Over the last 7 days, the Australian market has dropped 1.5%, but it has risen by 19% over the past year and is expected to see earnings grow by 12% annually. In such a landscape, identifying stocks with solid fundamentals and growth potential becomes crucial, especially when considering penny stocks. Although "penny stocks" might seem like an outdated term, they still refer to smaller or emerging companies that can offer significant value if backed by strong financial health and clear growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.61 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$833.14M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers technology-driven captioning, transcription, and translation services across several regions including Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom with a market cap of A$160.79 million.

Operations: The company's revenue is generated from its Internet Software & Services segment, amounting to A$66.24 million.

Market Cap: A$160.79M

Ai-Media Technologies Limited, with a market cap of A$160.79 million, has shown resilience despite being unprofitable by maintaining a positive free cash flow and reducing losses by 23.3% annually over five years. The company is debt-free and its short-term assets of A$26.8 million exceed both short-term and long-term liabilities, providing financial stability. Recent executive changes include the appointment of Jason Singh as CFO to drive performance improvements in the SaaS environment. Although there was significant insider selling recently, earnings have grown modestly from A$61.8 million to A$66.24 million year-over-year with reduced net losses reported at A$1.34 million from A$4 million previously.

- Click here and access our complete financial health analysis report to understand the dynamics of Ai-Media Technologies.

- Evaluate Ai-Media Technologies' prospects by accessing our earnings growth report.

Articore Group (ASX:ATG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Articore Group Limited operates as an online marketplace for art and design products in Australia, the United States, the United Kingdom, and internationally, with a market cap of A$108.49 million.

Operations: The company's revenue of A$492.99 million is generated from its Redbubble and Teepublic marketplaces.

Market Cap: A$108.49M

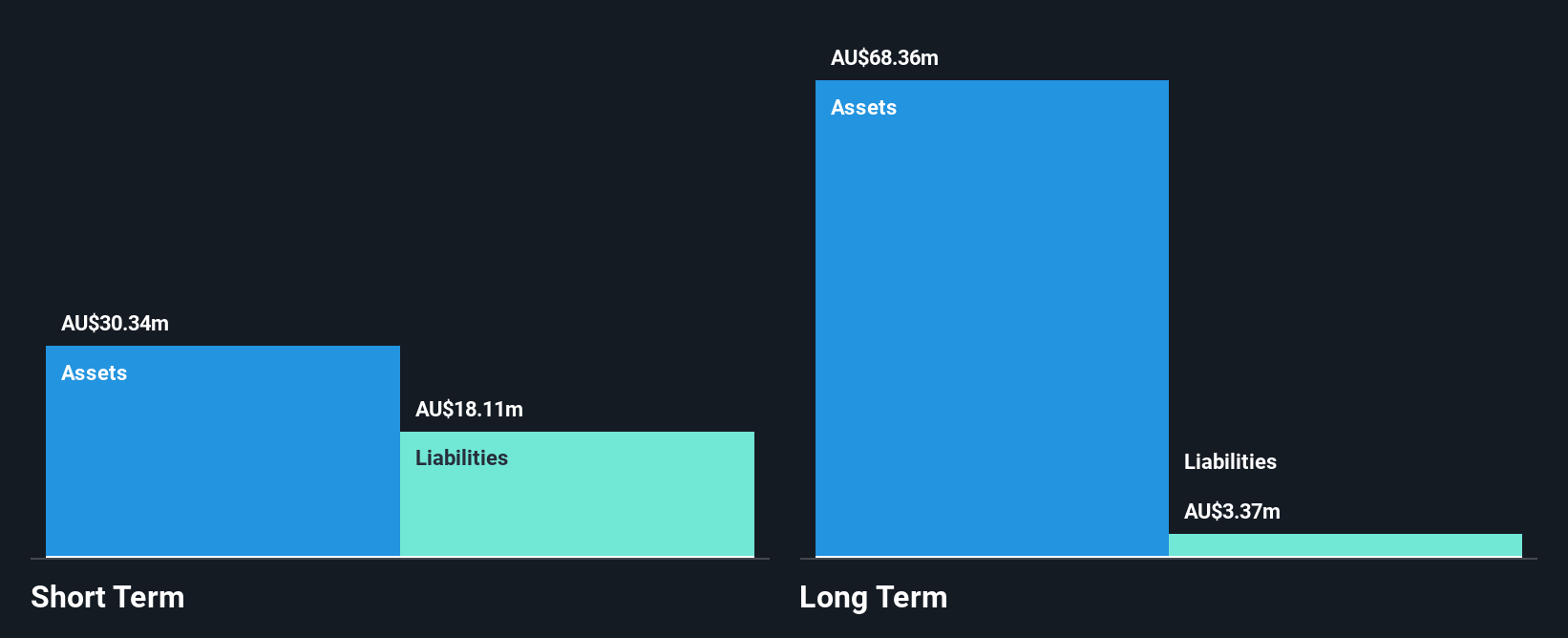

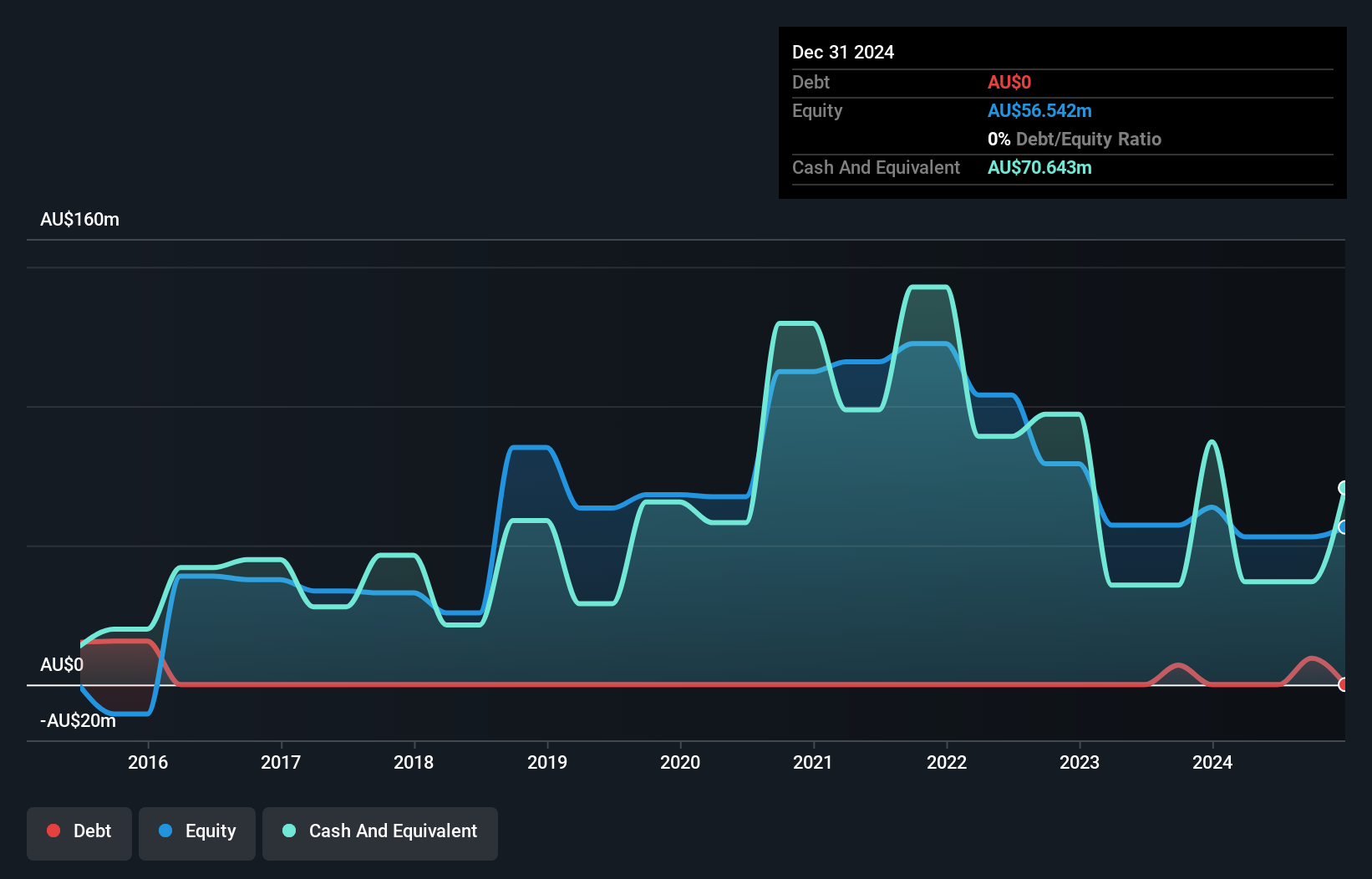

Articore Group Limited, with a market cap of A$108.49 million, faces challenges despite generating A$492.99 million in revenue through its Redbubble and Teepublic marketplaces. The company remains unprofitable, reporting a net loss of A$8.84 million for the year ending June 2024, though losses have decreased from the previous year's A$54.18 million. Short-term assets of A$49.8 million do not cover liabilities of A$68.7 million, indicating liquidity pressure despite having no debt and sufficient cash runway for over three years at current free cash flow levels. Recent activist investor involvement highlights strategic concerns and calls for board changes to enhance shareholder value.

- Take a closer look at Articore Group's potential here in our financial health report.

- Assess Articore Group's future earnings estimates with our detailed growth reports.

Wisr (ASX:WZR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wisr Limited operates in the lending business in Australia with a market capitalization of A$38.66 million.

Operations: The company's revenue segment consists of the provision of personal loans to consumers, generating A$21.78 million.

Market Cap: A$38.66M

Wisr Limited, with a market cap of A$38.66 million, operates in the lending sector and reported revenues of A$21.78 million. Despite reducing its net loss from A$13.15 million to A$8.19 million over the past year, Wisr remains unprofitable and is not expected to achieve profitability in the near term. The company's short-term assets significantly exceed both short- and long-term liabilities, providing a stable financial position despite high debt levels indicated by a net debt to equity ratio of 1482.6%. Recent board changes reflect ongoing governance adjustments as Wisr navigates its strategic path forward amidst industry challenges.

- Click here to discover the nuances of Wisr with our detailed analytical financial health report.

- Understand Wisr's earnings outlook by examining our growth report.

Key Takeaways

- Get an in-depth perspective on all 1,031 ASX Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ATG

Articore Group

Operates as an online marketplace that facilitates the sale of art and design products in Australia, the United States, the United Kingdom, and internationally.

Excellent balance sheet and good value.