- Australia

- /

- Capital Markets

- /

- ASX:IFL

Insignia Financial Ltd.'s (ASX:IFL) Price Is Right But Growth Is Lacking After Shares Rocket 26%

The Insignia Financial Ltd. (ASX:IFL) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 26%.

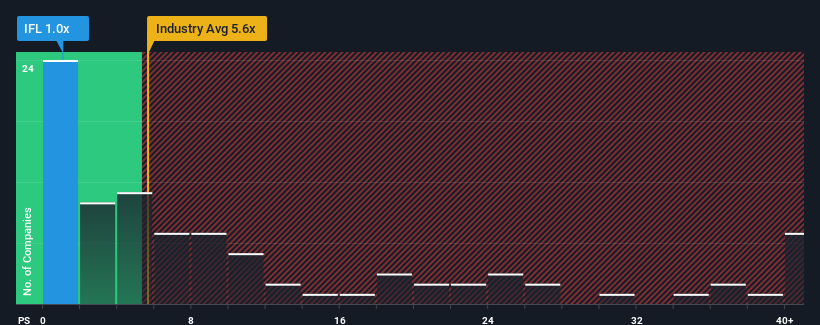

In spite of the firm bounce in price, Insignia Financial's price-to-sales (or "P/S") ratio of 1x might still make it look like a strong buy right now compared to the wider Capital Markets industry in Australia, where around half of the companies have P/S ratios above 5.7x and even P/S above 17x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Insignia Financial

How Insignia Financial Has Been Performing

Insignia Financial hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Insignia Financial will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Insignia Financial's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 51% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 10.0% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 7.6% per annum.

With this in consideration, we find it intriguing that Insignia Financial's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Shares in Insignia Financial have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Insignia Financial maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Insignia Financial with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IFL

Insignia Financial

Provides financial advice, superannuation, wrap platforms and asset management services to members, financial advisers and corporate employers in Australia.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives