As the Australian market experiences a mixed week with fluctuations in key indices like the ASX200, sectors such as IT, Discretionary, and Health Care have shown resilience while Materials and Energy face challenges. In this dynamic environment, identifying promising small-cap stocks requires a keen eye for companies with strong growth potential and strategic initiatives that align well with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$889.21 million, focusing on ethical and sustainable investment strategies.

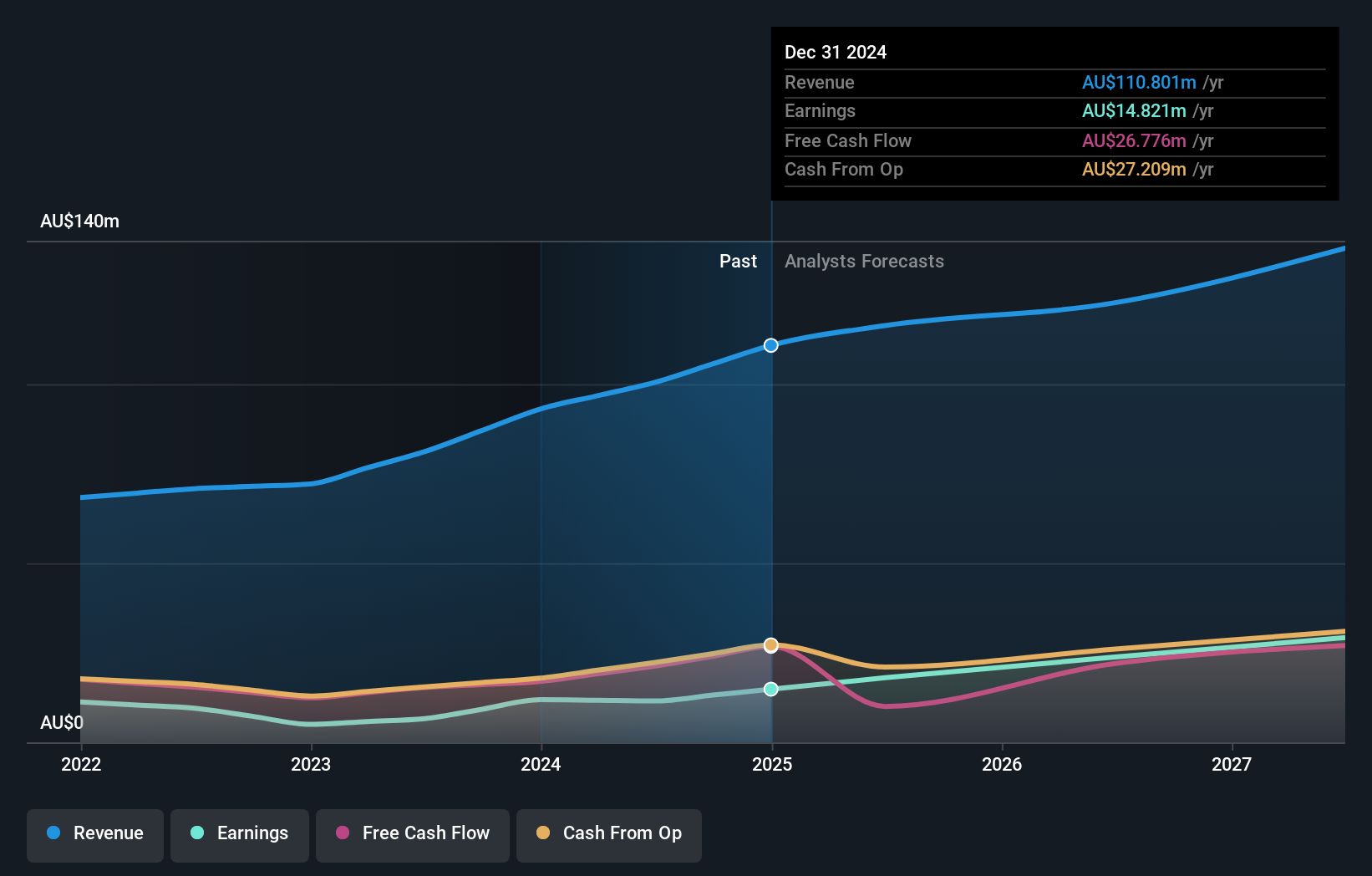

Operations: The company generates revenue primarily from its funds management segment, which reported A$110.80 million.

Australian Ethical Investment, a nimble player in the capital markets, has seen its earnings grow by 24.6% over the past year, outpacing industry growth of 23.4%. Despite a significant A$8.4M one-off loss impacting recent financials, the company remains debt-free and boasts positive free cash flow. The integration of Altius Asset Management has bolstered its funds under management and is expected to enhance revenue growth and net margins through cost efficiencies from platform transitions like GROW and State Street custody transfer. With projected annual revenue growth of 11.5%, potential risks include integration challenges affecting profit margins.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Value Rating: ★★★★★★

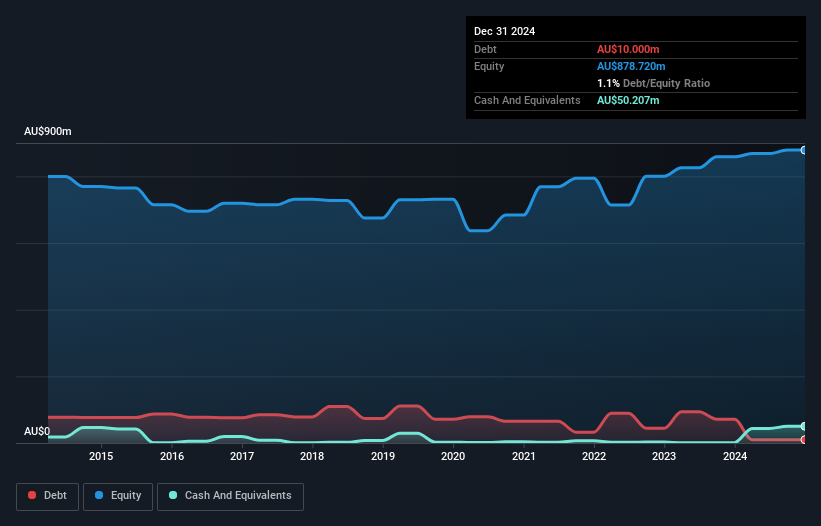

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market capitalization of A$852.29 million.

Operations: Djerriwarrh Investments generates revenue primarily from its portfolio of investments, amounting to A$53.07 million.

Djerriwarrh Investments, a small player in the capital markets, showcases solid financial health with earnings growing 7.9% annually over five years. The company boasts high-quality past earnings and maintains a debt-to-equity ratio that has improved significantly from 12.3% to 2.4%. While its recent earnings growth of 0.6% lags behind the industry average of 23.4%, Djerriwarrh remains free cash flow positive and covers interest payments comfortably at 24 times EBIT. Recent results show steady net income at A$39.18 million, slightly up from A$38.96 million last year, reflecting stable operational performance amidst broader market challenges.

Tuas (ASX:TUA)

Simply Wall St Value Rating: ★★★★★★

Overview: Tuas Limited owns and operates a mobile network in Singapore with a market cap of A$2.51 billion.

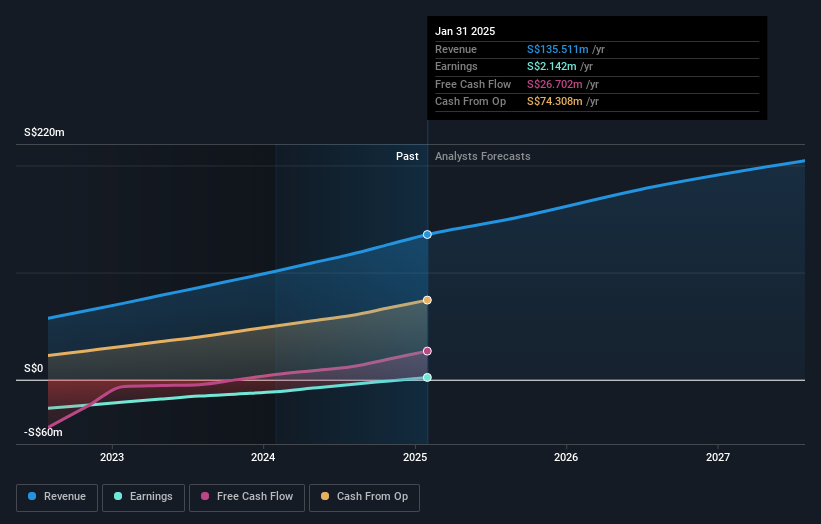

Operations: The company generates revenue primarily from its mobile operations, amounting to SGD 135.51 million.

Tuas, a nimble player in the telecom scene, has shown impressive strides with its recent profitability. The company is debt-free and boasts high-quality earnings, offering a solid foundation for growth. Its free cash flow turned positive this year at A$26.70 million, marking a significant turnaround from past years of negative figures. With revenue projected to grow by 16.81% annually, Tuas seems well-positioned against industry peers growing at 8.9%. Recent changes in leadership may bring fresh perspectives as the board seeks new talent following Robert Millner's departure as director earlier this year.

Taking Advantage

- Reveal the 48 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TUA

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives