The Australian market recently experienced a downturn, with most sectors showing red, while IT led the gains. Despite challenging conditions, penny stocks continue to intrigue investors due to their potential for growth and affordability. Though often seen as relics of past market eras, these smaller or newer companies can offer unique opportunities when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.52 | A$149.03M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.18 | A$102.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.875 | A$54.48M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.03 | A$468.52M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.52 | A$259.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.072 | A$37.28M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.49 | A$369.73M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$4.67 | A$1.14B | ✅ 3 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.805 | A$384.96M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 442 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology in the United States and internationally, with a market cap of A$239.80 million.

Operations: Aroa Biosurgery's revenue is primarily derived from its operations in developing, manufacturing, and selling soft tissue repair products, generating NZ$84.70 million.

Market Cap: A$239.8M

Aroa Biosurgery, with a market cap of A$239.80 million, is making strides in the biotech sector despite being unprofitable. The company has reduced its losses by 21.2% annually over the past five years and maintains a strong cash runway of over three years without debt. Recent developments include promising results from their ENIVO platform study, which could tap into a market opportunity exceeding US$1 billion once commercialized. While earnings are forecast to grow significantly at 86.16% per year, Aroa's short-term assets comfortably cover both short and long-term liabilities, indicating financial stability amidst its growth phase.

- Navigate through the intricacies of Aroa Biosurgery with our comprehensive balance sheet health report here.

- Gain insights into Aroa Biosurgery's future direction by reviewing our growth report.

Immutep (ASX:IMM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Immutep Limited is a biotechnology company focused on developing novel Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia, with a market cap of A$359.63 million.

Operations: Immutep's revenue is primarily derived from its immunotherapy segment, which generated A$5.03 million.

Market Cap: A$359.63M

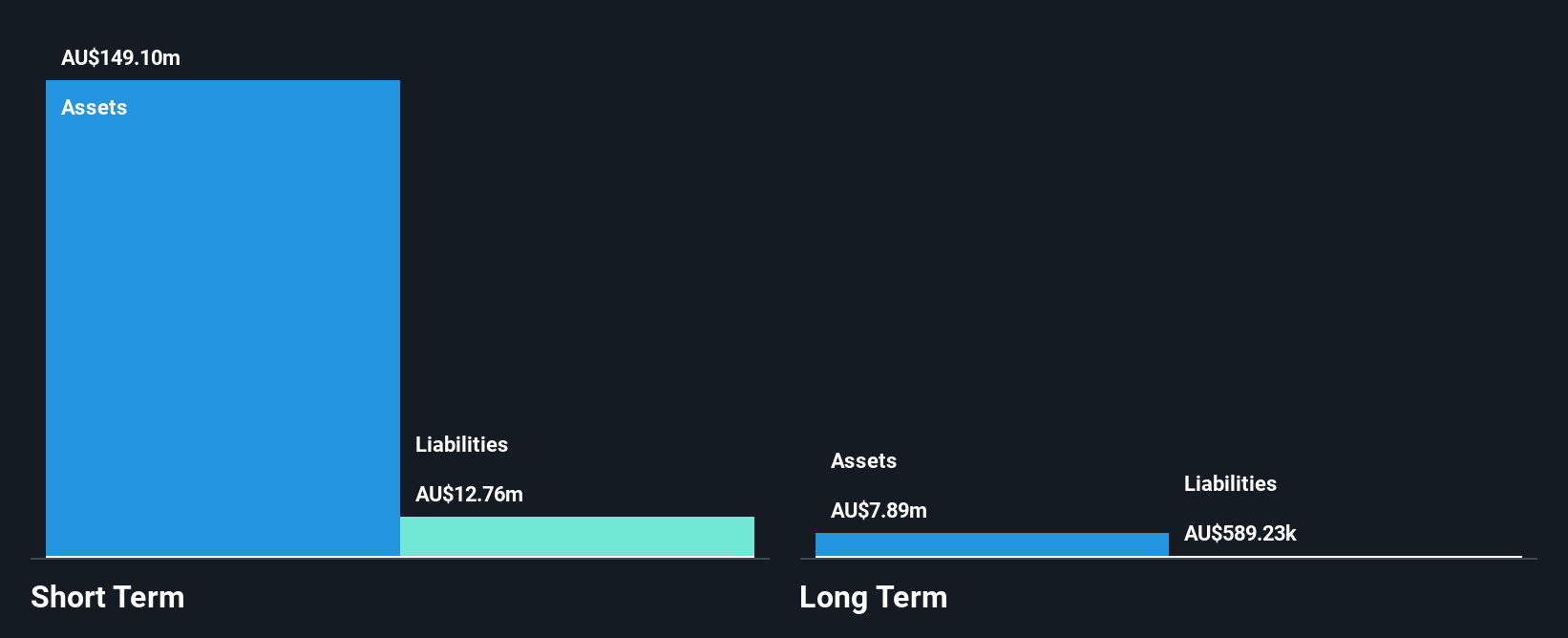

Immutep Limited, with a market cap of A$359.63 million, is navigating the biotech landscape with its focus on LAG-3 related immunotherapies despite being unprofitable. The company reported revenue of A$10.33 million for the year ended June 2025 but continues to incur substantial net losses. Immutep's short-term assets of A$149.1 million exceed both its short and long-term liabilities, providing some financial stability. Recent developments include positive FDA feedback on eftilagimod alfa for cancer treatment and promising Phase I data for IMP761 in autoimmune diseases, underscoring potential future growth opportunities in large markets despite current challenges.

- Dive into the specifics of Immutep here with our thorough balance sheet health report.

- Examine Immutep's earnings growth report to understand how analysts expect it to perform.

Regal Partners (ASX:RPL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of approximately A$999.76 million.

Operations: The company generates revenue primarily through the provision of investment management services, amounting to A$245.45 million.

Market Cap: A$999.76M

Regal Partners Limited, with a market cap of approximately A$999.76 million, has shown mixed financial performance recently. The company reported half-year revenue of A$128.72 million, down from the previous year, and a net income decrease to A$26.27 million. Despite these declines, Regal maintains strong liquidity with short-term assets exceeding both short and long-term liabilities significantly. While its profit margins have narrowed to 17.2%, the company's debt is well covered by operating cash flow and it trades below estimated fair value by 27.5%. However, recent significant insider selling may warrant caution for potential investors in this sector.

- Jump into the full analysis health report here for a deeper understanding of Regal Partners.

- Review our growth performance report to gain insights into Regal Partners' future.

Summing It All Up

- Investigate our full lineup of 442 ASX Penny Stocks right here.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARX

Aroa Biosurgery

Develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix (ECM) technology in the United States and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives