- Australia

- /

- Hospitality

- /

- ASX:WEB

The one-year earnings decline is not helping Web Travel Group's (ASX:WEB share price, as stock falls another 5.4% in past week

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Web Travel Group Limited (ASX:WEB) shareholders over the last year, as the share price declined 44%. That's disappointing when you consider the market returned 15%. However, the longer term returns haven't been so bad, with the stock down 17% in the last three years. Shareholders have had an even rougher run lately, with the share price down 14% in the last 90 days.

After losing 5.4% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

While Web Travel Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last year Web Travel Group saw its revenue grow by 2.6%. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 44% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

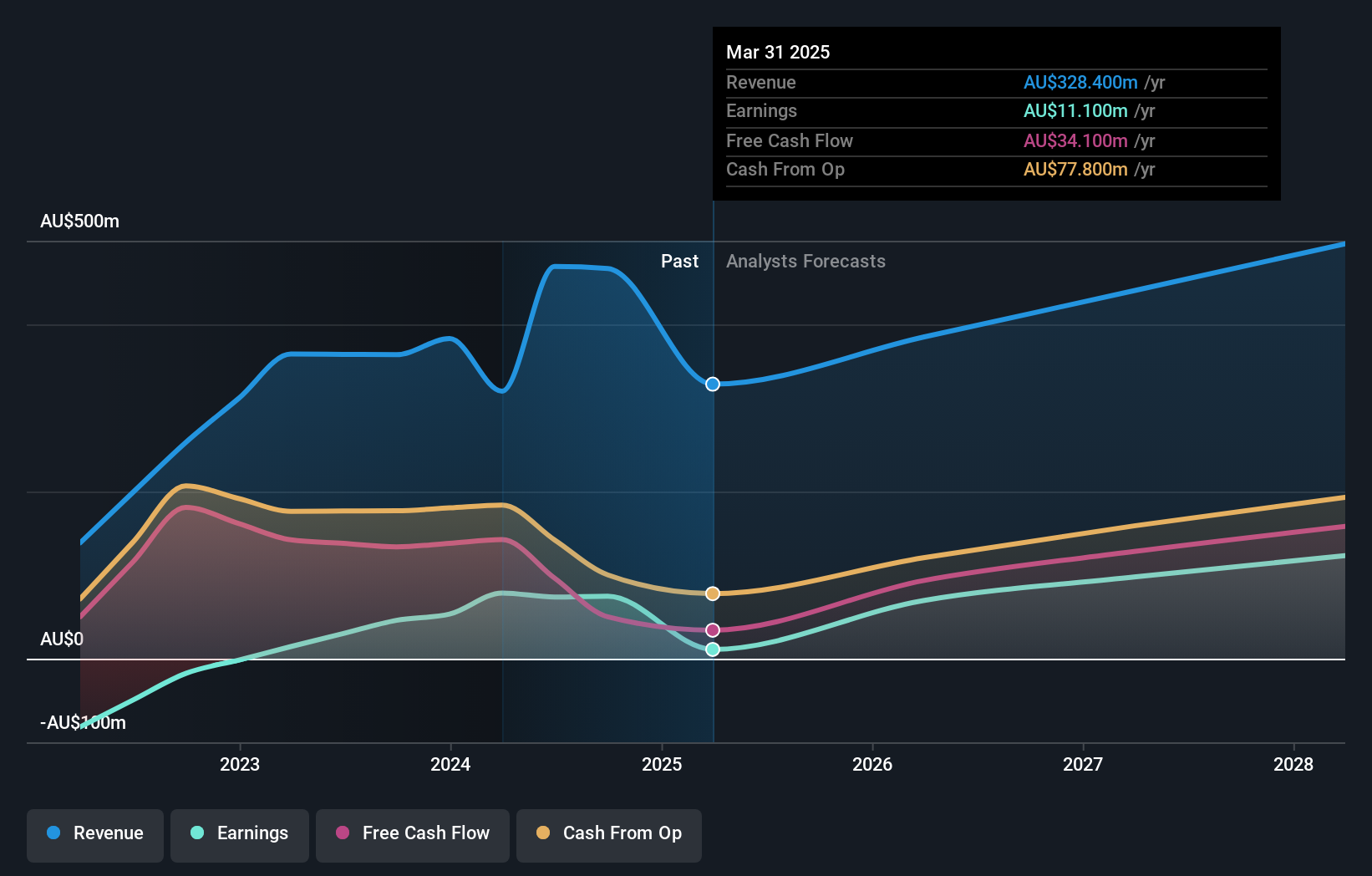

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Web Travel Group is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Web Travel Group in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Web Travel Group's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Web Travel Group shareholders, and that cash payout explains why its total shareholder loss of 36%, over the last 1 year, isn't as bad as the share price return.

A Different Perspective

Investors in Web Travel Group had a tough year, with a total loss of 36%, against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Web Travel Group better, we need to consider many other factors. Take risks, for example - Web Travel Group has 3 warning signs we think you should be aware of.

We will like Web Travel Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Web Travel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WEB

Web Travel Group

Provides online travel booking services in Australia, the United Arab Emirates, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives