- Australia

- /

- Consumer Finance

- /

- ASX:SVR

Solvar's (ASX:SVR) earnings trajectory could turn positive as the stock soars 12% this past week

It is doubtless a positive to see that the Solvar Limited (ASX:SVR) share price has gained some 32% in the last three months. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 64% in that period. So it is really good to see an improvement. Perhaps the company has turned over a new leaf.

On a more encouraging note the company has added AU$29m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Solvar

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

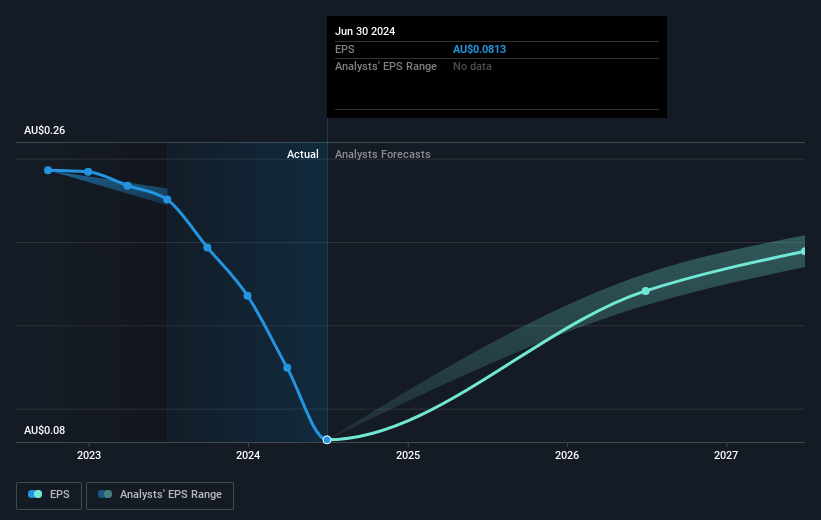

Solvar saw its EPS decline at a compound rate of 26% per year, over the last three years. This fall in EPS isn't far from the rate of share price decline, which was 29% per year. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Solvar the TSR over the last 3 years was -55%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Solvar shareholders gained a total return of 14% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Solvar (2 are a bit unpleasant) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SVR

Slight and fair value.