- Australia

- /

- Capital Markets

- /

- ASX:EQT

This Is Why EQT Holdings Limited's (ASX:EQT) CEO Compensation Looks Appropriate

Performance at EQT Holdings Limited (ASX:EQT) has been reasonably good and CEO Mick O’Brien has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 22 October 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for EQT Holdings

Comparing EQT Holdings Limited's CEO Compensation With the industry

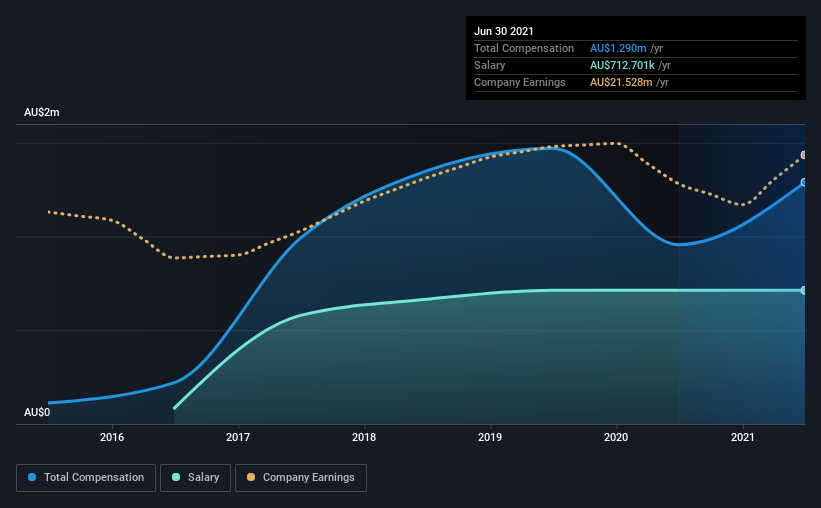

Our data indicates that EQT Holdings Limited has a market capitalization of AU$589m, and total annual CEO compensation was reported as AU$1.3m for the year to June 2021. We note that's an increase of 35% above last year. We note that the salary of AU$712.7k makes up a sizeable portion of the total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between AU$270m and AU$1.1b had a median total CEO compensation of AU$1.0m. This suggests that EQT Holdings remunerates its CEO largely in line with the industry average. Furthermore, Mick O’Brien directly owns AU$2.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$713k | AU$713k | 55% |

| Other | AU$577k | AU$243k | 45% |

| Total Compensation | AU$1.3m | AU$957k | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. Although there is a difference in how total compensation is set, EQT Holdings more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

EQT Holdings Limited's Growth

EQT Holdings Limited's earnings per share (EPS) grew 1.7% per year over the last three years. Its revenue is up 5.9% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but we're happy with the modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has EQT Holdings Limited Been A Good Investment?

We think that the total shareholder return of 34%, over three years, would leave most EQT Holdings Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for EQT Holdings that investors should think about before committing capital to this stock.

Important note: EQT Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if EQT Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EQT

EQT Holdings

Provides philanthropic, trustee, and investment services in Australia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026