- Australia

- /

- Capital Markets

- /

- ASX:MFG

How Asset Growth and Buy-Backs at Magellan (ASX:MFG) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Magellan Financial Group recently reported an increase in assets under management to A$40.2 billion at September-end, supported by positive net flows and continued progress in its on-market buy-back program.

- This combination of asset growth and capital management actions highlights Magellan’s ongoing efforts to attract investor confidence while optimizing its capital structure.

- We’ll now examine how recent asset growth and capital initiatives could influence Magellan Financial Group’s outlook and overall investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Magellan Financial Group Investment Narrative Recap

For investors considering Magellan Financial Group, belief in the company’s ability to rebuild confidence, stabilize client flows, and grow assets under management is central. The recent increase in AUM and continuation of the buy-back program offer near-term validation, but fee pressure and retail outflows remain significant risks that may challenge any swift turnaround; the impact of this news on those issues appears modest, and the biggest short-term catalyst, sustained improvement in net inflows, remains largely unchanged.

Among recent company actions, Magellan’s announcement of continued progress in its on-market share buy-back program stands out. This initiative has seen the repurchase of over 14.6 million shares and signals the firm’s attention to capital management at a time when restoring investor trust and improving operating performance are front of mind.

However, investors should also be aware that, in contrast to the recent positive headlines, ongoing retail outflows and fee pressures threaten medium-term stability if...

Read the full narrative on Magellan Financial Group (it's free!)

Magellan Financial Group is projected to generate A$259.3 million in revenue and A$152.1 million in earnings by 2028. This outlook assumes a 6.6% annual revenue decline and a decrease of A$12.9 million in earnings from the current level of A$165.0 million.

Uncover how Magellan Financial Group's forecasts yield a A$10.03 fair value, a 4% downside to its current price.

Exploring Other Perspectives

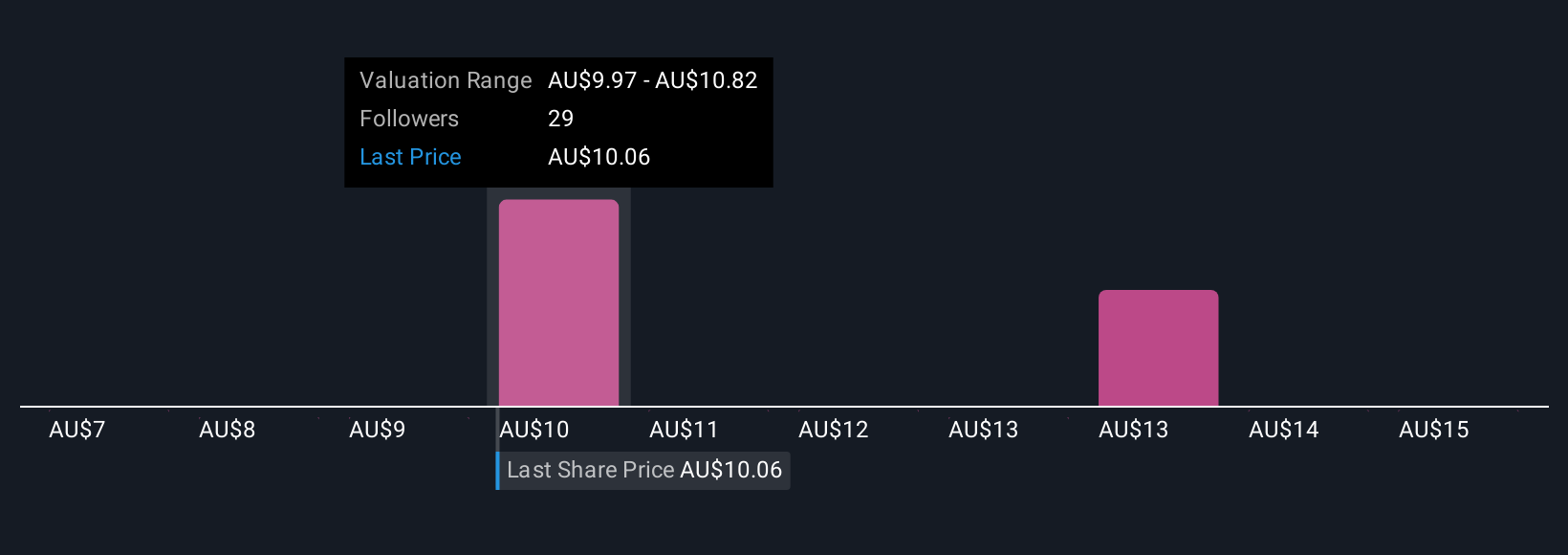

Seven individual views from the Simply Wall St Community place Magellan Financial Group’s fair value between A$7.40 and A$15.95 per share. Persistent fee compression risks are weighing on projected revenue and margins, prompting a closer look at the assumptions you rely on.

Explore 7 other fair value estimates on Magellan Financial Group - why the stock might be worth as much as 53% more than the current price!

Build Your Own Magellan Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magellan Financial Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Magellan Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magellan Financial Group's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFG

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion