- Australia

- /

- Oil and Gas

- /

- ASX:COE

The past five years for Cooper Energy (ASX:COE) investors has not been profitable

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the Cooper Energy Limited (ASX:COE) share price dropped 58% over five years. We certainly feel for shareholders who bought near the top.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for Cooper Energy

Given that Cooper Energy didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Cooper Energy saw its revenue increase by 26% per year. That's well above most other pre-profit companies. Unfortunately for shareholders the share price has dropped 10% per year - disappointing considering the growth. It's safe to say investor expectations are more grounded now. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

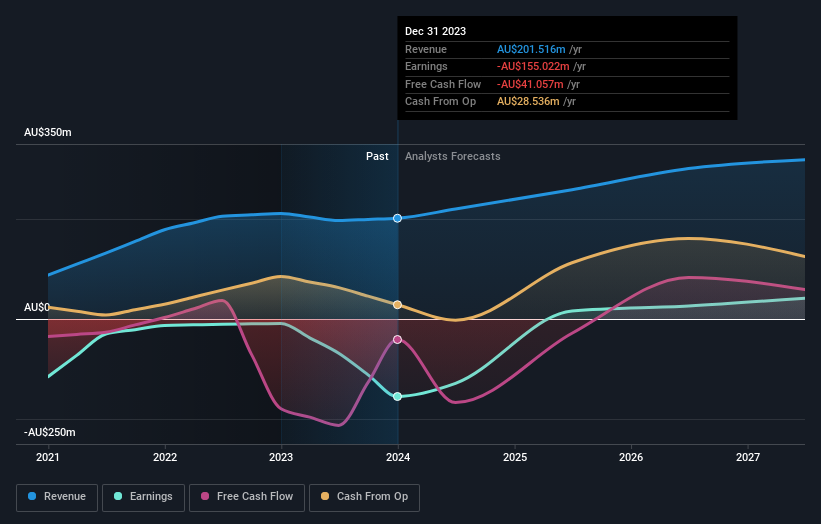

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Cooper Energy is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We've already covered Cooper Energy's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Cooper Energy hasn't been paying dividends, but its TSR of -55% exceeds its share price return of -58%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Cooper Energy shareholders have received a total shareholder return of 57% over the last year. That certainly beats the loss of about 9% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. If you would like to research Cooper Energy in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Cooper Energy better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:COE

Cooper Energy

An upstream gas and oil exploration and production company, engages in securing, finding, developing, producing, and selling of hydrocarbons in Australia.

Undervalued with reasonable growth potential.