- Australia

- /

- Capital Markets

- /

- ASX:EZL

Euroz (ASX:EZL) Will Pay A Larger Dividend Than Last Year At AU$0.14

The board of Euroz Limited (ASX:EZL) has announced that the dividend on 6th of August will be increased to AU$0.14, which will be 125% higher than last year. This makes the dividend yield 8.5%, which is above the industry average.

Check out our latest analysis for Euroz

Euroz Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, Euroz was paying out quite a large proportion of both earnings and cash flow, with the dividend being 186% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Over the next year, EPS could expand by 3.7% if the company continues along the path it has been on recently. However, if the dividend continues growing along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 141% over the next year.

Dividend Volatility

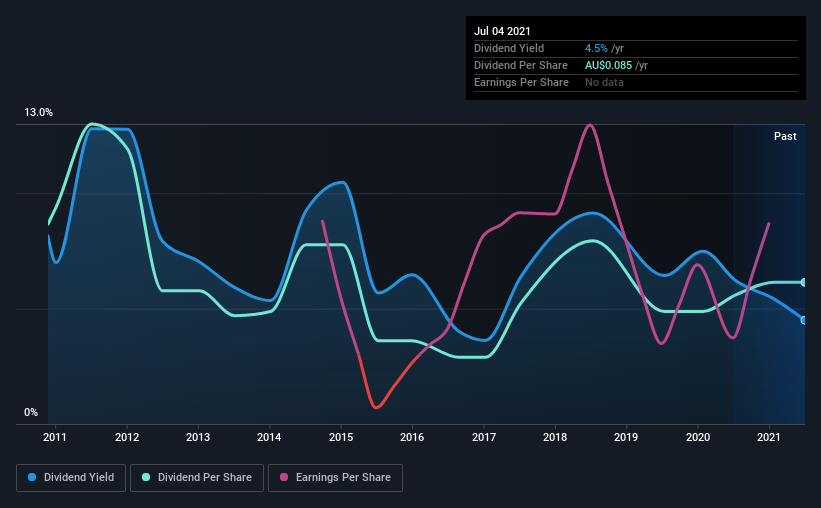

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from AU$0.12 in 2011 to the most recent annual payment of AU$0.085. This works out to be a decline of approximately 3.4% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings per share has been crawling upwards at 3.7% per year. Euroz's earnings per share has barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. This isn't the end of the world, but for investors looking for strong dividend growth they may want to look elsewhere.

We'd also point out that Euroz has issued stock equal to 20% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On Euroz's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While Euroz is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 3 warning signs for Euroz that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you decide to trade Euroz, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Euroz Hartleys Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EZL

Euroz Hartleys Group

A diversified financial services company, provides stockbroking, corporate finance, funds management, investment advice, financial advisory, and wealth management services to private, institutional, and corporate clients in Australia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives