- Australia

- /

- Healthtech

- /

- ASX:MDR

ASX Penny Stocks With Market Caps Under A$400M To Consider

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close up 0.33% at 8,178 points, with Energy leading the way as the strongest performing sector. In such a climate, investors often look for opportunities in various corners of the market, including penny stocks. Although "penny stocks" might seem like an outdated term, they still represent smaller or newer companies that can offer significant growth potential when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.70 | A$136.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.90 | A$1.08B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.46 | A$68.87M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.64 | A$407.04M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.58M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.77 | A$463.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.30 | A$156.59M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.16 | A$726.11M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.56 | A$764.52M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.76 | A$1.26B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 992 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AMCIL (ASX:AMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amcil Limited is a publicly owned investment manager with a market cap of A$348.66 million.

Operations: The company generates revenue primarily from its investments, amounting to A$9.74 million.

Market Cap: A$348.66M

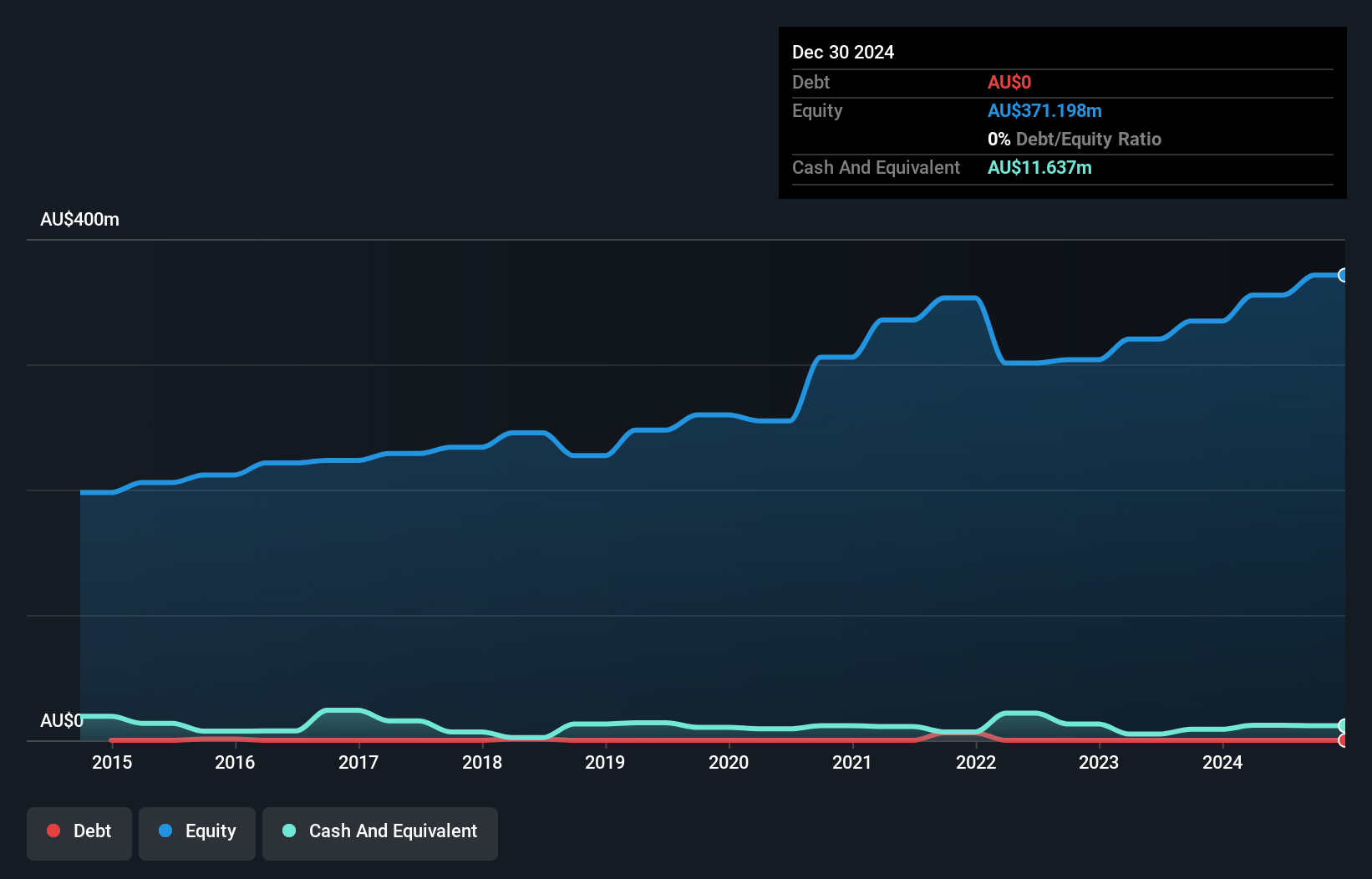

AMCIL's market cap of A$348.66 million positions it as a significant entity within the penny stock category, though its recent negative earnings growth of -7.5% contrasts with the industry average. Despite high-quality earnings and a seasoned management team with an average tenure of 8.8 years, AMCIL faces challenges such as short-term assets (A$12.3M) not covering long-term liabilities (A$49.8M). The company's dividend yield of 3.62% is not well supported by earnings or free cash flow, and its Return on Equity stands at a low 1.9%, suggesting room for improvement in profitability metrics.

- Click to explore a detailed breakdown of our findings in AMCIL's financial health report.

- Understand AMCIL's track record by examining our performance history report.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited specializes in carbon abatement and renewable energy solutions by utilizing biogas from landfill, with a market cap of A$268.20 million.

Operations: The company generates revenue from Carbon Abatement (A$17.03 million), Renewable Energy (A$15.05 million), and Infrastructure Construction and Management (A$2.21 million).

Market Cap: A$268.2M

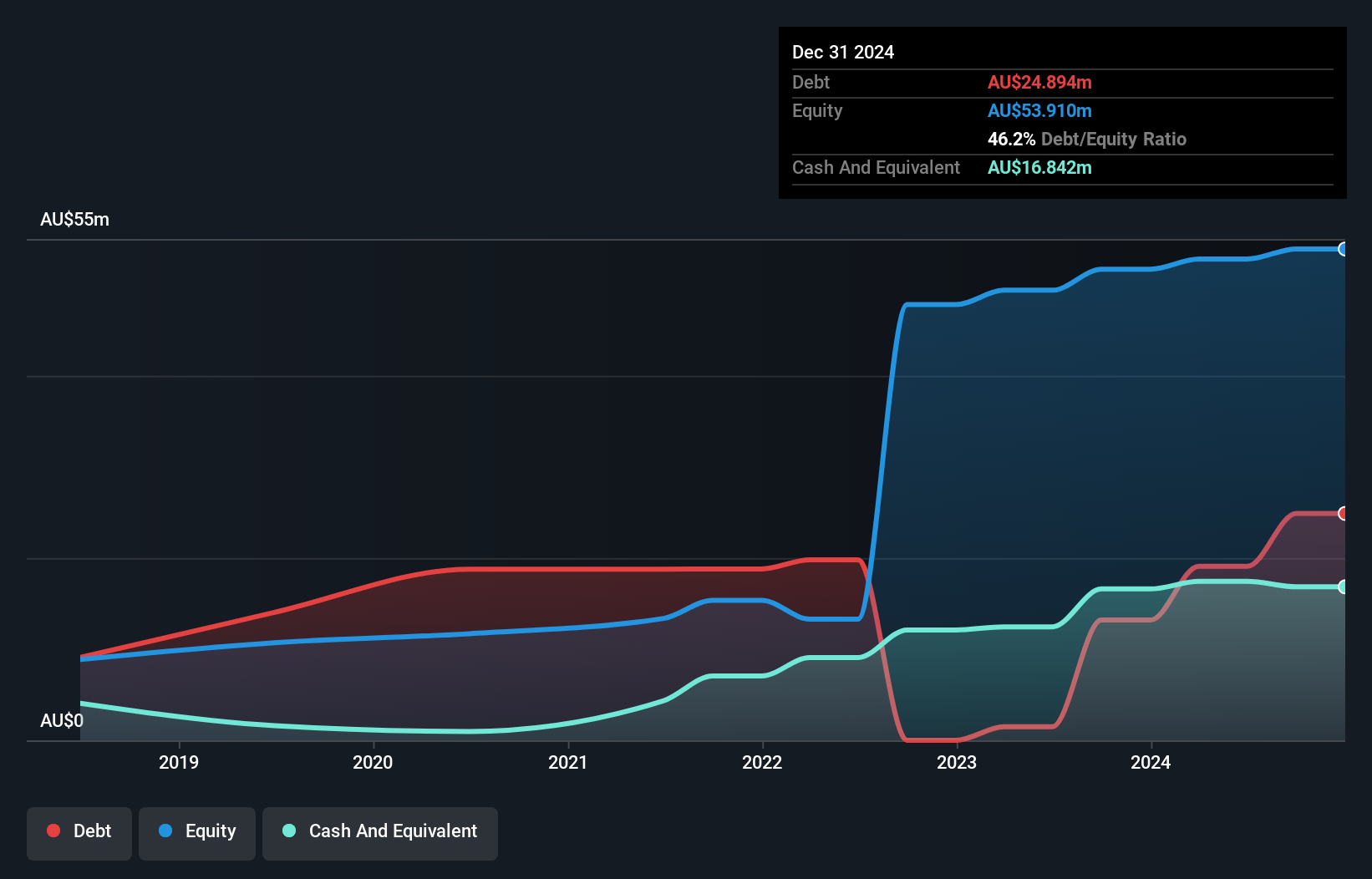

LGI Limited, with a market cap of A$268.20 million, has shown significant debt reduction over five years and maintains a satisfactory net debt to equity ratio of 14.9%. Despite facing negative earnings growth last year, its earnings have grown significantly over the past five years at 29.4% per annum. LGI's operating cash flow effectively covers its debt obligations, and interest payments are well covered by EBIT. However, current profit margins have declined compared to last year, and the management team is relatively inexperienced with an average tenure of 1.2 years. Recent dividend announcements reflect consistent shareholder returns despite fluctuating net income figures.

- Click here to discover the nuances of LGI with our detailed analytical financial health report.

- Examine LGI's earnings growth report to understand how analysts expect it to perform.

MedAdvisor (ASX:MDR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MedAdvisor Limited, with a market cap of A$77.70 million, offers pharmacy-driven patient engagement solutions across Australia, New Zealand, the United States, and the United Kingdom.

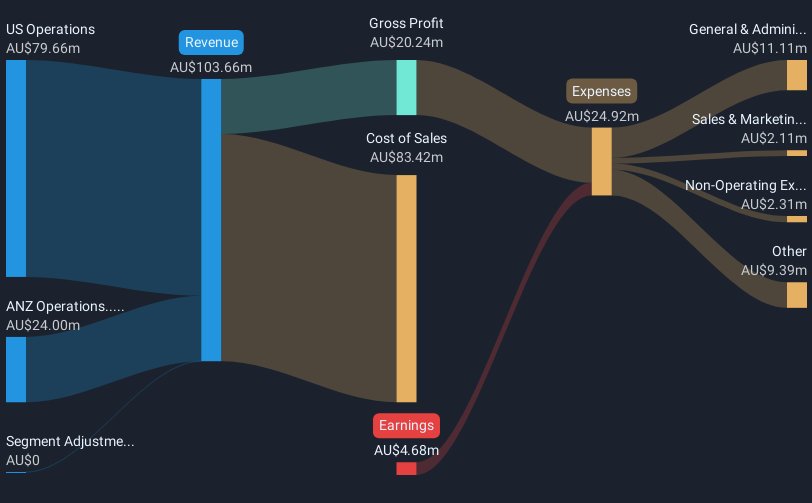

Operations: The company generates revenue through its US Operations, which contribute A$79.66 million, and ANZ Operations, providing A$24.00 million.

Market Cap: A$77.7M

MedAdvisor Limited, with a market cap of A$77.70 million, is navigating the challenges of being unprofitable yet has shown resilience by reducing losses at 17% annually over five years. The company recently completed follow-on equity offerings totaling A$7 million to bolster its cash runway beyond 12 months. Despite volatile share prices and a negative return on equity, MedAdvisor's short-term assets surpass both short-term and long-term liabilities, reflecting financial stability. The board and management team are experienced, averaging tenures of 6.5 and 2.6 years respectively, providing seasoned leadership as the company forecasts significant revenue growth for fiscal year-end June 2025.

- Jump into the full analysis health report here for a deeper understanding of MedAdvisor.

- Assess MedAdvisor's future earnings estimates with our detailed growth reports.

Make It Happen

- Dive into all 992 of the ASX Penny Stocks we have identified here.

- Want To Explore Some Alternatives? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MDR

MedAdvisor

Provides pharmacy-driven patient engagement solutions in Australia, New Zealand, the United States, and the United Kingdom.

Excellent balance sheet and good value.

Market Insights

Community Narratives