- Australia

- /

- Capital Markets

- /

- ASX:EZL

ASX Penny Stocks To Consider In August 2025

Reviewed by Simply Wall St

The Australian market is currently experiencing a mixed sentiment, with the ASX futures appearing red on the last day of earnings, while positive news from the U.S. economy has bolstered Wall Street to new highs. In this context, penny stocks—though an older term—remain a relevant investment area for those interested in smaller or newer companies that may offer significant value. By focusing on firms with strong financials and growth potential, investors can uncover opportunities that might provide both stability and upside in today's evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.445 | A$127.53M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.46 | A$116.05M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.78 | A$429.86M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.65 | A$269.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$37.8M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.16 | A$342.55M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Bravura Solutions (ASX:BVS) | A$2.23 | A$999.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Praemium (ASX:PPS) | A$0.765 | A$365.83M | ✅ 5 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.865 | A$150.22M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 438 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Bell Financial Group (ASX:BFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bell Financial Group Limited provides full-service and online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients across several regions including Australia, the US, the UK, Hong Kong, and Kuala Lumpur with a market cap of A$407.34 million.

Operations: The company's revenue is derived from three main segments: Broking (A$150.73 million), Products & Services (A$53.21 million), and Technology & Platforms (A$32.15 million).

Market Cap: A$407.34M

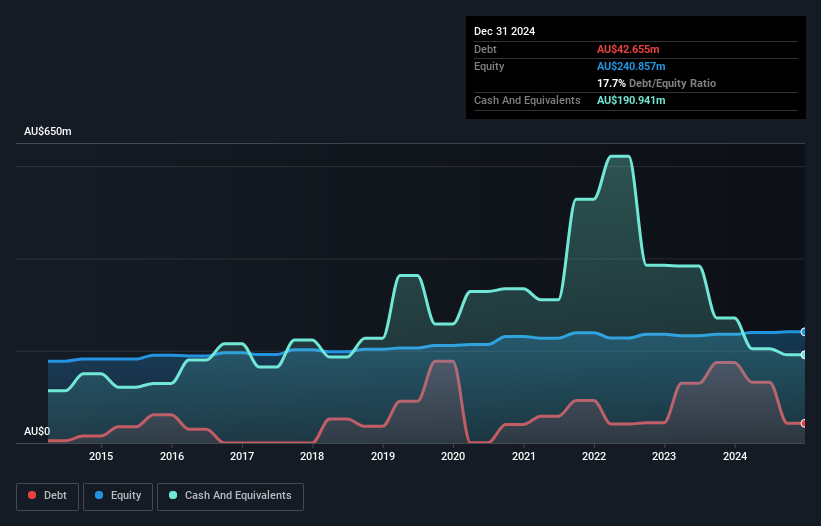

Bell Financial Group's recent performance highlights both opportunities and challenges typical of penny stocks. With a market cap of A$407.34 million, its revenue streams are diversified across Broking, Products & Services, and Technology & Platforms segments. However, recent earnings show a decline with net income at A$9.35 million compared to A$16.62 million the previous year, impacting profit margins and dividend sustainability. Despite this, Bell's short-term assets exceed liabilities significantly (A$1 billion vs A$919.9 million), indicating solid liquidity management. The appointment of Nick Hamilton as CFO could bring strategic financial oversight amidst these dynamics.

- Navigate through the intricacies of Bell Financial Group with our comprehensive balance sheet health report here.

- Gain insights into Bell Financial Group's outlook and expected performance with our report on the company's earnings estimates.

Euroz Hartleys Group (ASX:EZL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Euroz Hartleys Group Limited is a diversified financial services company offering stockbroking, wealth and funds management, and investing services in Australia, with a market cap of A$152.35 million.

Operations: The company's revenue is derived from two primary segments: Wholesale, which contributes A$44.16 million, and Private Wealth, accounting for A$54.17 million.

Market Cap: A$152.35M

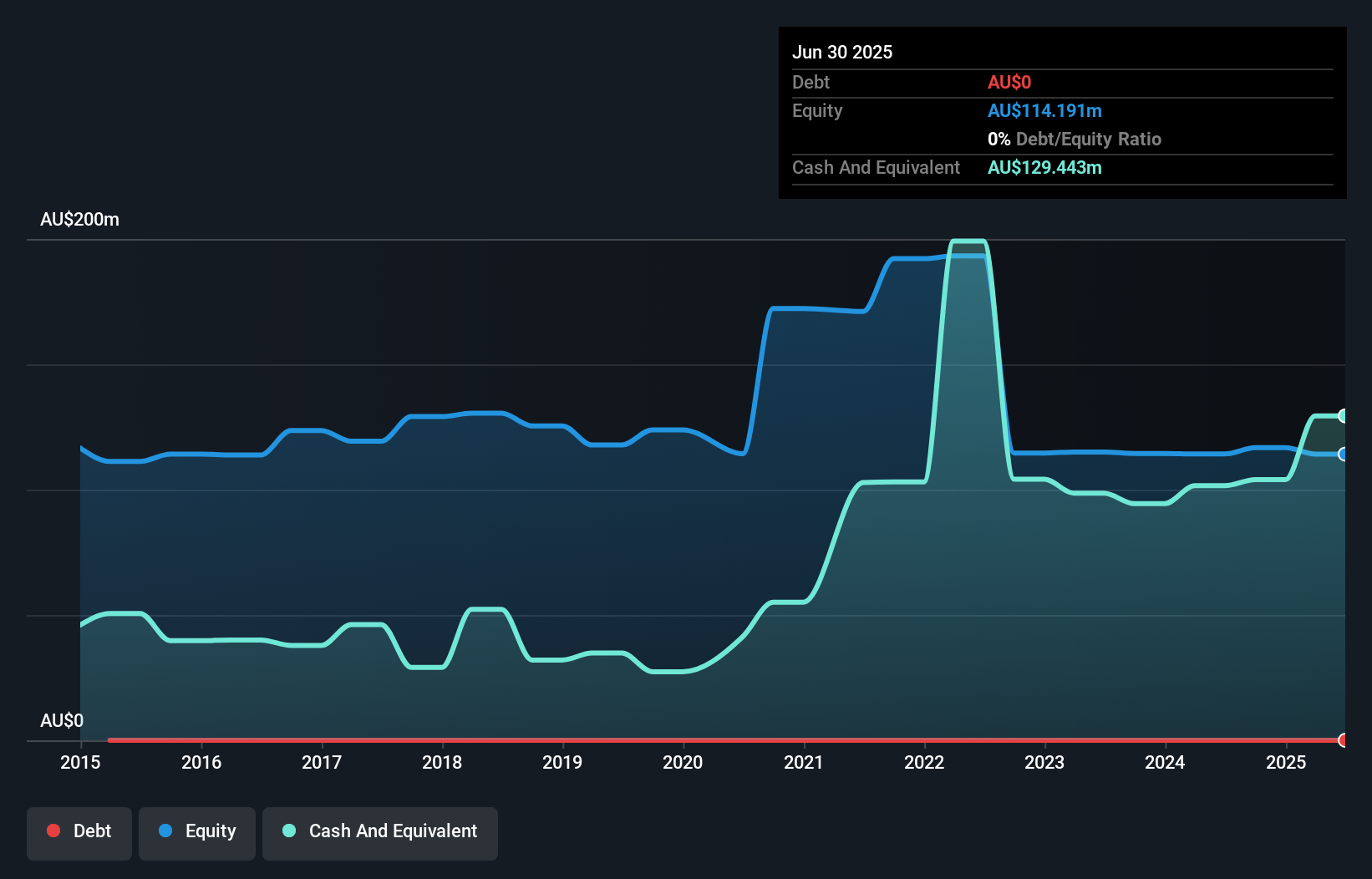

Euroz Hartleys Group demonstrates characteristics typical of penny stocks, with a market cap of A$152.35 million and a focus on financial services. The company's recent earnings report shows revenue growth to A$98.68 million and net income doubling to A$10.26 million, indicating improved profitability with higher profit margins compared to last year. Euroz Hartleys maintains strong liquidity, as its short-term assets significantly exceed liabilities, and it operates debt-free, reducing financial risk. However, the company faces challenges in maintaining consistent dividend payouts and long-term earnings growth has been negative over five years despite recent improvements.

- Unlock comprehensive insights into our analysis of Euroz Hartleys Group stock in this financial health report.

- Review our historical performance report to gain insights into Euroz Hartleys Group's track record.

Tribeca Global Natural Resources (ASX:TGF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tribeca Global Natural Resources Limited is an investment firm focused on infrastructure investments, with a market cap of A$124.89 million.

Operations: The company's revenue is derived entirely from its investment in securities, amounting to A$20.23 million.

Market Cap: A$124.89M

Tribeca Global Natural Resources, with a market cap of A$124.89 million, has transitioned to profitability this year, reporting A$20.23 million in revenue and a net income of A$5.02 million. The company is debt-free and maintains robust liquidity, with short-term assets significantly exceeding liabilities. Recent announcements include a share buyback program aimed at enhancing shareholder value and an annual dividend of A$0.0500 per share. Despite these positives, the company's return on equity remains low at 3%, and its dividend yield is not well covered by free cash flows, indicating potential sustainability concerns for investors seeking consistent income streams.

- Click here and access our complete financial health analysis report to understand the dynamics of Tribeca Global Natural Resources.

- Assess Tribeca Global Natural Resources' previous results with our detailed historical performance reports.

Key Takeaways

- Explore the 438 names from our ASX Penny Stocks screener here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euroz Hartleys Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EZL

Euroz Hartleys Group

A diversified financial services company, provides stockbroking, wealth and funds management, and investing services in Australia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives