David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Tabcorp Holdings Limited (ASX:TAH) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Tabcorp Holdings

How Much Debt Does Tabcorp Holdings Carry?

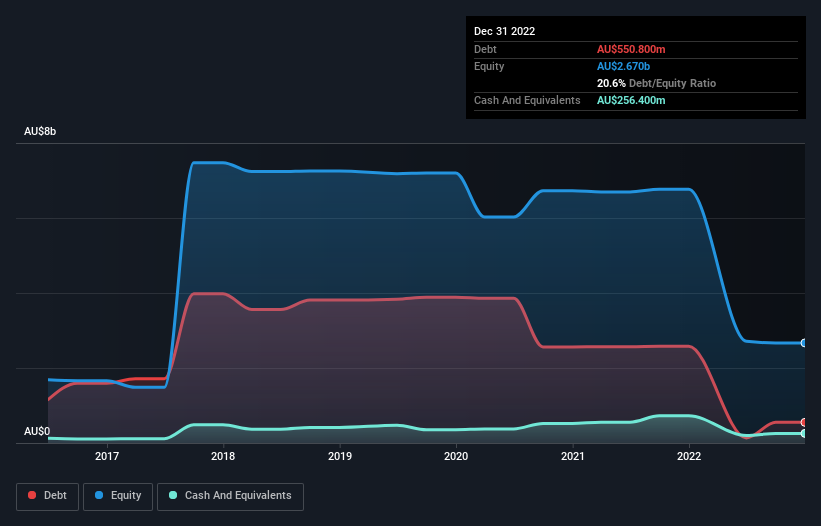

As you can see below, Tabcorp Holdings had AU$550.8m of debt at December 2022, down from AU$2.58b a year prior. However, it also had AU$256.4m in cash, and so its net debt is AU$294.4m.

How Healthy Is Tabcorp Holdings' Balance Sheet?

According to the last reported balance sheet, Tabcorp Holdings had liabilities of AU$654.9m due within 12 months, and liabilities of AU$877.7m due beyond 12 months. Offsetting this, it had AU$256.4m in cash and AU$265.2m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$1.01b.

While this might seem like a lot, it is not so bad since Tabcorp Holdings has a market capitalization of AU$2.29b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Tabcorp Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Tabcorp Holdings reported revenue of AU$2.5b, which is a gain of 231%, although it did not report any earnings before interest and tax. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

Caveat Emptor

Even though Tabcorp Holdings managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. To be specific the EBIT loss came in at AU$21m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through AU$55m of cash over the last year. So suffice it to say we do consider the stock to be risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Tabcorp Holdings insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Tabcorp Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TAH

Tabcorp Holdings

Provides gambling, and entertainment and integrity services in Australia.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives