- Australia

- /

- Capital Markets

- /

- ASX:BKI

ASX Penny Stocks Spotlight: BKI Investment And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

The Australian stock market is experiencing a surge, with shares poised for a significant leap following a tech rally in New York, sparking bullish sentiment. Penny stocks, often overlooked and considered relics of past trading days, still hold potential for growth by offering investors access to smaller or newer companies at lower price points. By focusing on those with strong financials and clear growth paths, investors can uncover hidden gems that might offer both stability and upside potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.42 | A$120.37M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.84 | A$52.31M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$431.87M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.75 | A$276.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.047 | A$54.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.068 | A$35.82M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.21 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.47 | A$228.68M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.45 | A$642.88M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 410 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

BKI Investment (ASX:BKI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BKI Investment Company Limited is a publicly owned investment manager with a market cap of A$1.39 billion.

Operations: The company's revenue is primarily derived from the securities industry, totaling A$69.33 million.

Market Cap: A$1.39B

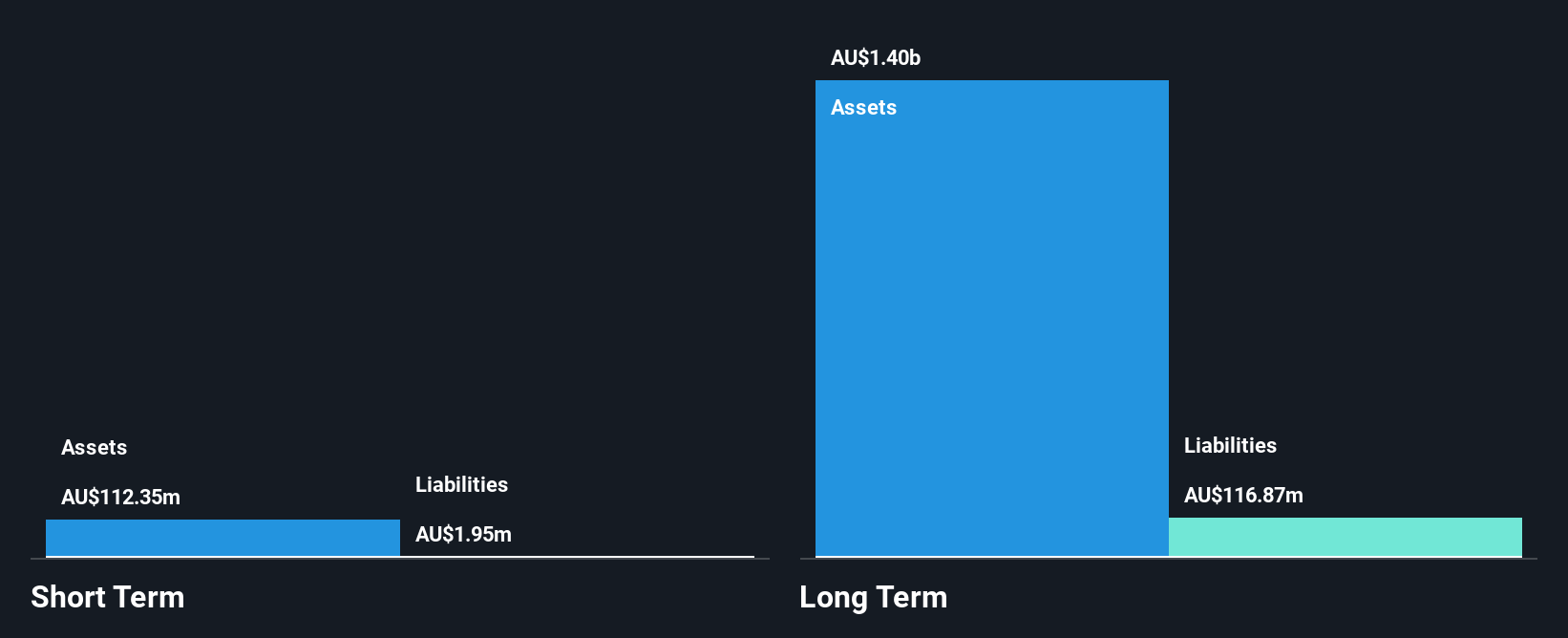

BKI Investment Company Limited, with a market cap of A$1.39 billion, operates debt-free but faces challenges such as negative earnings growth and a low return on equity of 4.3%. Despite high-quality earnings and stable weekly volatility at 2%, its net profit margin has declined from the previous year. The board is seasoned with an average tenure of 22.1 years, yet the management team's experience remains unclear. Short-term assets cover short-term liabilities but fall short against long-term obligations. Recent executive changes include Belinda Cleminson's appointment as Company Secretary, bringing over two decades of governance experience to the firm.

- Navigate through the intricacies of BKI Investment with our comprehensive balance sheet health report here.

- Assess BKI Investment's previous results with our detailed historical performance reports.

Cuscal (ASX:CCL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cuscal Limited, with a market cap of A$749.01 million, offers payment and regulated data products and services to financial and consumer-focused institutions in Australia.

Operations: The company's revenue segment is generated entirely from its operations in Australia, amounting to A$492.5 million.

Market Cap: A$749.01M

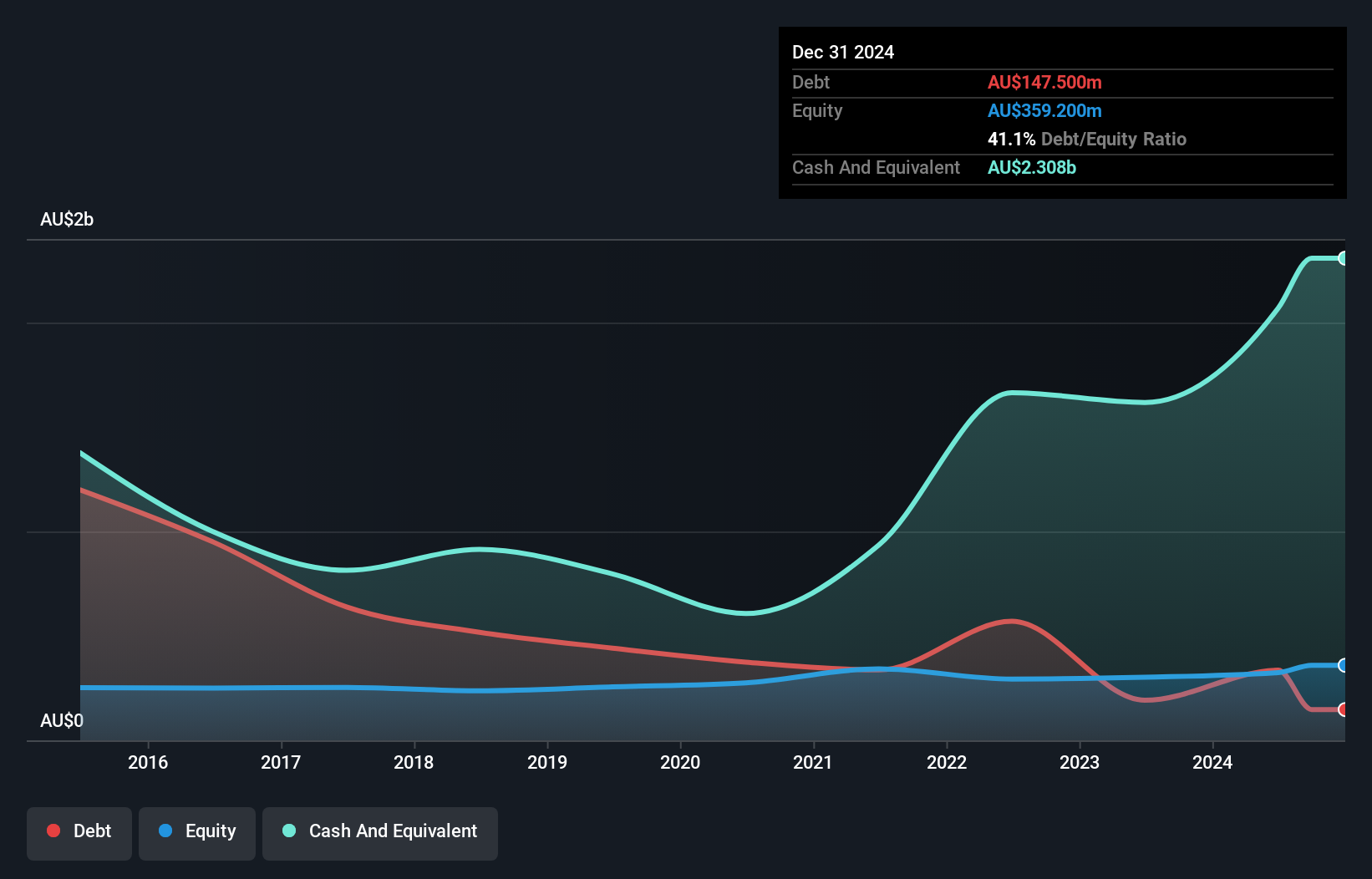

Cuscal Limited, with a market cap of A$749.01 million, demonstrates financial stability through its short-term assets exceeding both short and long-term liabilities. The management team is experienced with an average tenure of 2.8 years, and the board averages 5.6 years in tenure. Despite having high-quality earnings and reducing its debt-to-equity ratio from 136.1% to 97% over five years, Cuscal faces challenges such as low return on equity at 7.6% and negative earnings growth over the past year compared to industry averages. Additionally, interest payments are not well covered by EBIT at only 1.4x coverage.

- Dive into the specifics of Cuscal here with our thorough balance sheet health report.

- Gain insights into Cuscal's outlook and expected performance with our report on the company's earnings estimates.

XRF Scientific (ASX:XRF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XRF Scientific Limited manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries across Australia, Canada, and Europe with a market cap of A$280.98 million.

Operations: The company's revenue is derived from three main segments: Consumables (A$19.26 million), Precious Metals (A$21.51 million), and Capital Equipment (A$22.56 million).

Market Cap: A$280.98M

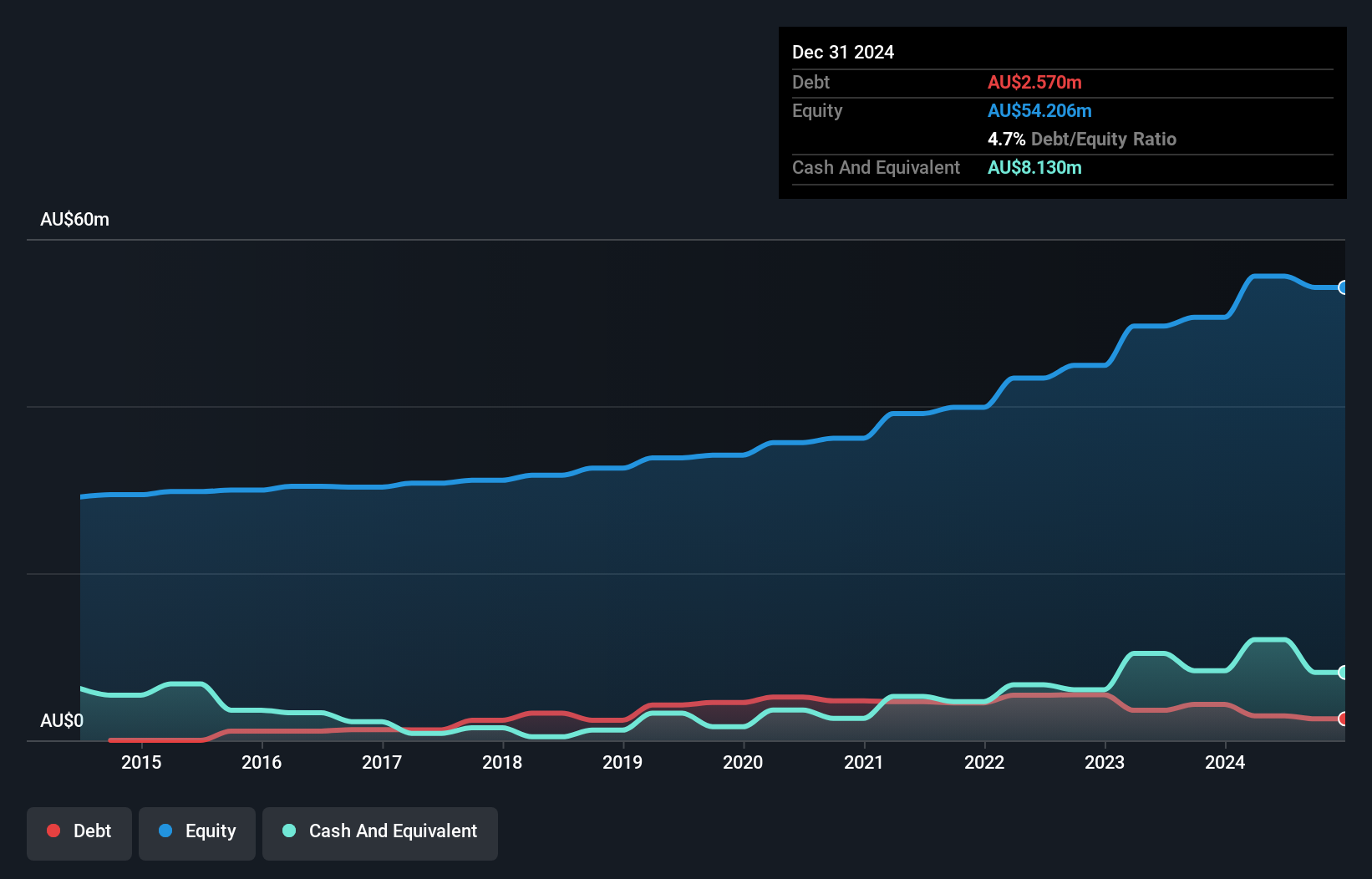

XRF Scientific Limited, with a market cap of A$280.98 million, shows financial resilience as its short-term assets surpass both short and long-term liabilities. The company benefits from a seasoned management team and board, with average tenures of 12.3 and 13.5 years respectively. Its debt is well-covered by operating cash flow, while interest payments are comfortably managed by EBIT at 57.6x coverage. Despite having high-quality earnings and reducing its debt-to-equity ratio significantly over five years, XRF faces challenges such as low return on equity at 17.2% and recent insider selling activity over the past quarter.

- Take a closer look at XRF Scientific's potential here in our financial health report.

- Review our growth performance report to gain insights into XRF Scientific's future.

Next Steps

- Click through to start exploring the rest of the 407 ASX Penny Stocks now.

- Searching for a Fresh Perspective? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BKI Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BKI

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success