- Australia

- /

- Capital Markets

- /

- ASX:IFL

Do These 3 Checks Before Buying Insignia Financial Ltd. (ASX:IFL) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Insignia Financial Ltd. (ASX:IFL) is about to trade ex-dividend in the next 4 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, Insignia Financial investors that purchase the stock on or after the 10th of March will not receive the dividend, which will be paid on the 1st of April.

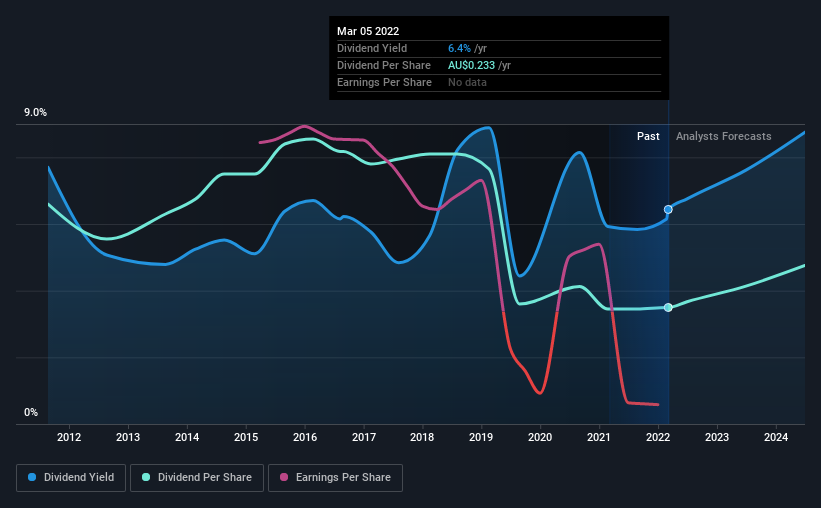

The company's next dividend payment will be AU$0.12 per share, on the back of last year when the company paid a total of AU$0.23 to shareholders. Based on the last year's worth of payments, Insignia Financial has a trailing yield of 6.4% on the current stock price of A$3.62. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Insignia Financial has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Insignia Financial

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Insignia Financial lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Insignia Financial reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Insignia Financial's dividend payments per share have declined at 6.2% per year on average over the past 10 years, which is uninspiring. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

We update our analysis on Insignia Financial every 24 hours, so you can always get the latest insights on its financial health, here.

Final Takeaway

Should investors buy Insignia Financial for the upcoming dividend? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Worse, the general trend in its earnings looks negative in recent years. Insignia Financial doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

Although, if you're still interested in Insignia Financial and want to know more, you'll find it very useful to know what risks this stock faces. For example - Insignia Financial has 1 warning sign we think you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IFL

Insignia Financial

Provides financial advice, superannuation, wrap platforms and asset management services to members, financial advisers and corporate employers in Australia.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives