- Australia

- /

- Hospitality

- /

- ASX:TAH

ASX Stocks Including Integral Diagnostics That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the ASX200 traded flat today, with Real Estate leading gains and Energy lagging behind, investors are closely monitoring sector performances to identify potential opportunities. In this environment, finding stocks that may be trading below their estimated value can offer a strategic advantage for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PointsBet Holdings (ASX:PBH) | A$1.26 | A$2.05 | 38.4% |

| Kogan.com (ASX:KGN) | A$3.99 | A$7.77 | 48.6% |

| Kinatico (ASX:KYP) | A$0.265 | A$0.46 | 42.1% |

| Integral Diagnostics (ASX:IDX) | A$2.94 | A$5.87 | 49.9% |

| Elders (ASX:ELD) | A$7.40 | A$14.04 | 47.3% |

| Credit Clear (ASX:CCR) | A$0.255 | A$0.47 | 45.8% |

| Collins Foods (ASX:CKF) | A$9.69 | A$16.13 | 39.9% |

| Austal (ASX:ASB) | A$6.75 | A$13.22 | 48.9% |

| Atturra (ASX:ATA) | A$0.77 | A$1.24 | 37.8% |

| Advanced Braking Technology (ASX:ABV) | A$0.099 | A$0.16 | 39% |

Let's take a closer look at a couple of our picks from the screened companies.

Integral Diagnostics (ASX:IDX)

Overview: Integral Diagnostics Limited is a healthcare services company that offers diagnostic imaging services to medical professionals and their patients in Australia and New Zealand, with a market cap of A$1.09 billion.

Operations: The company generates revenue of A$627.22 million from the operation of diagnostic imaging facilities across Australia and New Zealand.

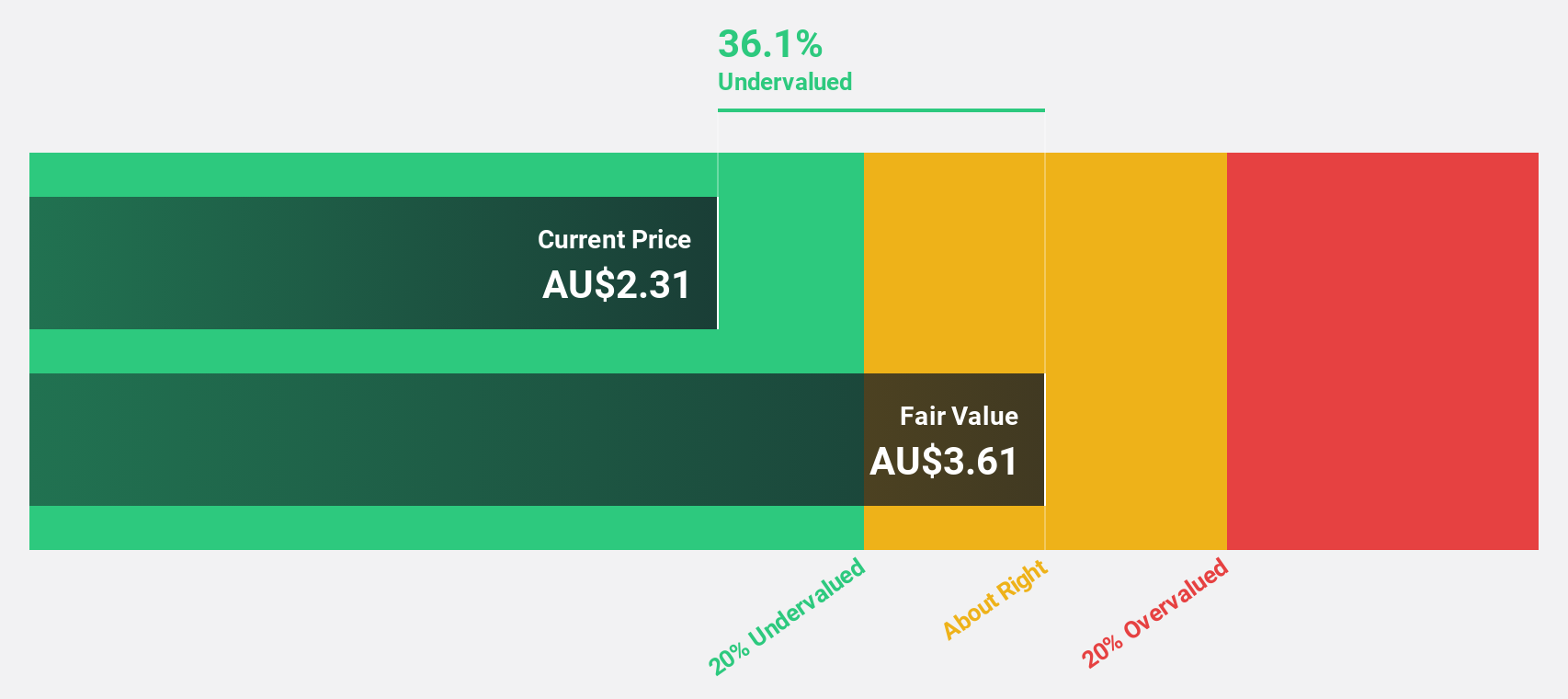

Estimated Discount To Fair Value: 49.9%

Integral Diagnostics appears undervalued, trading at A$2.94, significantly below its estimated fair value of A$5.87. Despite recent shareholder dilution and low forecasted return on equity, the company has become profitable with net income of A$4.67 million for the year ending June 2025, compared to a loss previously. Earnings are expected to grow significantly at 31.23% annually, outpacing both revenue growth and market averages in Australia, highlighting potential for cash flow-driven valuation appreciation.

- The analysis detailed in our Integral Diagnostics growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Integral Diagnostics stock in this financial health report.

IDP Education (ASX:IEL)

Overview: IDP Education Limited facilitates student placements into educational institutions across Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland with a market cap of A$1.64 billion.

Operations: The company's revenue segments include facilitating student placements into educational institutions across Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland.

Estimated Discount To Fair Value: 31.2%

IDP Education is trading at A$5.89, below its estimated fair value of A$8.56, presenting a potential undervaluation based on cash flows. Despite recent earnings decline, with net income dropping to A$44.51 million for the year ending June 2025 from A$132.75 million previously, earnings are forecast to grow at 24.51% annually over the next three years, outpacing market averages in Australia and suggesting room for valuation improvement driven by expected profit growth.

- According our earnings growth report, there's an indication that IDP Education might be ready to expand.

- Take a closer look at IDP Education's balance sheet health here in our report.

Tabcorp Holdings (ASX:TAH)

Overview: Tabcorp Holdings Limited operates in Australia, offering gambling, entertainment, and integrity services with a market capitalization of A$2.20 billion.

Operations: Tabcorp's revenue is primarily derived from its Wagering and Media segment, which generated A$2.44 billion, complemented by A$175.80 million from Integrity Services.

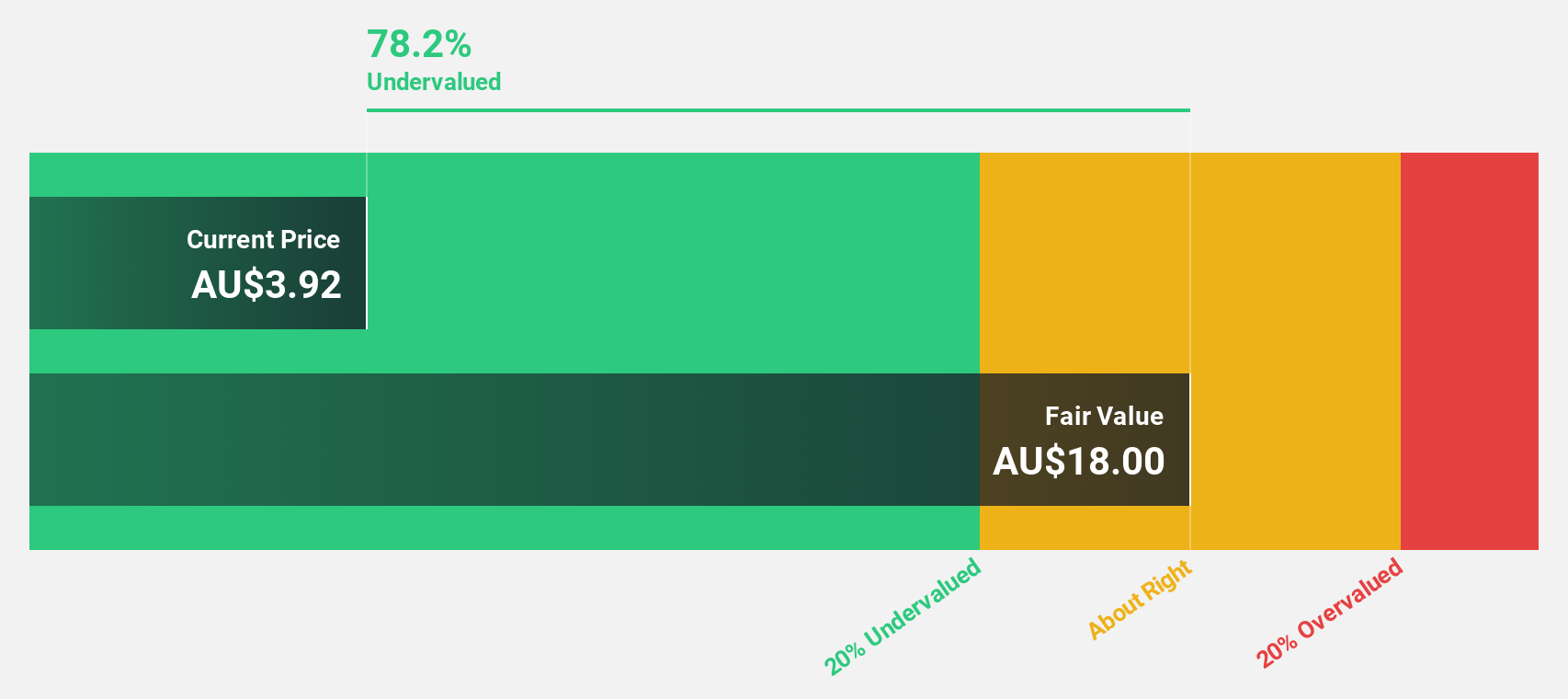

Estimated Discount To Fair Value: 31.9%

Tabcorp Holdings is trading at A$0.97, below its estimated fair value of A$1.42, highlighting potential undervaluation based on cash flows. The company recently turned profitable with a net income of A$36.6 million for the fiscal year ending June 2025, compared to a significant net loss the previous year. Earnings are projected to grow at 24% annually over the next three years, surpassing market averages in Australia and indicating potential for valuation enhancement through profit growth.

- Insights from our recent growth report point to a promising forecast for Tabcorp Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in Tabcorp Holdings' balance sheet health report.

Make It Happen

- Delve into our full catalog of 34 Undervalued ASX Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tabcorp Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TAH

Tabcorp Holdings

Provides gambling, and entertainment and integrity services in Australia.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives