- Australia

- /

- Capital Markets

- /

- ASX:EQT

Exploring 3 Undiscovered Gems In Australia For Potential Portfolio Growth

Reviewed by Simply Wall St

The Australian market experienced a modest rebound, closing slightly up by 0.04% this Thursday, with notable sector gains in Communication and Real Estate despite some losses in Energy and Utilities. In this environment of cautious optimism and selective sector strength, discovering lesser-known stocks that demonstrate resilience and potential for growth can be an effective strategy for investors looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Argosy Minerals | NA | -12.81% | -19.89% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Investigator Silver | NA | 54.36% | 52.03% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Cobram Estate Olives (ASX:CBO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is involved in the production and marketing of olive oil across Australia, the United States, and internationally, with a market capitalization of approximately A$1.36 billion.

Operations: Cobram Estate Olives generates revenue primarily from its Australian olive oil operations, contributing A$183.82 million, and its US operations with A$64.97 million. The company experiences a financial impact from eliminations and corporate expenses totaling -A$7.13 million.

Cobram Estate Olives, a notable player in the Australian market, has shown impressive growth with earnings surging by 168% over the past year, outpacing its industry peers. Despite a high net debt to equity ratio of 72%, the company has managed to reduce it from 119.5% over five years, indicating improved financial management. Recent activities include follow-on equity offerings totaling A$11.97 million and a dividend increase to A$0.045 per share, reflecting confidence in future prospects. With EBIT covering interest payments 8 times over and revenue forecasted to grow annually by nearly 14%, Cobram seems poised for continued expansion.

EQT Holdings (ASX:EQT)

Simply Wall St Value Rating: ★★★★★☆

Overview: EQT Holdings Limited, with a market cap of A$656.27 million, operates in Australia offering philanthropic, trustee, and investment services through its subsidiaries.

Operations: EQT Holdings generates revenue primarily from Trustee & Wealth Services, excluding Superannuation Trustee Services, amounting to A$102.18 million, and Corporate & Superannuation Trustee Services contributing A$79.99 million.

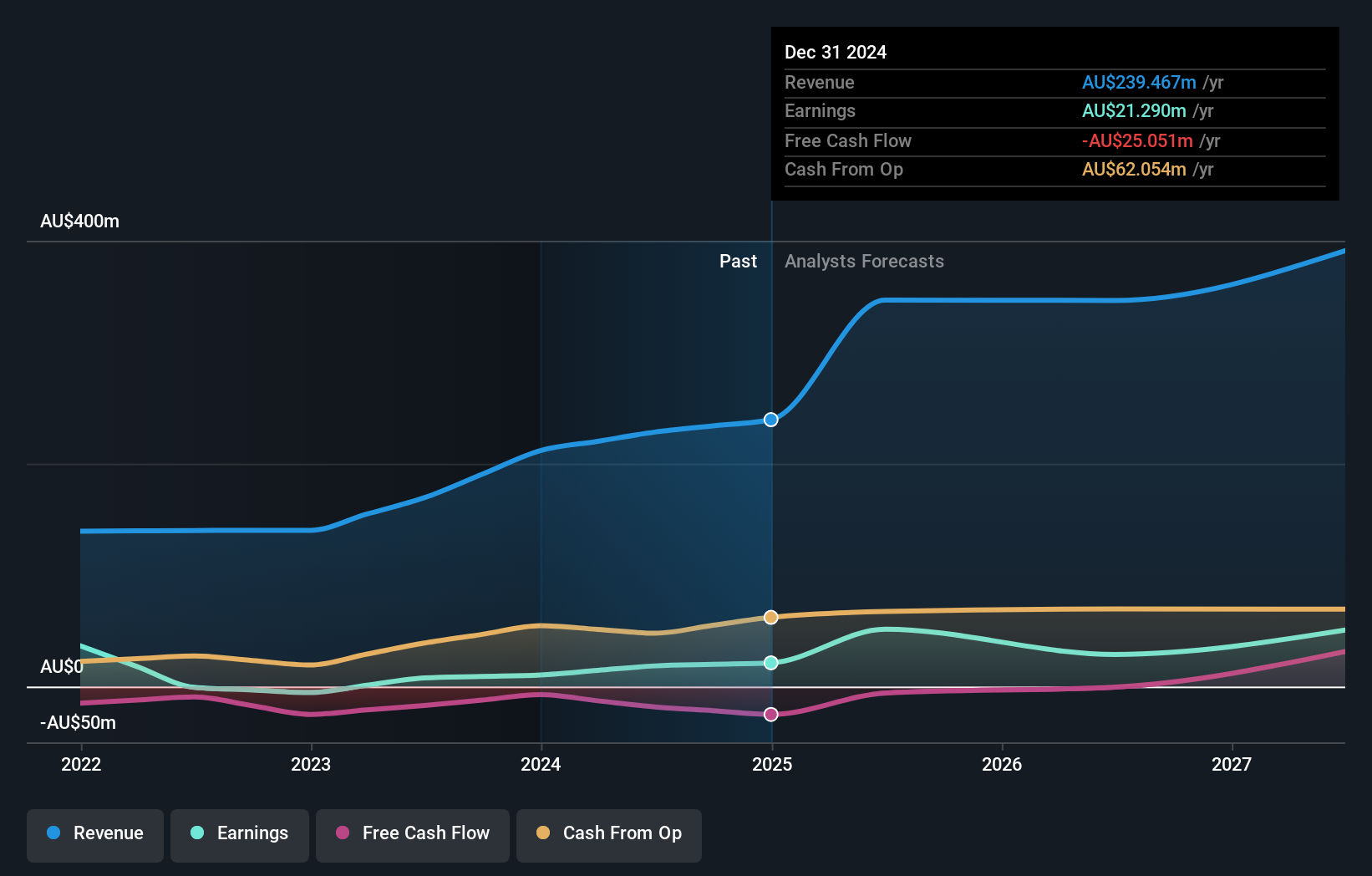

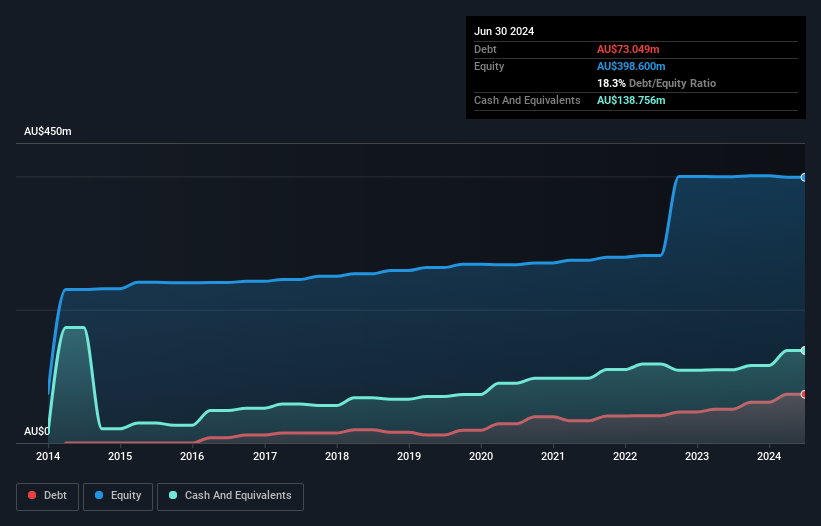

EQT Holdings stands out with its compelling financial profile, boasting high-quality earnings and a forecasted annual growth of 12.01%. The company’s recent earnings surge of 19.7% surpasses the Capital Markets industry's 12.7%, indicating robust performance in a competitive landscape. With a price-to-earnings ratio of 19.2x, it offers better value compared to the broader Australian market at 21.2x, suggesting potential for value-conscious investors. Despite an increase in debt to equity from 10.8% to 20.5% over five years, EQT's interest coverage is strong at 10.8 times EBIT, reflecting sound financial management and stability moving forward.

- Click to explore a detailed breakdown of our findings in EQT Holdings' health report.

Assess EQT Holdings' past performance with our detailed historical performance reports.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★★

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.93 billion.

Operations: The primary revenue stream for MFF Capital Investments comes from its equity investments, generating A$631.43 million. The company's financial performance is reflected in its market capitalization of A$2.93 billion.

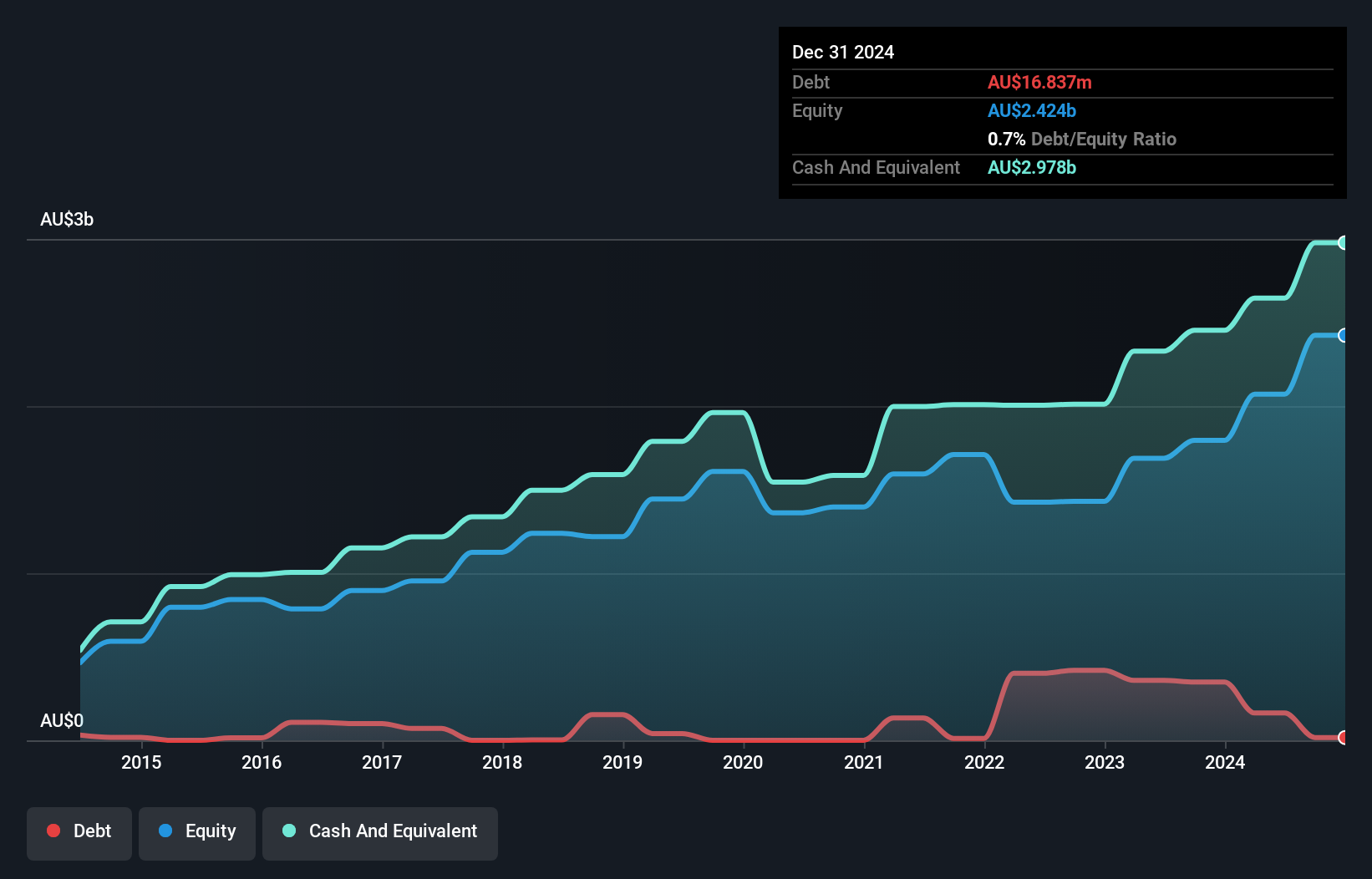

MFF Capital Investments, a nimble player in the investment space, is debt-free with no interest coverage concerns. The company trades at 66% below its estimated fair value, suggesting potential undervaluation. Despite a recent dip in earnings growth by 3%, MFF boasts high-quality past earnings and positive free cash flow of A$336.60 million as of June 2025. Recent executive changes see Gerald Stack stepping up as CEO from January 2026, bringing over three decades of financial expertise to the table. This leadership shift could enhance MFF's strategic direction and investment capabilities moving forward.

- Delve into the full analysis health report here for a deeper understanding of MFF Capital Investments.

Explore historical data to track MFF Capital Investments' performance over time in our Past section.

Where To Now?

- Access the full spectrum of 58 ASX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EQT Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EQT

EQT Holdings

Provides philanthropic, trustee, and investment services in Australia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion