- Australia

- /

- Metals and Mining

- /

- ASX:GNG

Cuscal And 2 Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As the Australian market navigates the complexities of new U.S. tariffs and fluctuating energy prices, the ASX200 finds itself near significant highs despite recent volatility. In this environment, identifying promising small-cap stocks like Cuscal and others can provide unique opportunities for portfolio enhancement by tapping into sectors resilient to these global shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Cuscal (ASX:CCL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cuscal Limited, with a market cap of A$478.91 million, offers payment and regulated data-related products and services to financial and consumer-centric institutions in Australia.

Operations: Cuscal generates revenue through its payment and regulated data-related products and services. The company has a market cap of A$478.91 million, reflecting its financial standing in the industry.

Cuscal, a financial entity in Australia, has shown promising growth with earnings increasing by 4.3% over the past year, outpacing the Diversified Financial industry which saw a -6.8%. Despite this growth, its interest payments are not well covered by EBIT at 1.3x coverage. The company boasts high-quality past earnings and is seen as good value with a price-to-earnings ratio of 15.9x, below the national average of 17.2x. Recently added to the S&P/ASX All Ordinaries Index and presenting at key conferences signals growing recognition within its sector.

- Dive into the specifics of Cuscal here with our thorough health report.

Examine Cuscal's past performance report to understand how it has performed in the past.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services primarily to the mining and mineral processing sectors both in Australia and globally, with a market capitalization of A$470.26 million.

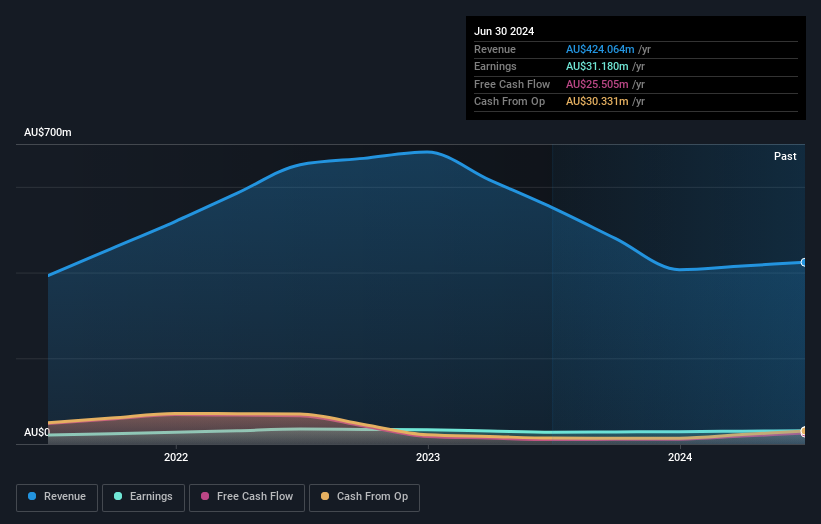

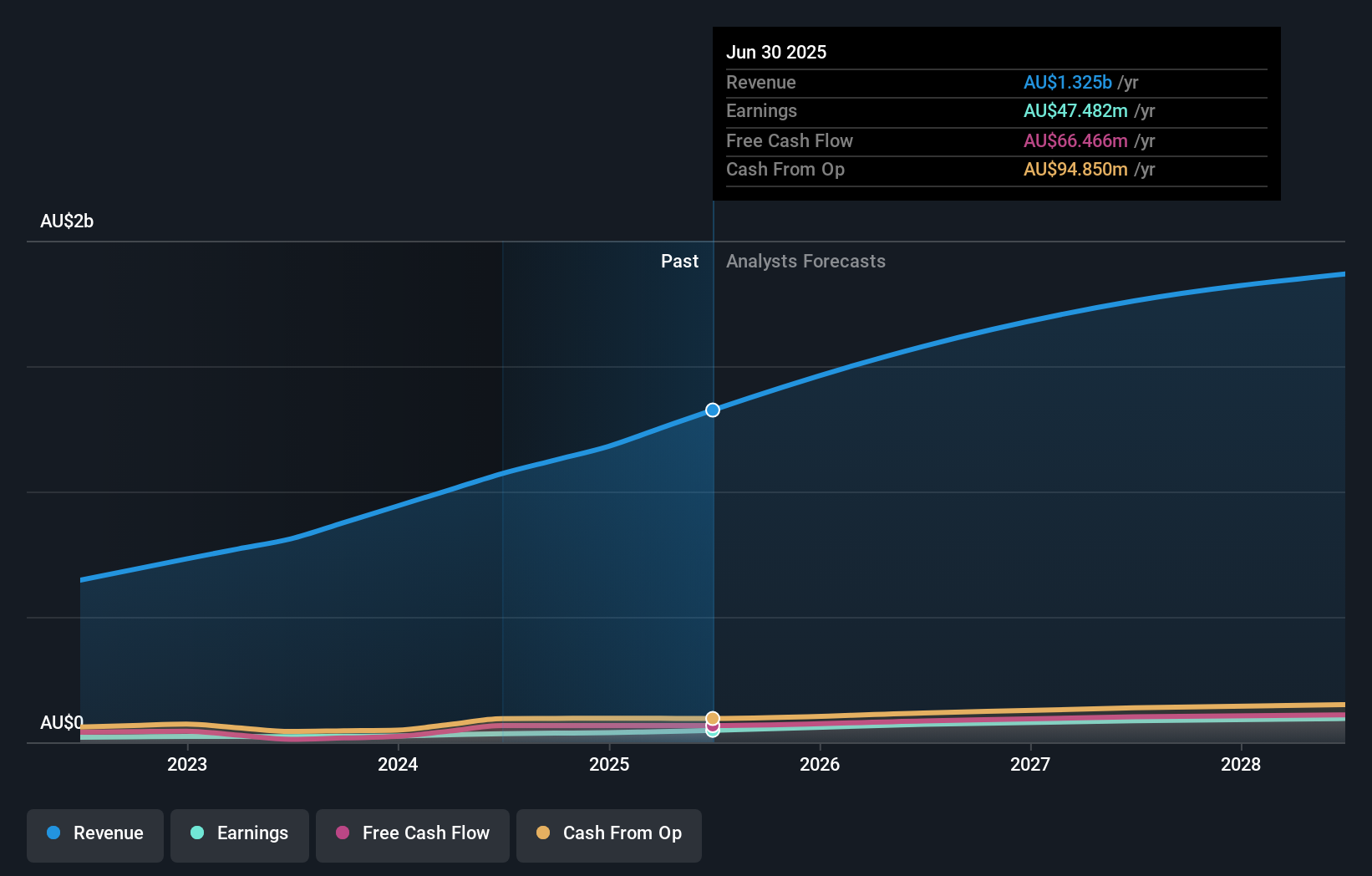

Operations: The company generates revenue primarily from its Mineral Processing segment, contributing A$412.30 million, and the Oil and Gas segment, which adds A$96.61 million. The focus on these sectors provides a diversified income stream across different industries.

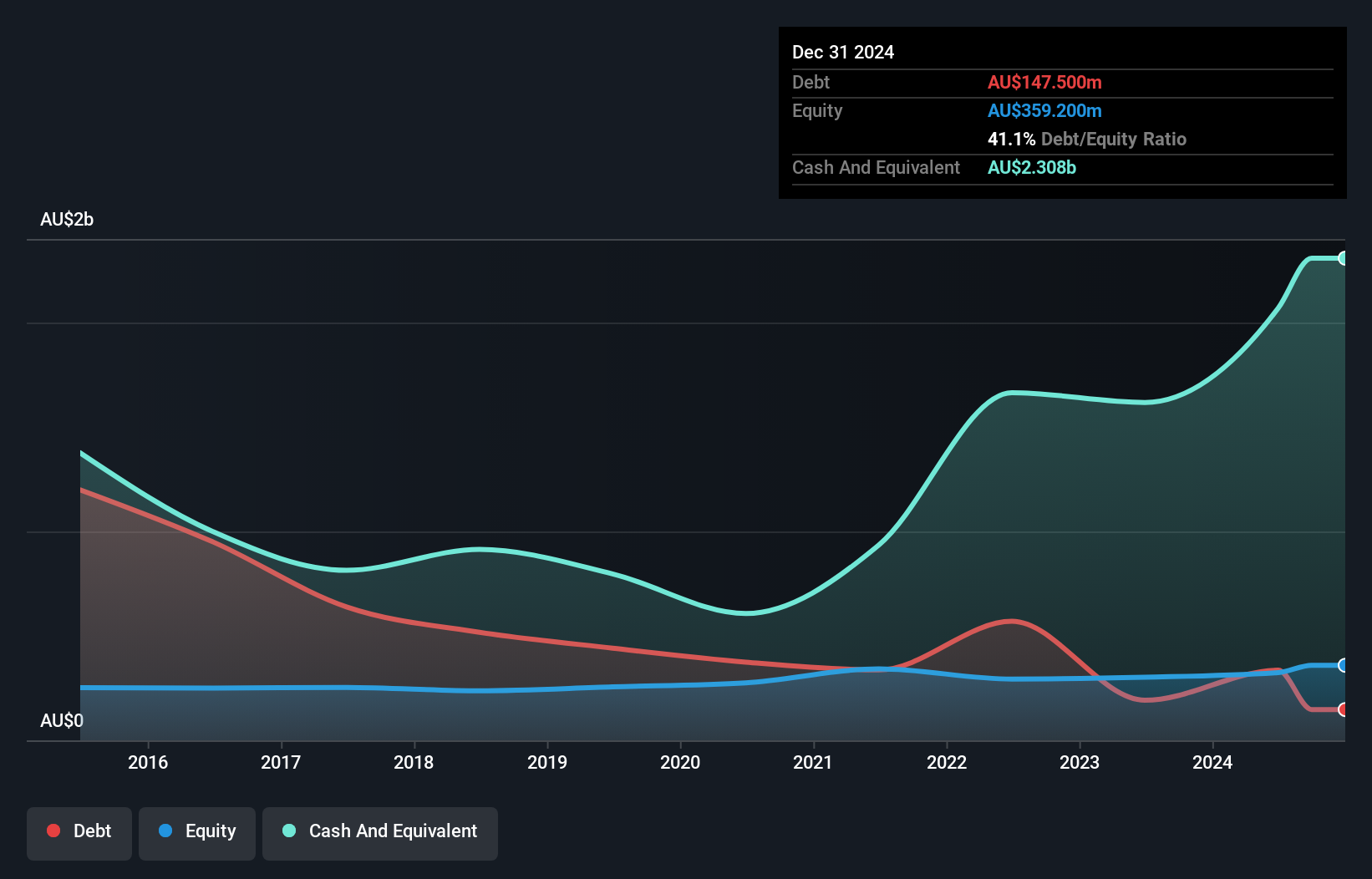

GR Engineering Services, a nimble player in the engineering sector, recently secured a contract with Horizon Minerals for refurbishing the Black Swan processing plant. The company reported robust earnings growth of 34.3% over the past year, outpacing its industry peers by a wide margin. With no debt on its books and high-quality past earnings, GR Engineering appears financially sound. Its recent financials show sales at A$272 million and net income at A$21.82 million for the half-year ending December 2024. The firm declared an increased interim dividend of 10 cents per share, reflecting strong cash flow generation capabilities.

SRG Global (ASX:SRG)

Simply Wall St Value Rating: ★★★★★☆

Overview: SRG Global Limited is a company that offers engineering-led maintenance, industrial services, and engineering and construction services across Australia, New Zealand, and internationally with a market capitalization of approximately A$779.11 million.

Operations: SRG Global generates revenue primarily from its Maintenance and Industrial Services segment, contributing A$724.53 million, and its Engineering and Construction segment, contributing A$453.78 million.

SRG Global, a promising player in the construction sector, is leveraging its strategic acquisition of Diona to strengthen its position in water security and energy transition. With work-in-hand reaching A$3.4 billion—an 80% increase from last year—the company demonstrates robust growth potential. Its capital-light model enhances financial flexibility, while an 80% annuity recurring earnings profile provides revenue stability. Despite challenges like competition and integration risks, SRG's interest payments are well-covered by EBIT at 47 times coverage, indicating strong operational efficiency. Trading at a significant discount of 46.7% below fair value adds to its investment appeal as analysts forecast earnings growth of nearly 16% annually over the next five years.

Taking Advantage

- Get an in-depth perspective on all 51 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GNG

GR Engineering Services

Provides engineering, process control, automation, and construction services to the mining and mineral processing industries in Australia and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion