- Australia

- /

- Capital Markets

- /

- ASX:TIP

I Ran A Stock Scan For Earnings Growth And Teaminvest Private Group (ASX:TIP) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Teaminvest Private Group (ASX:TIP), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Teaminvest Private Group

How Fast Is Teaminvest Private Group Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. It is therefore awe-striking that Teaminvest Private Group's EPS went from AU$0.012 to AU$0.052 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

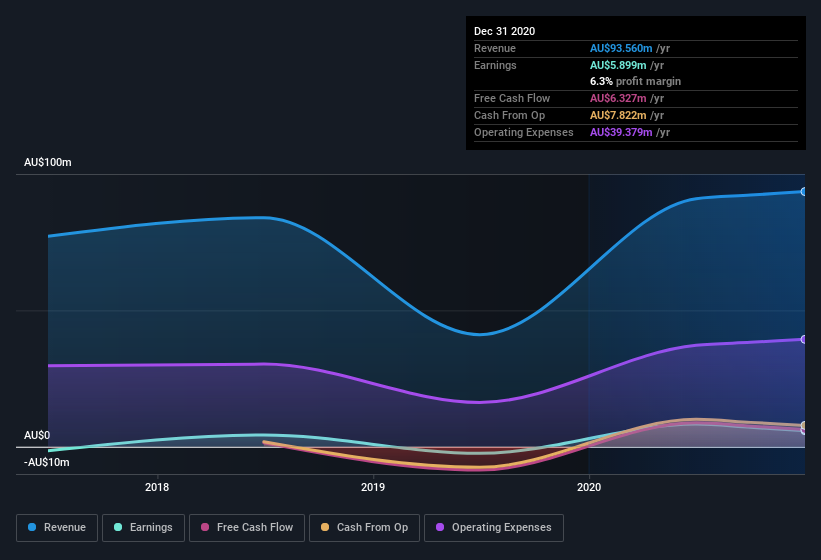

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Teaminvest Private Group's EBIT margins were flat over the last year, revenue grew by a solid 41% to AU$94m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Teaminvest Private Group isn't a huge company, given its market capitalization of AU$70m. That makes it extra important to check on its balance sheet strength.

Are Teaminvest Private Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Teaminvest Private Group insiders walking the walk, by spending AU$336k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Non-Executive Director, Howard Coleman, who made the biggest single acquisition, paying AU$98k for shares at about AU$0.65 each.

Does Teaminvest Private Group Deserve A Spot On Your Watchlist?

Teaminvest Private Group's earnings have taken off like any random crypto-currency did, back in 2017. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. We should say that we've discovered 3 warning signs for Teaminvest Private Group that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Teaminvest Private Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Teaminvest Private Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Teaminvest Private Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:TIP

Teaminvest Private Group

A private equity firm specializing in middle market and mature companies providing buyout and growth capital transactions.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives