- Australia

- /

- Capital Markets

- /

- ASX:PL8

Three Undiscovered Gems in Australia with Strong Fundamentals

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 1.25% at 7777.7 points, buoyed by positive sentiment following China's latest inflation data and a strong performance across various sectors. Amid this backdrop of volatility and recovery, identifying stocks with solid fundamentals becomes crucial for investors looking to capitalize on opportunities in the small-cap space. In this article, we explore three undiscovered gems in Australia that exhibit strong fundamentals and potential for growth despite recent market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.00% | ★★★★★★ |

| Lycopodium | NA | 15.62% | 29.55% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| Hearts and Minds Investments | NA | 18.39% | -3.93% | ★★★★★★ |

| SKS Technologies Group | NA | 31.29% | 43.27% | ★★★★★★ |

| BSP Financial Group | 4.92% | 6.74% | 5.29% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Paragon Care | 340.88% | 28.05% | 68.37% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

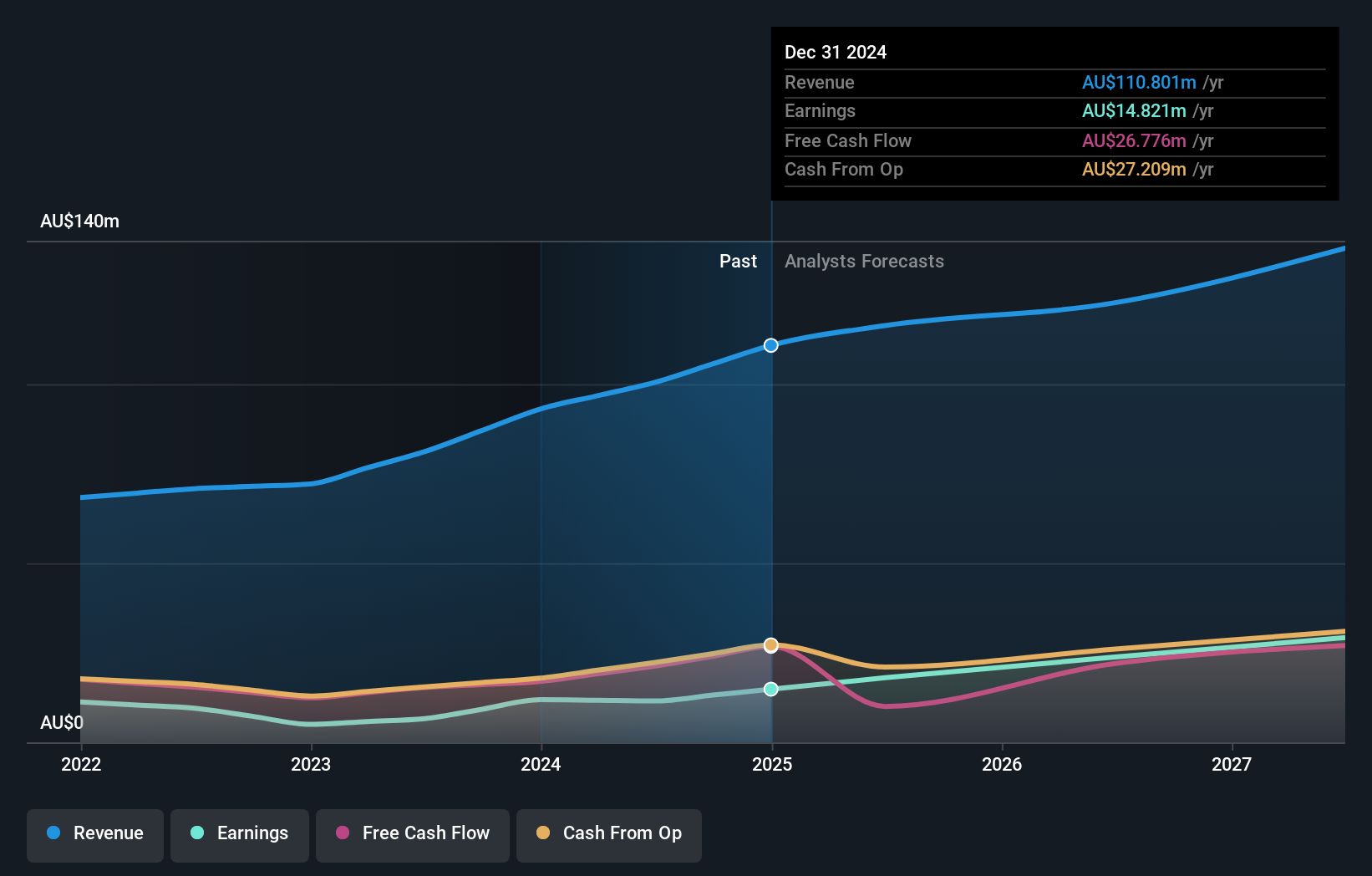

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd (ASX:AEF) is a publicly owned investment manager with a market cap of A$445.49 million.

Operations: The company generates revenue primarily from its funds management segment, which brought in A$93.03 million.

Australian Ethical Investment has shown impressive earnings growth of 137.8% over the past year, significantly outperforming the Capital Markets industry average of -0.1%. Despite a one-off loss of A$4.7M impacting its last 12 months to December 2023, it remains debt-free and has been for five years. Additionally, the company is free cash flow positive and does not face any concerns regarding interest coverage due to its lack of debt.

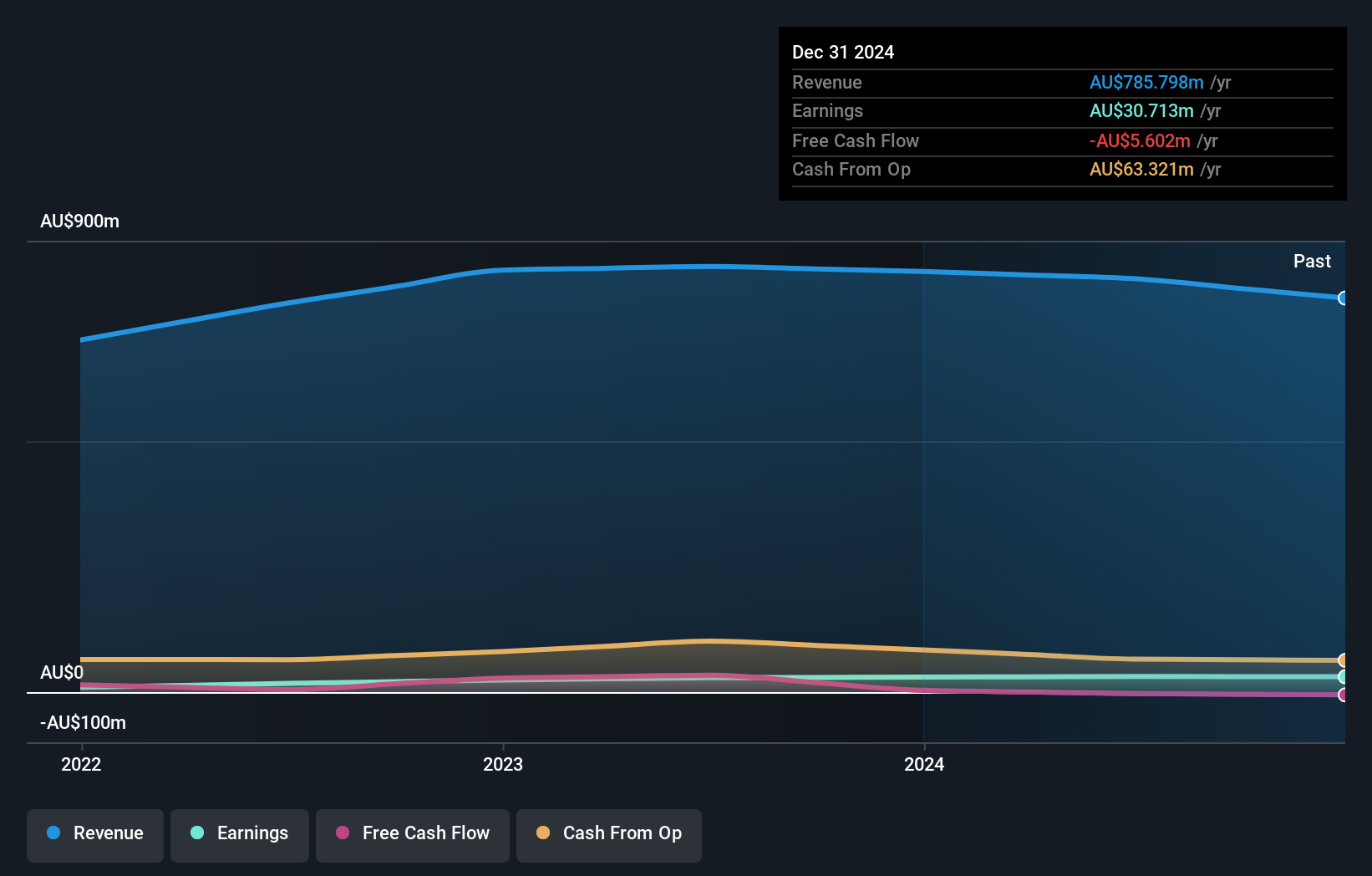

K&S (ASX:KSC)

Simply Wall St Value Rating: ★★★★★★

Overview: K&S Corporation Limited operates in transportation and logistics, contract management, warehousing and distribution, and fuel distribution across Australia and New Zealand with a market cap of A$458.44 million.

Operations: K&S Corporation Limited generates revenue primarily from its Australian Transport (A$600.34 million), Fuel (A$228.78 million), and New Zealand Transport (A$71.16 million) segments.

K&S has shown impressive earnings growth of 22.9% over the past year, outpacing the logistics industry's -26.2%. The company's debt to equity ratio has improved from 16.1% to 15.2% in five years, indicating prudent financial management. With interest payments well covered by EBIT at 10.7x and trading at a significant discount of 36.5% below its estimated fair value, K&S appears poised for continued strength in its sector.

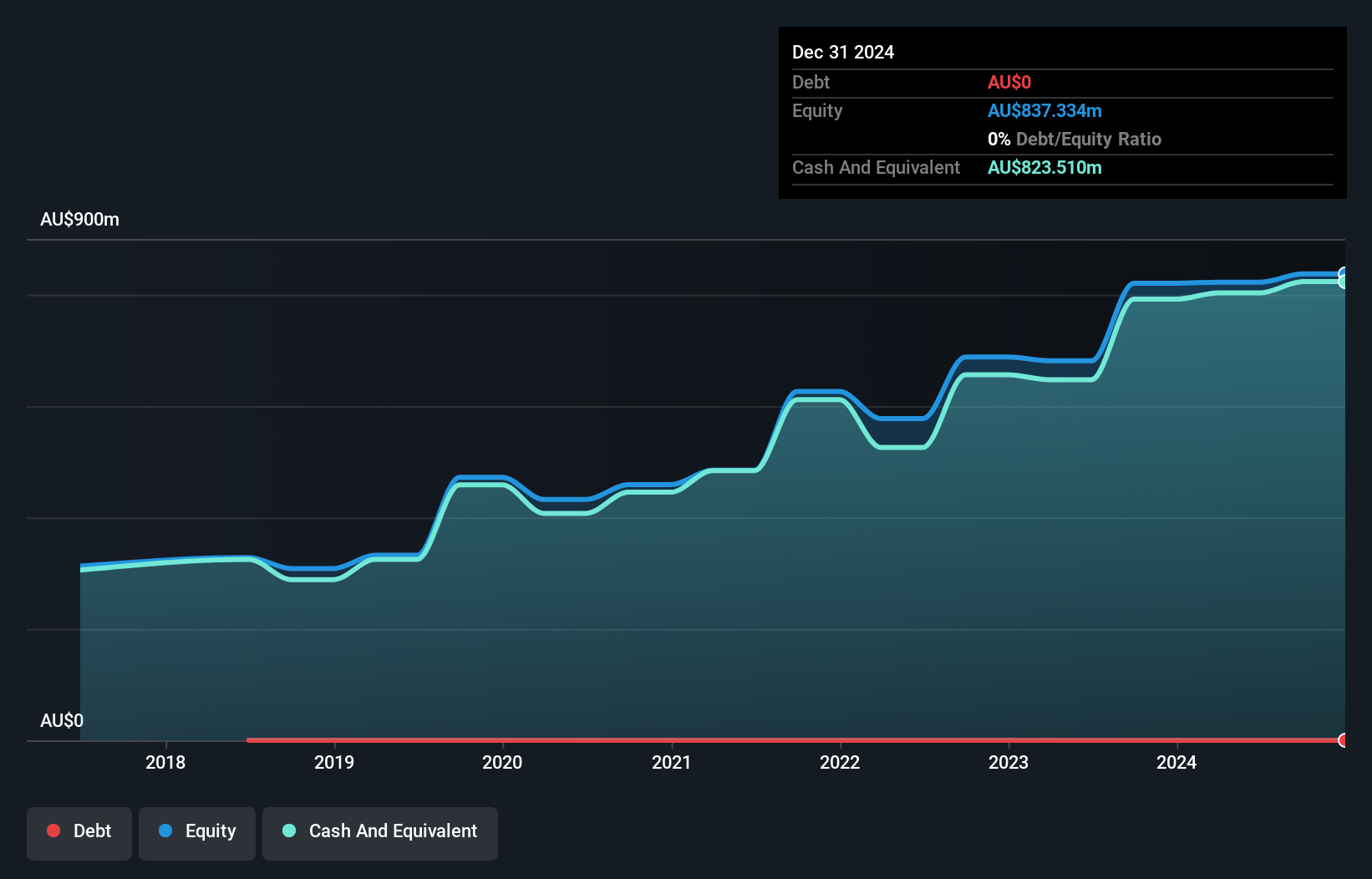

Plato Income Maximiser (ASX:PL8)

Simply Wall St Value Rating: ★★★★★★

Overview: Plato Income Maximiser Limited is a privately owned investment manager with a market cap of A$917.08 million.

Operations: The company generates revenue primarily through investment activities, totaling A$64.98 million.

Plato Income Maximiser has shown remarkable performance with a 255% earnings growth over the past year, significantly outpacing the Capital Markets industry. The company is debt-free and boasts a price-to-earnings ratio of 17.1x, which is below the Australian market average of 18.9x. Despite an improved profit margin at 82.5%, it remains lower than last year's figures, and shareholders have experienced dilution recently. Additionally, three fully franked dividends of A$0.0055 per share are scheduled for July to September 2024.

Key Takeaways

- Unlock more gems! Our ASX Undiscovered Gems With Strong Fundamentals screener has unearthed 52 more companies for you to explore.Click here to unveil our expertly curated list of 55 ASX Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PL8

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives