- Australia

- /

- Capital Markets

- /

- ASX:FID

3 ASX Dividend Stocks To Consider With Up To 7.7% Yield

Reviewed by Simply Wall St

As the Australian market remains relatively flat, with the ASX hovering around 8,542 points, discussions about potential tax reforms are capturing attention alongside sector-specific movements. In this environment of economic uncertainty and mixed sector performance, dividend stocks can offer a stable income stream for investors seeking reliable returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 8.59% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.37% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.23% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.75% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.47% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.95% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.71% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.71% | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | 9.67% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 10.00% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

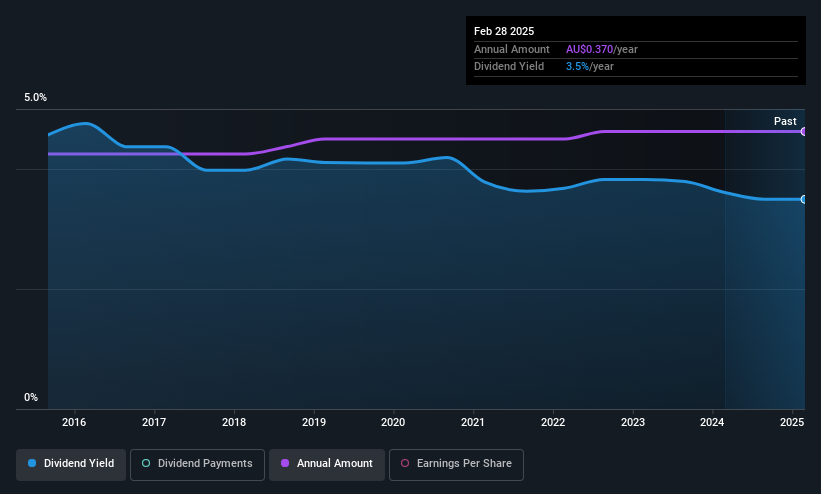

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited is a publicly owned investment manager with a market cap of A$1.36 billion.

Operations: Australian United Investment Company Limited generates its revenue primarily from investment activities, amounting to A$58.38 million.

Dividend Yield: 3.4%

Australian United Investment's dividends have been stable and reliable over the past decade, with consistent growth and minimal volatility. However, its dividend yield of 3.38% is relatively low compared to top-tier Australian dividend payers. The high payout ratio (91.9%) indicates dividends are not well covered by earnings, though they are supported by cash flows with an 89.7% cash payout ratio. Recent news includes an extension of its buyback plan until May 2026.

- Unlock comprehensive insights into our analysis of Australian United Investment stock in this dividend report.

- The analysis detailed in our Australian United Investment valuation report hints at an inflated share price compared to its estimated value.

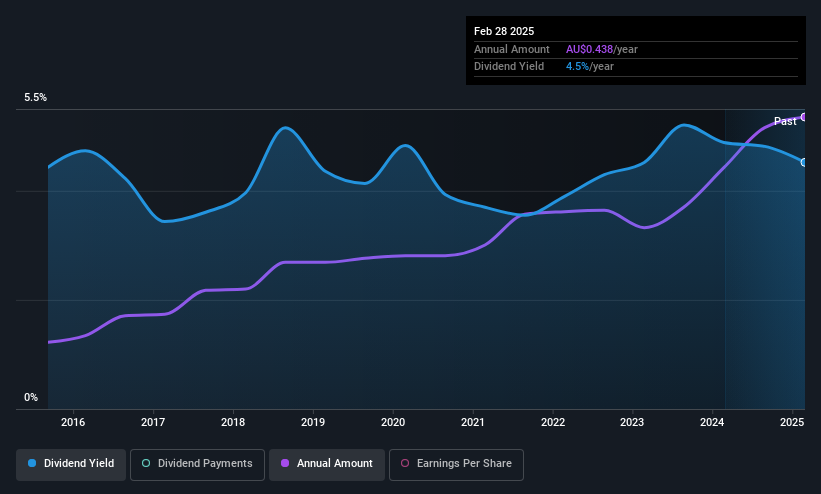

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd, with a market cap of A$293.58 million, operates in Australia through its subsidiaries to offer financial services.

Operations: Fiducian Group Ltd generates revenue through its subsidiaries in Australia from four main segments: Funds Management (A$24.34 million), Corporate Services (A$16.38 million), Financial Planning (A$28.93 million), and Platform Administration (A$16.49 million).

Dividend Yield: 4.7%

Fiducian Group offers a stable dividend yield of 4.71%, which is lower than the top Australian payers but remains reliable with consistent growth over the past decade. The company maintains a sustainable payout ratio of 80.4%, indicating dividends are well covered by earnings and cash flows, with a cash payout ratio of 67.8%. Its price-to-earnings ratio of 17.4x suggests reasonable valuation compared to the broader market, enhancing its appeal for dividend-focused investors.

- Take a closer look at Fiducian Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Fiducian Group shares in the market.

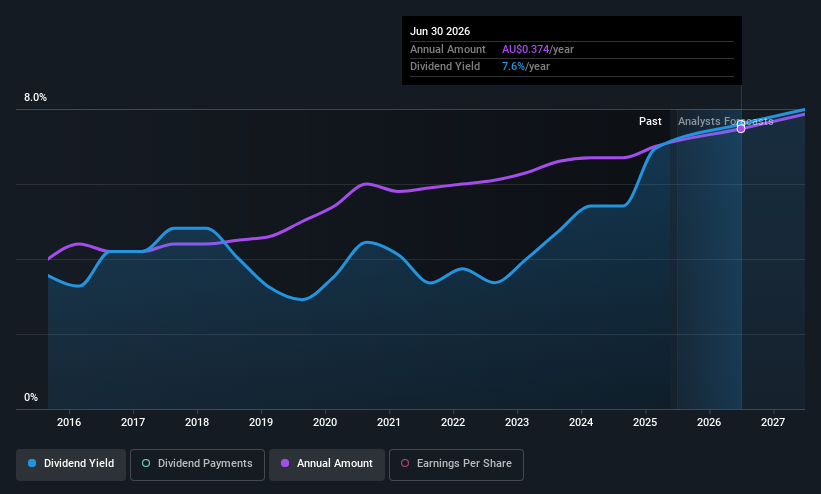

IPH (ASX:IPH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IPH Limited, along with its subsidiaries, offers intellectual property services and products and has a market capitalization of approximately A$1.18 billion.

Operations: IPH Limited generates revenue through its intellectual property services, with A$121 million from Asia, A$259.20 million from Canada, and A$300.30 million from Australia & New Zealand.

Dividend Yield: 7.7%

IPH's dividend yield of 7.71% ranks in the top 25% of Australian payers, but its sustainability is questionable due to a high payout ratio of 119.5%, indicating dividends are not well covered by earnings. Despite this, dividends have been stable and growing over the past decade with reliable cash flow coverage at an 82.8% cash payout ratio. Recent buyback completion might support shareholder value, although it doesn't directly enhance dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of IPH.

- Our valuation report unveils the possibility IPH's shares may be trading at a discount.

Key Takeaways

- Gain an insight into the universe of 29 Top ASX Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FID

Fiducian Group

Through its subsidiaries, provides financial services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives