- Australia

- /

- Commercial Services

- /

- ASX:SPZ

Djerriwarrh Investments And 2 Hidden Australian Gems To Consider For Your Portfolio

Reviewed by Simply Wall St

As the Australian market navigates a landscape marked by inflation at 3.8% and fluctuating indices, investors are keenly observing sectors like materials, which have shown resilience with gold's recent upswing. In this context, identifying potential stock opportunities involves looking for companies that can thrive amid economic shifts and sector-specific trends. Djerriwarrh Investments and two other lesser-known Australian stocks may offer intriguing prospects for those seeking to diversify their portfolios in these dynamic times.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

| Reef Casino Trust | 19.84% | 6.96% | 10.88% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Value Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market cap of A$806.98 million.

Operations: Djerriwarrh generates revenue primarily through its portfolio of investments, amounting to A$53.07 million.

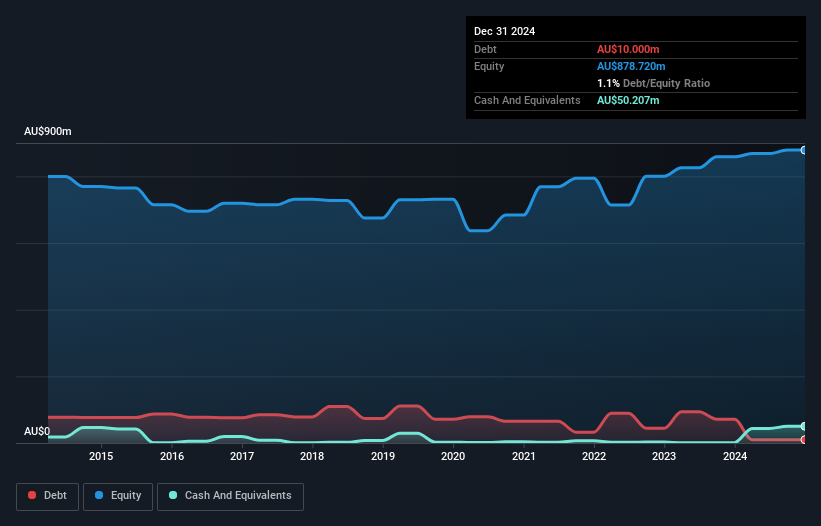

Djerriwarrh Investments, a smaller player in the Australian market, has shown a solid financial footing with more cash than its total debt and a significantly reduced debt-to-equity ratio from 12.3% to 2.4% over five years. Earnings have increased by 7.9% annually during this period, indicating steady growth despite trailing the broader Capital Markets industry's recent performance of 12.7%. The company’s earnings quality is high, and it trades at a price-to-earnings ratio of 20.6x, slightly under the market average of 21x—suggesting potential value for investors seeking stability in an emerging entity like DJW.

- Unlock comprehensive insights into our analysis of Djerriwarrh Investments stock in this health report.

Assess Djerriwarrh Investments' past performance with our detailed historical performance reports.

Lycopodium (ASX:LYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lycopodium Limited offers engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors in Australia, with a market cap of A$500.43 million.

Operations: Lycopodium generates revenue primarily from the resources sector, contributing A$342.76 million, with additional income from rail infrastructure and process industries at A$11.03 million and A$10.08 million respectively. The company's net profit margin is a crucial metric to consider when analyzing its financial performance.

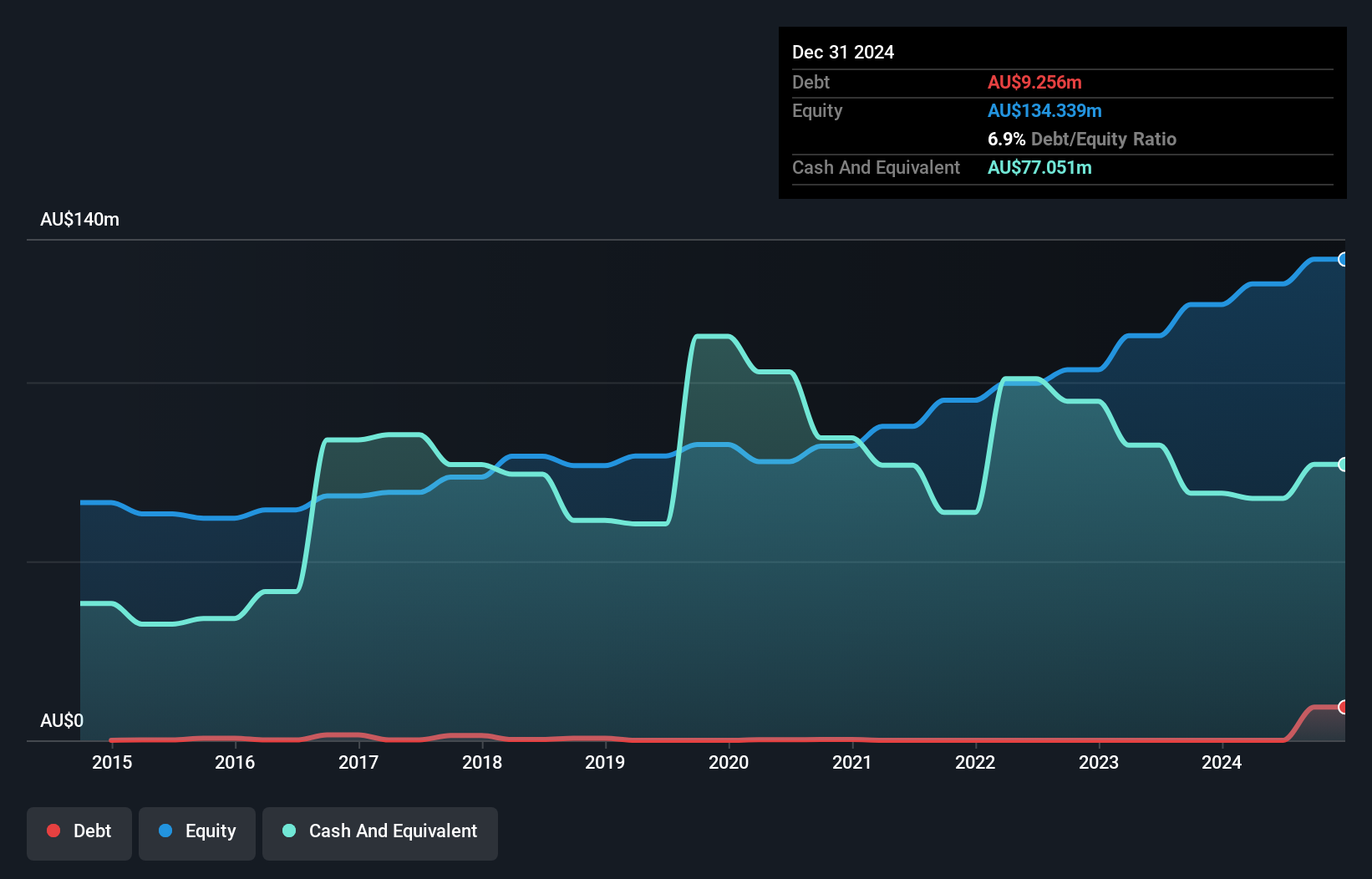

Lycopodium, a notable player in the engineering and project management sector, is trading at a significant 49.6% discount to its estimated fair value. Despite recent insider selling, the company remains profitable with high-quality earnings and more cash than debt, suggesting financial stability. Over five years, its debt-to-equity ratio rose from 0.2% to 1%, yet it still covers interest payments comfortably. Earnings guidance for fiscal year 2026 predicts revenue between A$390 million and A$410 million, indicating potential growth despite last year's negative earnings growth of -16.8%. With positive free cash flow and a forecasted revenue increase of 7.5% annually, Lycopodium presents an intriguing prospect in its industry landscape.

- Take a closer look at Lycopodium's potential here in our health report.

Evaluate Lycopodium's historical performance by accessing our past performance report.

Smart Parking (ASX:SPZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Smart Parking Limited specializes in designing, developing, and managing parking management solutions across New Zealand, Australia, Denmark, Germany, and the United Kingdom with a market cap of A$543.09 million.

Operations: Smart Parking Limited generates revenue primarily from its parking management operations, with the United Kingdom contributing A$52.52 million and the United States adding A$10.22 million. The company's technology division also plays a role in its revenue stream, bringing in A$5.27 million.

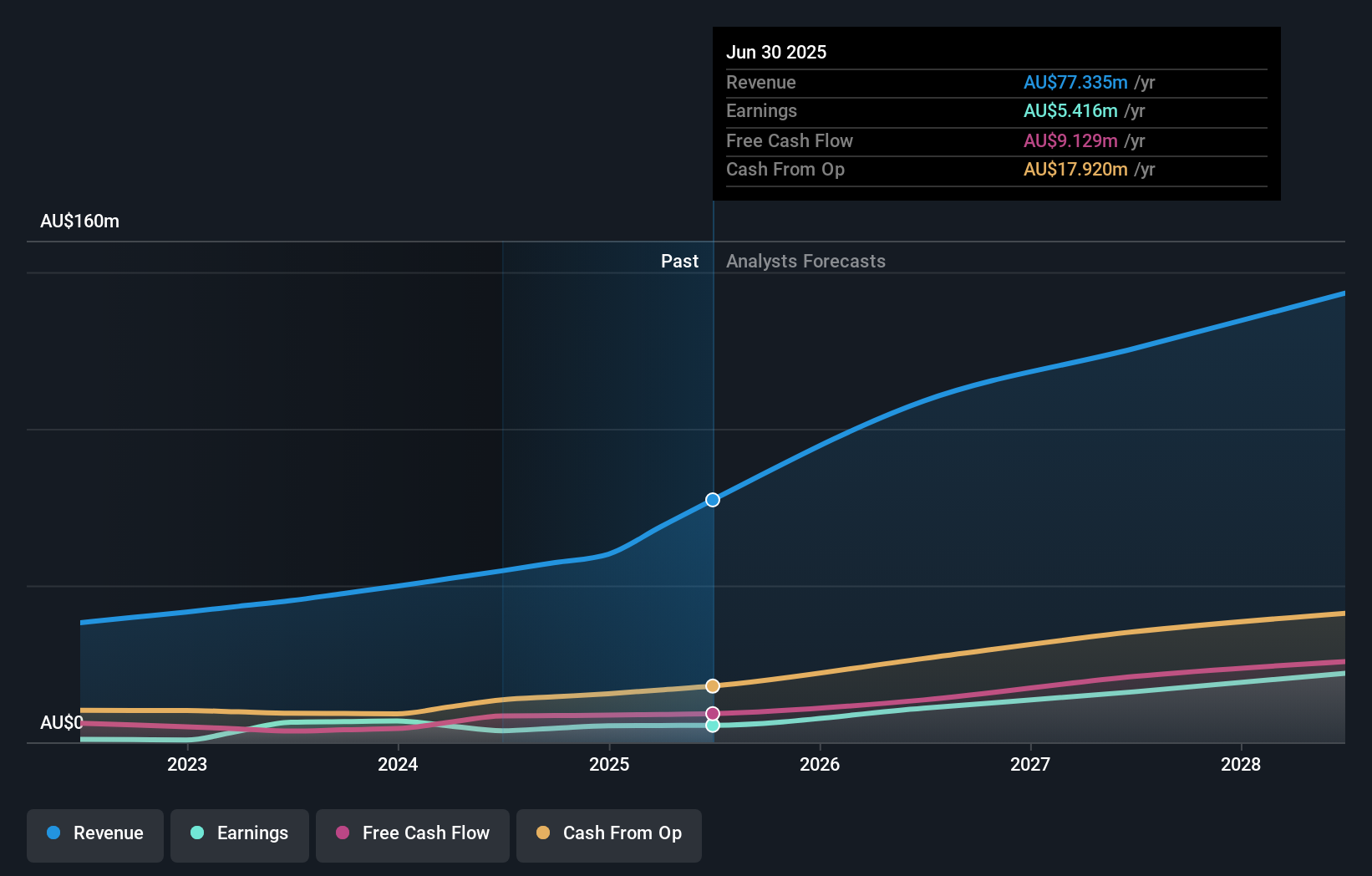

Smart Parking, a promising player in the parking technology sector, is trading at 41.2% below its estimated fair value, suggesting potential upside. The company boasts high-quality earnings and impressive growth with a 46.8% increase in earnings over the past year, outpacing industry averages. Its debt-to-equity ratio has risen slightly to 0.9% over five years but remains manageable with interest payments well covered by EBIT at 7.4x coverage. Despite shareholder dilution last year, Smart Parking's strategic market expansion into regions like the U.S., Germany, and New Zealand positions it for continued growth amid evolving urban mobility trends and regulatory challenges.

Summing It All Up

- Click this link to deep-dive into the 56 companies within our ASX Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SPZ

Smart Parking

Engages in the design, development, and management of parking management solutions in New Zealand, Australia, Denmark, Germany, and the United Kingdom.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success