- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

Could Stripe Partnership Push Zip Co (ASX:ZIP) Toward a Stronger US Market Position?

Reviewed by Sasha Jovanovic

- On October 23, 2025, Zip Co Limited announced an expanded partnership with Stripe, enabling U.S. merchants to activate Zip’s buy-now-pay-later solution through Stripe’s optimized checkout interfaces, including a no-code setup via the Stripe Dashboard.

- This partnership positions Zip to reach a broader segment of financially underserved consumers while helping U.S. merchants enhance conversion rates through embedded installment payment options.

- We’ll look at how the integration with Stripe’s streamlined checkout could strengthen Zip Co’s U.S. presence and overall growth trajectory.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Zip Co Investment Narrative Recap

To be a Zip Co shareholder, you’d need to believe in the company’s ability to scale its buy-now-pay-later platform through rapid partnerships and digital innovation, especially in the key U.S. market. The expanded partnership with Stripe could accelerate U.S. adoption by making Zip’s solution effortless for thousands of merchants to activate, directly supporting the short-term catalyst of distribution growth; however, it does not materially reduce Zip’s exposure to intensifying competition and ongoing margin pressure in that region.

One closely related announcement worth noting is the August 2025 integration with Google Pay, which brought Zip’s installment payments to Chrome users. Like the Stripe deal, this initiative is central to Zip’s strategy of embedding its offering within widely used e-commerce channels, seeking to boost transaction volumes and merchant engagement, key factors in the company’s growth outlook.

But, in contrast to these promising integrations, investors should be aware that Zip’s reliance on lower-margin U.S. business could still…

Read the full narrative on Zip Co (it's free!)

Zip Co's narrative projects A$1.7 billion revenue and A$216.9 million earnings by 2028. This requires 17.4% yearly revenue growth and a A$137 million earnings increase from A$79.9 million today.

Uncover how Zip Co's forecasts yield a A$5.10 fair value, a 41% upside to its current price.

Exploring Other Perspectives

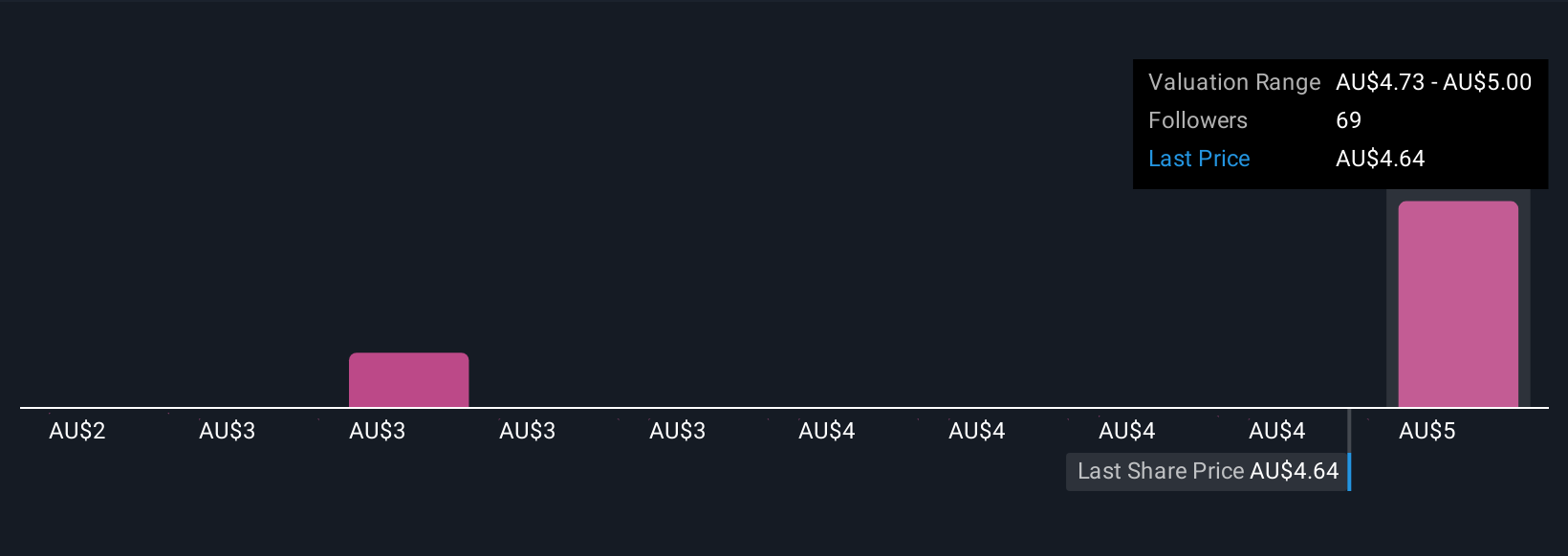

Seven distinct fair value estimates from the Simply Wall St Community put Zip Co between A$2.27 and A$5.10 per share, revealing broad differences among retail investors. While distribution partnerships are expanding, sustained competition and ongoing margin compression still shape the direction of Zip Co’s longer-term business performance.

Explore 7 other fair value estimates on Zip Co - why the stock might be worth 37% less than the current price!

Build Your Own Zip Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zip Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zip Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zip Co's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zip Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance, personal finance, and payments solutions in Australia, New Zealand, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion