- Australia

- /

- Capital Markets

- /

- ASX:AVC

Market Participants Recognise Auctus Investment Group Limited's (ASX:AVC) Revenues

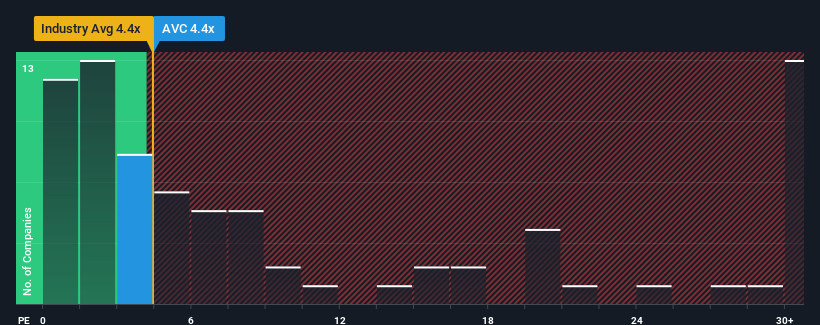

With a median price-to-sales (or "P/S") ratio of close to 4.4x in the Capital Markets industry in Australia, you could be forgiven for feeling indifferent about Auctus Investment Group Limited's (ASX:AVC) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Auctus Investment Group

How Has Auctus Investment Group Performed Recently?

Recent times have been pleasing for Auctus Investment Group as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Auctus Investment Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Auctus Investment Group?

The only time you'd be comfortable seeing a P/S like Auctus Investment Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 3.3%. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 1.7% during the coming year according to the sole analyst following the company. With the rest of the industry predicted to shrink by 3.3%, it's set to post a similar result.

In light of this, it's understandable that Auctus Investment Group's P/S sits in line with the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Auctus Investment Group's analyst forecasts revealed that its equally shaky outlook against the industry is keeping its P/S in line with the industry too. Right now, shareholders are comfortable with the P/S as they have faith that future revenue will not uncover any unpleasant surprises. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Auctus Investment Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AVC

Pier 12 Capital

Auctus Investment Group Limited previously known as Yonder and Beyond Group Limited is a private equity, and venture capital firm specializing in mid-market, growth sectors, real estate, and infrastructure.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives