Stock Analysis

3 High-Yielding ASX Dividend Stocks With Yields From 3% To 9.9%

Reviewed by Simply Wall St

The Australian stock market experienced a downturn this week, with the ASX200 closing down 0.81% and all sectors finishing in the red. This recent volatility highlights the importance of considering stable, high-yielding dividend stocks as part of a diversified investment strategy, especially in times when market recalibrations impact broader economic sentiments.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Collins Foods (ASX:CKF) | 3.17% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.22% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.01% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.84% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.07% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.02% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.52% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.38% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.09% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 7.17% | ★★★★☆☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

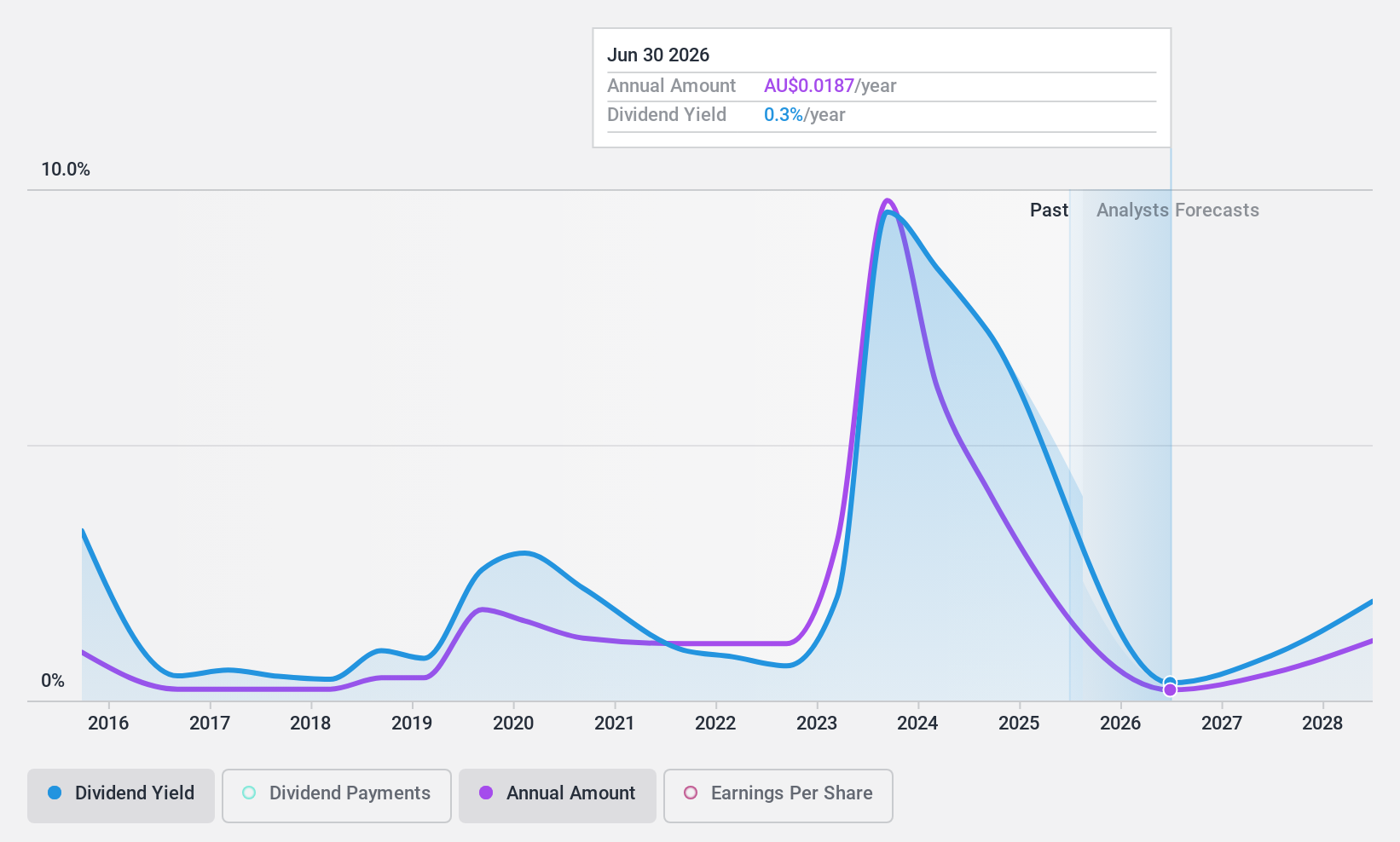

IGO (ASX:IGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company specializing in metals critical for clean energy, with a market capitalization of A$4.47 billion.

Operations: IGO Limited generates revenue primarily through its Nova Operation and Forrestania Operation, which collectively contributed A$903.40 million in the latest reporting period.

Dividend Yield: 9.3%

IGO offers a high dividend yield at 9.31%, ranking in the top 25% of Australian dividend payers. However, its sustainability is questionable with a payout ratio of 185%, indicating dividends are not well covered by earnings. Dividend reliability has been compromised by volatility and undercoverage over the past decade, despite an increase in payments during this period. Recent appointments on the board suggest a strengthening in governance which might impact future financial stability and dividend policies.

- Click to explore a detailed breakdown of our findings in IGO's dividend report.

- Upon reviewing our latest valuation report, IGO's share price might be too pessimistic.

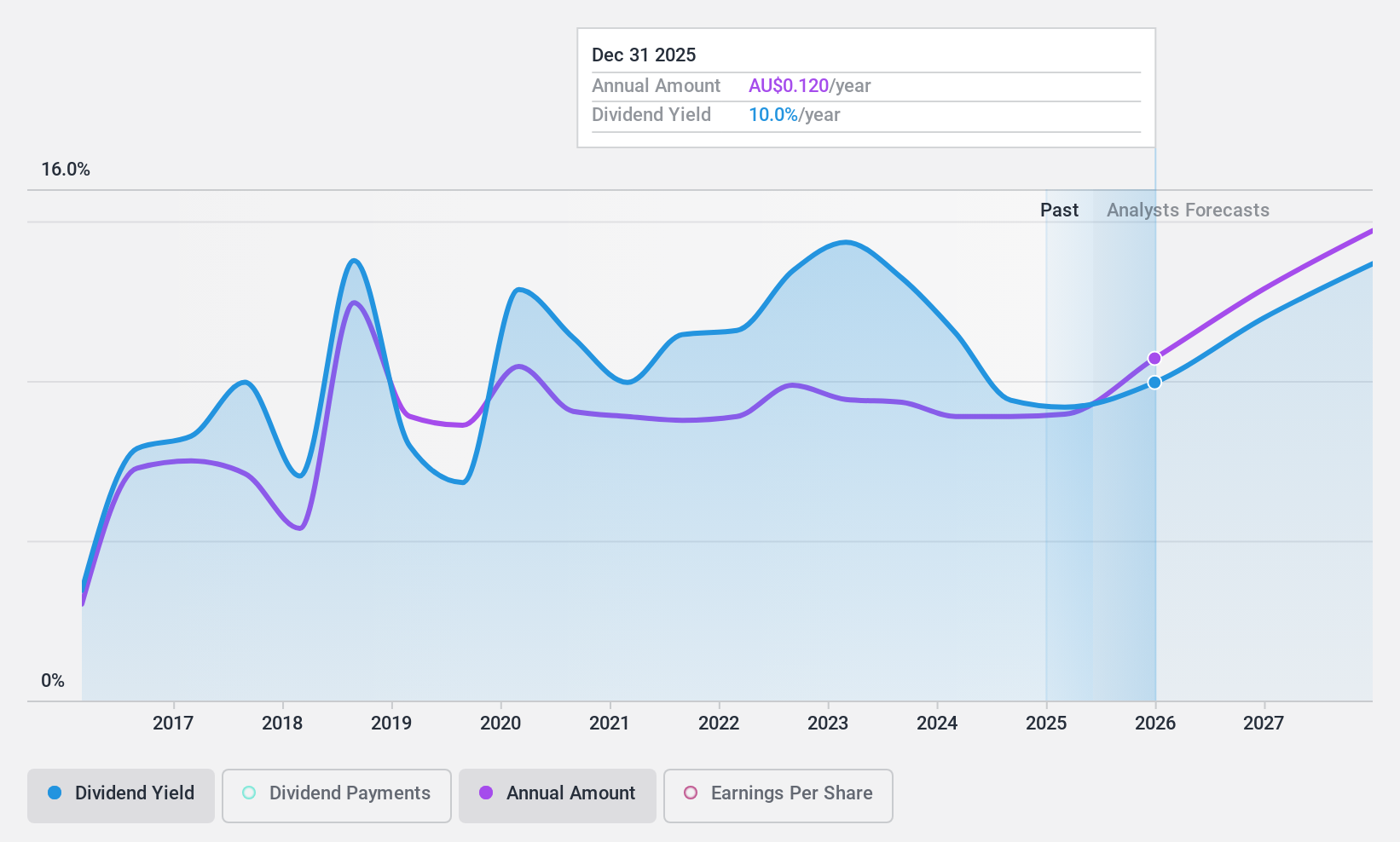

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited, operating in Papua New Guinea, offers a range of services including commercial banking, financial and fund administration, investment management, and share brokerage with a market capitalization of A$281.68 million.

Operations: Kina Securities Limited generates revenue primarily through its Wealth Management and Banking & Finance segments, totaling PGK 37.76 million and PGK 356.68 million respectively.

Dividend Yield: 10%

Kina Securities offers a high dividend yield of 9.98%, placing it among the top 25% of Australian dividend payers. However, its dividend history is marked by instability, with payments fluctuating significantly over its 8-year dividend-paying tenure. Currently, dividends are supported by earnings with a payout ratio of 70%, but projections show this coverage may decrease to 45.5% in three years. Additionally, the company faces challenges with a high bad loans ratio at 6.4%.

- Dive into the specifics of Kina Securities here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Kina Securities is trading behind its estimated value.

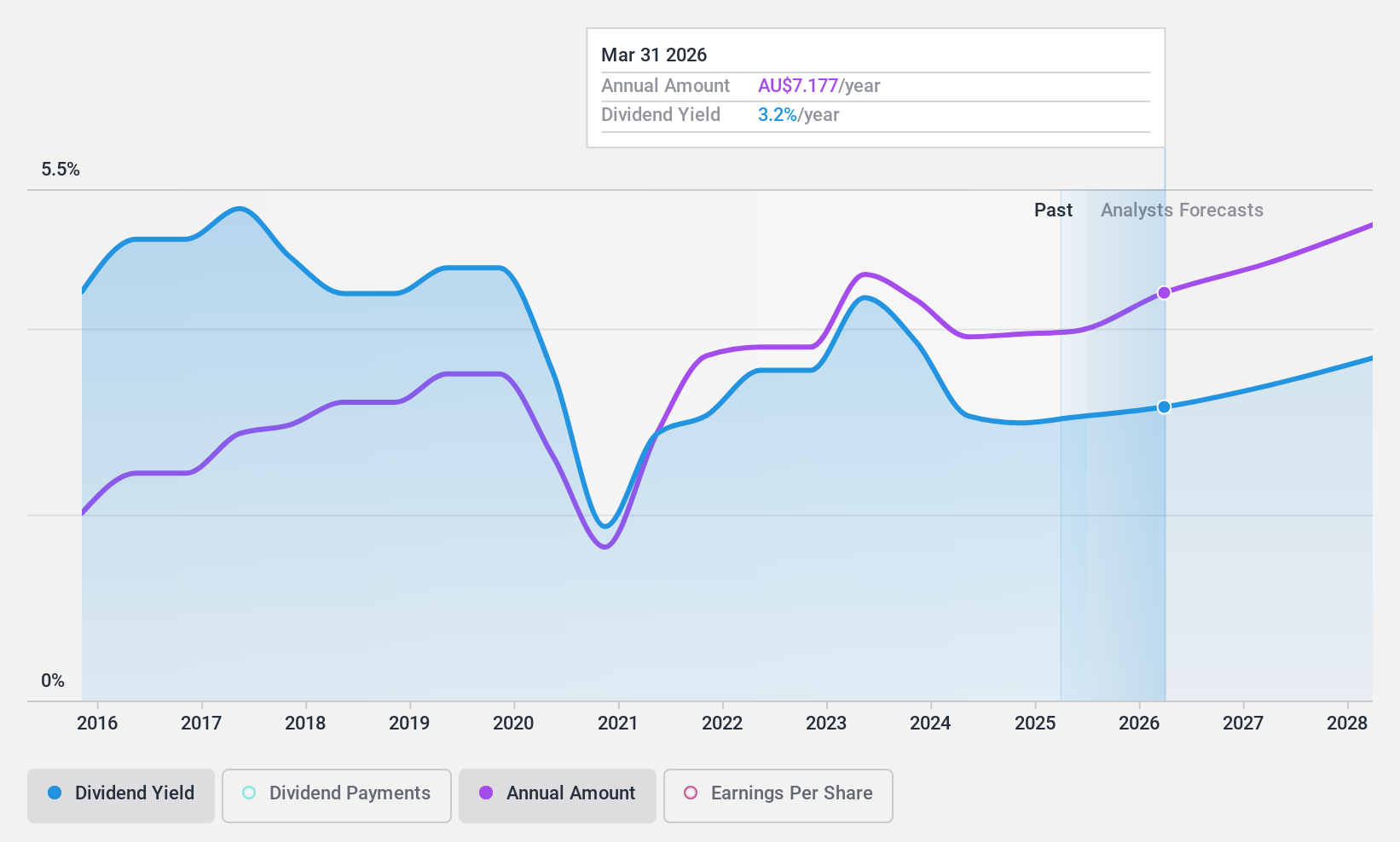

Macquarie Group (ASX:MQG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macquarie Group Limited operates as a diversified financial services provider across regions including Australia, the Americas, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately A$76.41 billion.

Operations: Macquarie Group Limited generates revenue through five primary segments: Macquarie Capital at A$2.61 billion, Macquarie Asset Management at A$3.75 billion, Banking and Financial Services at A$3.21 billion, Commodities and Global Markets at A$6.32 billion, and Corporate at A$0.99 billion.

Dividend Yield: 3%

Macquarie Group's recent involvement in potential acquisitions, such as the renewable energy platform O2 Power and ventures in healthcare, underscores its strategic diversification. Despite a volatile dividend history over the past decade, current dividends are supported by earnings with a 69.8% payout ratio. However, its dividend yield of 3.05% is lower than the top quartile of Australian dividend stocks at 6.28%. Additionally, 60% of its funding comes from higher-risk external borrowing sources, posing potential risks to financial stability.

- Click here to discover the nuances of Macquarie Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Macquarie Group is priced lower than what may be justified by its financials.

Where To Now?

- Dive into all 29 of the Top ASX Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Kina Securities is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSL

Kina Securities

Provides commercial banking and financial, fund administration, investment management, and share brokerage services in Papua New Guinea.

Good value with adequate balance sheet and pays a dividend.