- Australia

- /

- Oil and Gas

- /

- ASX:BPT

How Investors Are Reacting To Beach Energy (ASX:BPT) Western Flank Production Drop in Q1 2026

Reviewed by Sasha Jovanovic

- Beach Energy Limited recently reported its operating results for the first quarter of 2026, revealing Western Flank production of 371,000 barrels of oil equivalent (kboe), which represents a 16% decrease from the prior quarter, with oil and gas volumes both falling notably.

- This operational decline is significant, given the Western Flank's role as a key contributor to the company's overall output and future revenue streams.

- We will examine how the Western Flank's lower production levels may influence Beach Energy's investment narrative and future prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Beach Energy Investment Narrative Recap

To own Beach Energy shares, investors need to believe in the company’s ability to deliver consistent output as it pivots to new growth projects and navigates natural decline at mature assets. The recent 16% quarter-on-quarter production drop at the Western Flank pressures near-term confidence in Beach’s most important catalyst, the Waitsia Gas Project, by highlighting the portfolio’s vulnerability to operational setbacks. This same decline directly sharpens focus on the key risk of reserve depletion impacting future volumes.

Against this backdrop, Beach’s updated production guidance for FY2026, issued in August, remains relevant as it sets the company’s targets amid ongoing declines at legacy fields like the Western Flank. Whether actual output tracks the guided 19.7 million to 22.0 million barrels of oil equivalent will inform near-term sentiment and investor expectations about management’s ability to stabilize the production base as Waitsia ramps up.

However, investors should also be aware that with Western Flank output falling at an accelerated pace, the risk around Beach’s reserve life and ability to replace declining production volumes remains front and center…

Read the full narrative on Beach Energy (it's free!)

Beach Energy's narrative projects A$2.0 billion in revenue and A$537.5 million in earnings by 2028. This scenario assumes a 1.6% annual revenue decline and a A$581.3 million increase in earnings from the current A$-43.8 million.

Uncover how Beach Energy's forecasts yield a A$1.23 fair value, in line with its current price.

Exploring Other Perspectives

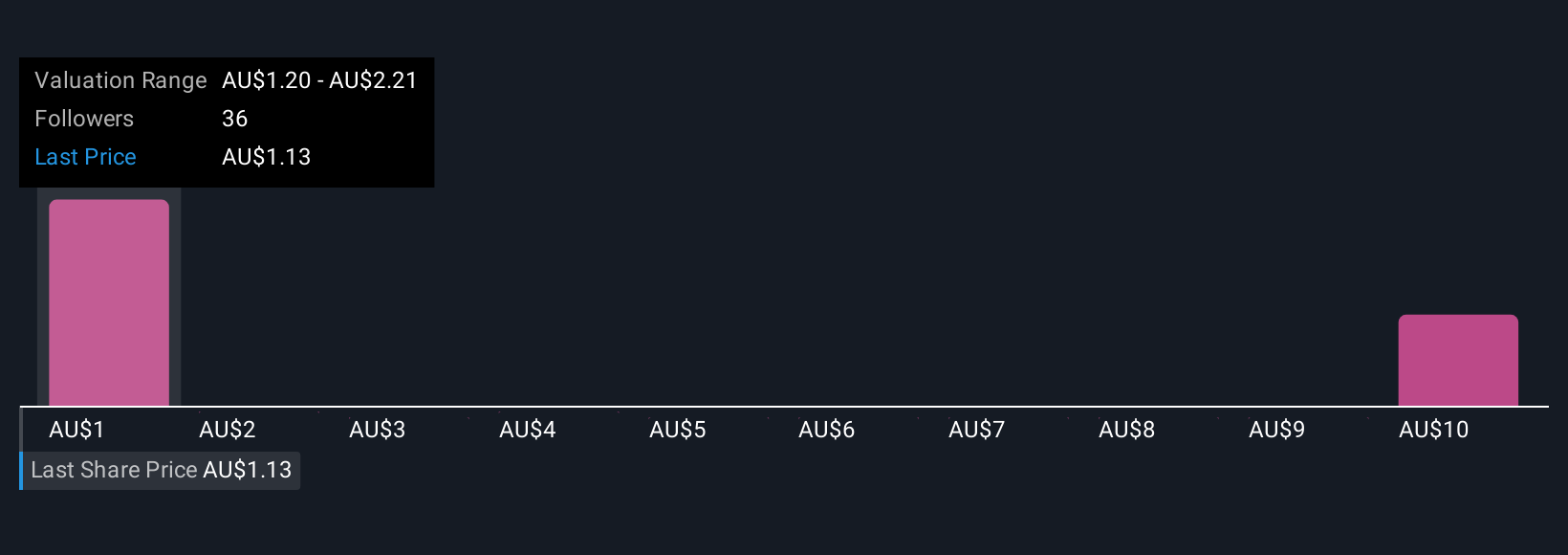

Simply Wall St Community members provided 10 individual fair value estimates for Beach Energy, ranging widely from A$1.20 to A$9.86 per share. With Western Flank production falling faster than expected, opinions on how quickly Beach can offset natural decline may influence your view of future performance and value, so see what others are forecasting.

Explore 10 other fair value estimates on Beach Energy - why the stock might be worth over 7x more than the current price!

Build Your Own Beach Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beach Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Beach Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beach Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beach Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BPT

Beach Energy

Operates as an oil and gas exploration and production company.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives