- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

Will Zip Co’s (ASX:ZIP) Nasdaq Ambitions Reshape Its Global Expansion Strategy?

Reviewed by Sasha Jovanovic

- Zip Co announced progress on its share buy-back program and revealed plans to pursue a Nasdaq listing to support its US expansion, aiming to tap new capital sources and increase exposure to American investors.

- This dual approach could influence Zip Co’s capital structure and global growth strategy, positioning the company to seek broader market opportunities in the competitive Buy Now, Pay Later space.

- We'll look at how Zip Co’s move toward a Nasdaq listing adds a new dimension to its long-term investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Zip Co Investment Narrative Recap

To own Zip Co shares, investors need to believe in the company’s ability to capture long-term growth from expanding digital payment adoption, especially in the underpenetrated US Buy Now, Pay Later market. The recent Nasdaq listing plan and share buy-back progress add flexibility and raise Zip’s public profile, but do not materially affect the company’s most important near-term catalyst: winning large-scale US partnerships. However, competitive pressure in the US market remains the biggest risk and is a factor to watch closely.

Of the company’s recent announcements, Zip Co’s expanded partnership with Stripe stands out, as it builds on the Nasdaq listing initiative by increasing the payment platform’s reach with American merchants. This partnerships-focused approach supports Zip’s pursuit of higher transaction volumes and active user growth, which connect directly to its short-term catalysts and medium-term US ambitions.

By contrast, investors should also be aware of how intensifying competition in the US could impact Zip Co’s ability to sustain transaction growth and market share...

Read the full narrative on Zip Co (it's free!)

Zip Co's outlook projects A$1.7 billion in revenue and A$216.9 million in earnings by 2028. This scenario assumes a 17.4% annual revenue growth rate and a A$137 million increase in earnings from the current A$79.9 million.

Uncover how Zip Co's forecasts yield a A$5.10 fair value, a 62% upside to its current price.

Exploring Other Perspectives

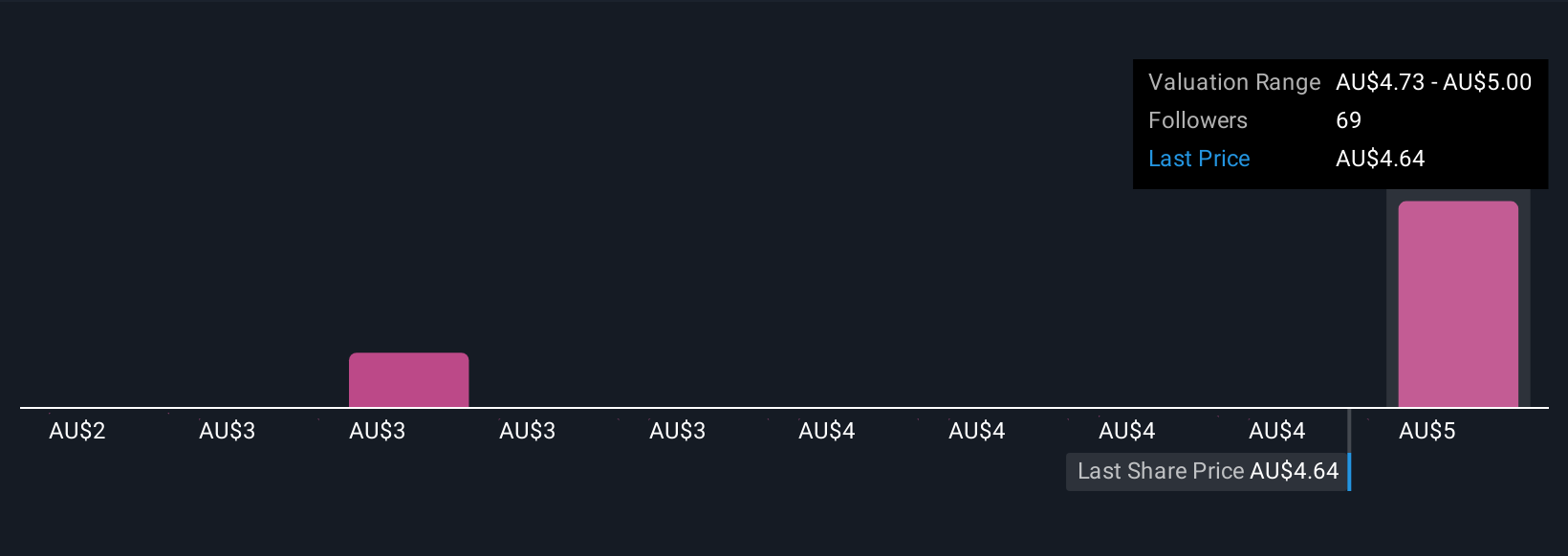

Seven user-generated fair value estimates in the Simply Wall St Community range from A$2.27 to A$5.10. While opinions differ, Zip's push in US markets coupled with high industry competition could mean performance expectations shift quickly.

Explore 7 other fair value estimates on Zip Co - why the stock might be worth 28% less than the current price!

Build Your Own Zip Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zip Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zip Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zip Co's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zip Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance, personal finance, and payments solutions in Australia, New Zealand, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives