- Australia

- /

- Capital Markets

- /

- ASX:MAM

Investors Holding Back On Microequities Asset Management Group Limited (ASX:MAM)

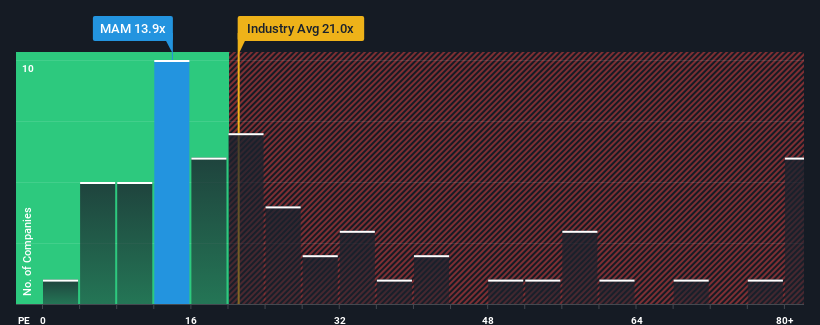

Microequities Asset Management Group Limited's (ASX:MAM) price-to-earnings (or "P/E") ratio of 13.9x might make it look like a buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 19x and even P/E's above 37x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Microequities Asset Management Group's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Microequities Asset Management Group

How Is Microequities Asset Management Group's Growth Trending?

In order to justify its P/E ratio, Microequities Asset Management Group would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 60% decrease to the company's bottom line. Even so, admirably EPS has lifted 69% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's about the same on an annualised basis.

With this information, we find it odd that Microequities Asset Management Group is trading at a P/E lower than the market. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Microequities Asset Management Group's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Microequities Asset Management Group revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Microequities Asset Management Group that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MAM

Microequities Asset Management Group

Provides investment fund management in Australia.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026