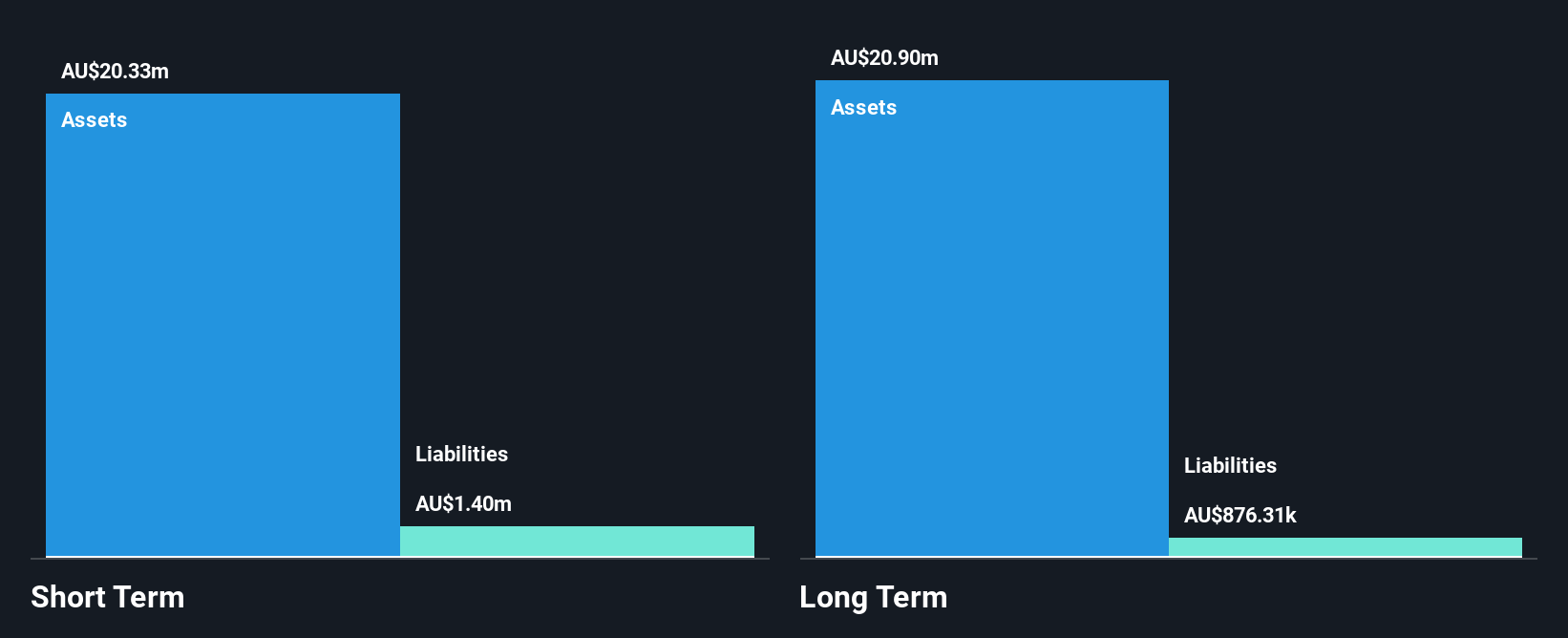

Cyclopharm Limited, with a market cap of A$83.35 million, is unprofitable and has seen its losses grow by 22% annually over the past five years. Despite this, it generates A$30.72 million in revenue from its Medical Imaging Systems segment and remains debt-free with short-term assets exceeding liabilities. The company trades at a significant discount to estimated fair value but faces financial challenges with less than a year of cash runway based on current free cash flow. Cyclopharm was recently dropped from the S&P/ASX All Ordinaries Index amid performance concerns but anticipates substantial revenue growth moving forward.

- Click to explore a detailed breakdown of our findings in Cyclopharm's financial health report.

- Evaluate Cyclopharm's prospects by accessing our earnings growth report.

Li-S Energy (ASX:LIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Li-S Energy Limited is an Australian company focused on developing and commercializing lithium sulphur and metal batteries, with a market cap of A$104.07 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$104.07M

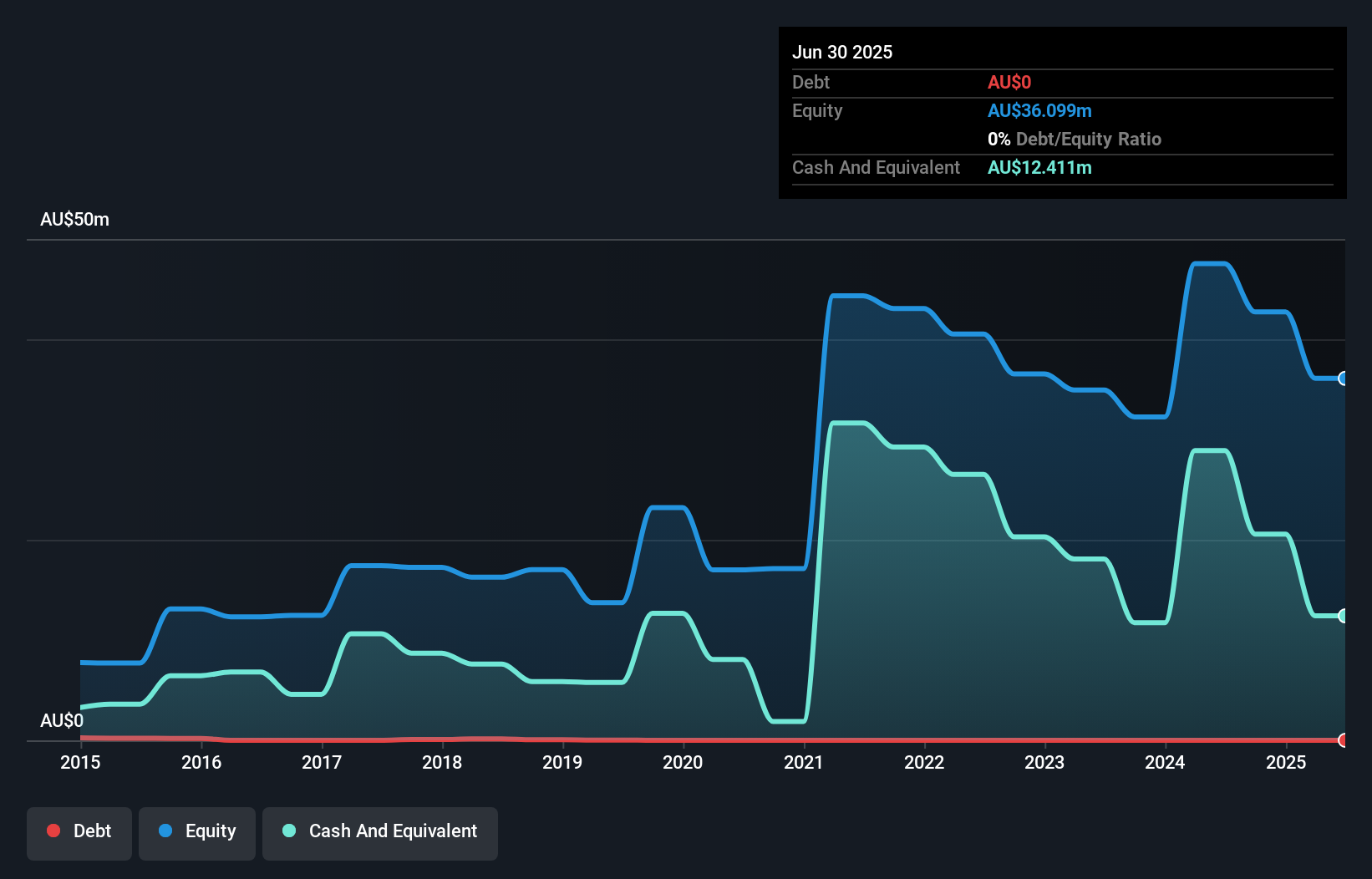

Li-S Energy, with a market cap of A$104.07 million, remains pre-revenue and unprofitable, yet it has a solid cash runway for over two years without debt. The company's recent collaboration with Praetorian Aeronautics aims to integrate its advanced lithium-sulfur batteries into defence drones, highlighting potential strategic growth in aerospace and defence sectors. Despite an inexperienced board and increasing losses, Li-S Energy's focus on high-energy-density battery technology positions it well for future opportunities in dual-use technologies. The management team is experienced, supporting ongoing commercialization efforts amid executive changes including a new CFO appointment.

- Jump into the full analysis health report here for a deeper understanding of Li-S Energy.

- Gain insights into Li-S Energy's past trends and performance with our report on the company's historical track record.

Next Steps

- Click here to access our complete index of 412 ASX Penny Stocks.

- Interested In Other Possibilities? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LIS

Li-S Energy

Engages in the development and commercialization of lithium sulphur and metal batteries in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives