Adam Davis has been the CEO of UCW Limited (ASX:UCW) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether UCW pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for UCW

Comparing UCW Limited's CEO Compensation With the industry

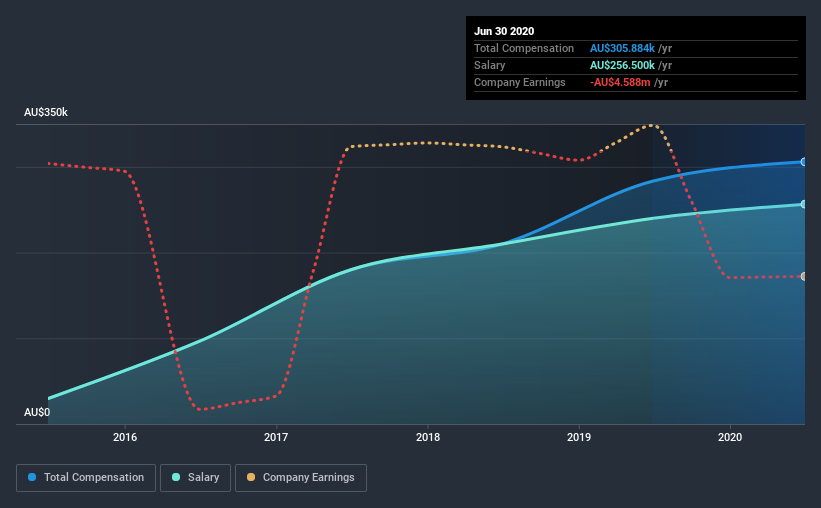

At the time of writing, our data shows that UCW Limited has a market capitalization of AU$23m, and reported total annual CEO compensation of AU$306k for the year to June 2020. That's a fairly small increase of 7.9% over the previous year. Notably, the salary which is AU$256.5k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below AU$254m, reported a median total CEO compensation of AU$478k. In other words, UCW pays its CEO lower than the industry median. What's more, Adam Davis holds AU$1.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$257k | AU$240k | 84% |

| Other | AU$49k | AU$44k | 16% |

| Total Compensation | AU$306k | AU$284k | 100% |

On an industry level, around 76% of total compensation represents salary and 24% is other remuneration. UCW is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

UCW Limited's Growth

UCW Limited has reduced its earnings per share by 118% a year over the last three years. In the last year, its revenue is up 15%.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has UCW Limited Been A Good Investment?

UCW Limited has generated a total shareholder return of 16% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

As previously discussed, Adam is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. And revenue growth for the company is showing some positive trends.And revenues are growing at a healthy clip.And revenues are increasing at a good pace over the past year. But we were hoping for higher shareholder returns and positive EPS growth during this stretch, which, unfortunately, did not materialize. We won't say CEO compensation is inappropriate, but shareholders will likely want to see healthier returns before they agree the company deserves a raise.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for UCW that investors should look into moving forward.

Important note: UCW is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade UCW, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EDU Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EDU

EDU Holdings

Through its subsidiaries, provides tertiary education services in Australia.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026