- Australia

- /

- Capital Markets

- /

- ASX:MQG

Macquarie Group (ASX:MQG): Revisiting Valuation as Fresh Leadership and Strategic Moves Draw Attention

Reviewed by Simply Wall St

Macquarie Group (ASX:MQG) is gathering attention as it prepares for its Energy Transition & Commodities Conference. The company is also welcoming Daniel Lane as head of securities financing transactions. Both moves point to evolving strategy and fresh leadership.

See our latest analysis for Macquarie Group.

Macquarie Group’s recent leadership moves and the industry spotlight from its upcoming Energy Transition & Commodities Conference have come at a tricky time, with a challenging market backdrop reflected in a 13.74% 1-month share price return and a year-to-date drop of over 12%. Despite recent volatility, investors with a longer view will note the company’s solid 68.6% total shareholder return over five years. This highlights both resilience and growth potential as momentum appears to be recalibrating.

If you’re keeping an eye out for market shifts and promising leadership changes, this could be the perfect moment to widen your search and discover fast growing stocks with high insider ownership

With recent setbacks in performance but strong long-term returns and upcoming strategic moves, the real question is whether Macquarie Group’s stock is undervalued and offers upside, or if the market has already priced in future growth expectations.

Most Popular Narrative: 13.5% Undervalued

Macquarie Group’s most widely followed narrative points to a fair value well above the recent close, setting up a debate around whether the share price is catching up to analyst expectations or still underestimates the company’s future prospects. There is real intrigue here as analysts weigh profit growth, margins, and the pace of operational change.

Macquarie Group is investing heavily in its asset management business, focusing on performance fees and fundraising, which should contribute to revenue growth and improve earnings as the market conditions align with these strategic moves. The continued investment in digitization within the Banking and Financial Services division is expected to drive operational efficiencies, potentially benefiting net margins over time by reducing costs and enhancing scalability.

Earnings upgrades. Margin expansion. Ambitious new efficiency targets. The narrative’s fair value is built on quantitative leaps. Find out what bold assumptions are fueling such optimism and whether they truly break the mold.

Result: Fair Value of $224.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a decline in assets under management, along with ongoing margin pressures from tough competition, could prompt a shift in the current upside narrative.

Find out about the key risks to this Macquarie Group narrative.

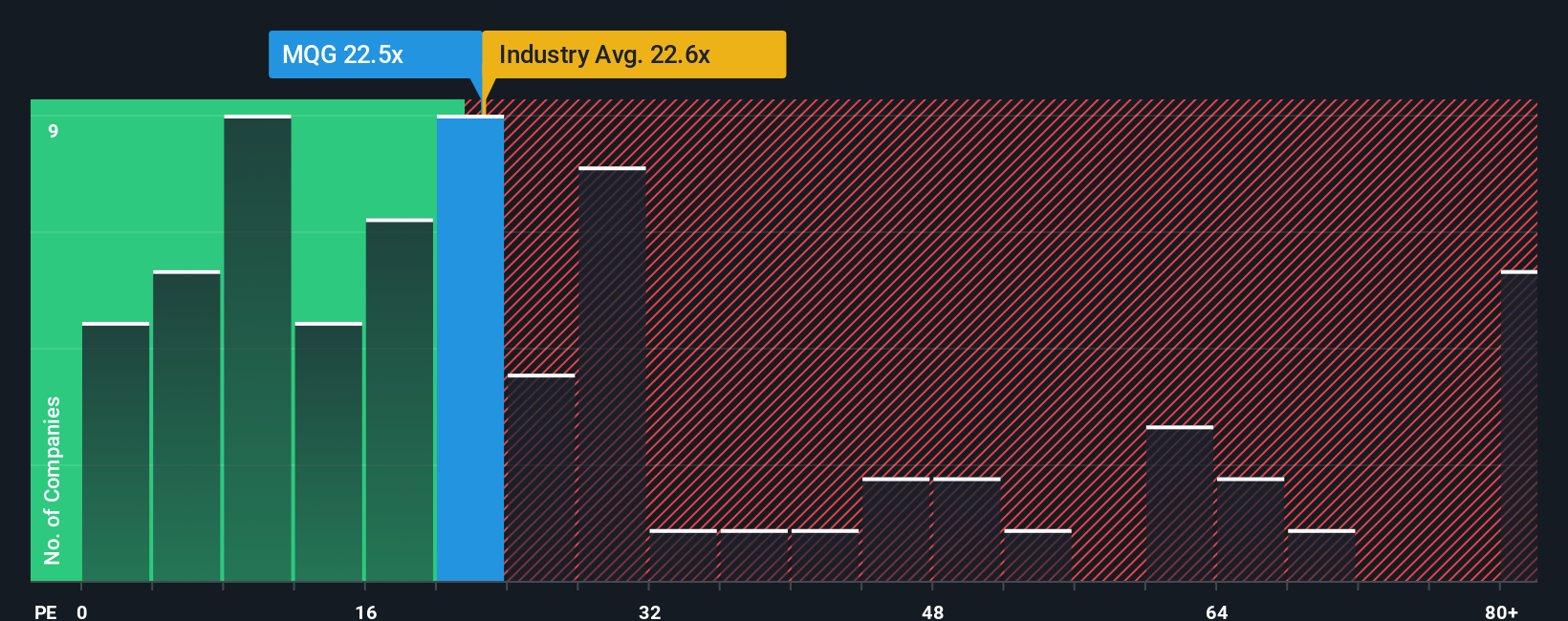

Another View: Market Ratios Tell a Cautious Story

Looking at price-to-earnings ratios, Macquarie Group trades at 19.6x, which is comfortably lower than both the Australian Capital Markets industry average of 22.2x and the peer average of 45.4x. This gap points to appealing value today but also signals the market is building in some risk. The fair ratio is higher at 21.8x. Does this discount suggest opportunity, or could it reflect uncertainty about Macquarie's future pace?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Macquarie Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Macquarie Group Narrative

If you think the story might be different or you want to dig into the numbers yourself, you can shape your own take in just a few minutes, and Do it your way.

A great starting point for your Macquarie Group research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Capitalize on momentum and access untapped opportunities by using hand-picked screeners designed for smarter investing. Seize your edge now before others catch on.

- Power up your portfolio returns by targeting strong yield performers and find potential standouts with these 16 dividend stocks with yields > 3%.

- Tap into the revolution in healthcare innovation with these 30 healthcare AI stocks, where you can spot companies transforming patient outcomes with AI-driven breakthroughs.

- Ride the surge in digital assets by uncovering pioneers shaping the future of decentralized finance with these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives