- Australia

- /

- Specialty Stores

- /

- ASX:APE

3 Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

The Australian market has shown robust performance, climbing 1.1% in the last week and achieving an impressive 18% increase over the past year, with earnings projected to grow by 12% annually in the coming years. In this dynamic environment, identifying stocks that are potentially undervalued and exhibit insider buying can be a promising strategy for investors seeking opportunities within the small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.1x | 1.5x | 42.56% | ★★★★★★ |

| Magellan Financial Group | 7.4x | 4.7x | 38.44% | ★★★★★☆ |

| Bigtincan Holdings | NA | 1.3x | 41.11% | ★★★★★☆ |

| Centuria Capital Group | 22.9x | 5.1x | 42.50% | ★★★★☆☆ |

| Bapcor | NA | 0.9x | 44.29% | ★★★★☆☆ |

| Corporate Travel Management | 21.3x | 2.5x | 0.98% | ★★★★☆☆ |

| Eagers Automotive | 10.9x | 0.3x | 37.53% | ★★★★☆☆ |

| Dicker Data | 21.0x | 0.8x | -72.57% | ★★★☆☆☆ |

| Coventry Group | 221.9x | 0.4x | -11.49% | ★★★☆☆☆ |

| Credit Corp Group | 21.4x | 2.9x | 39.10% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

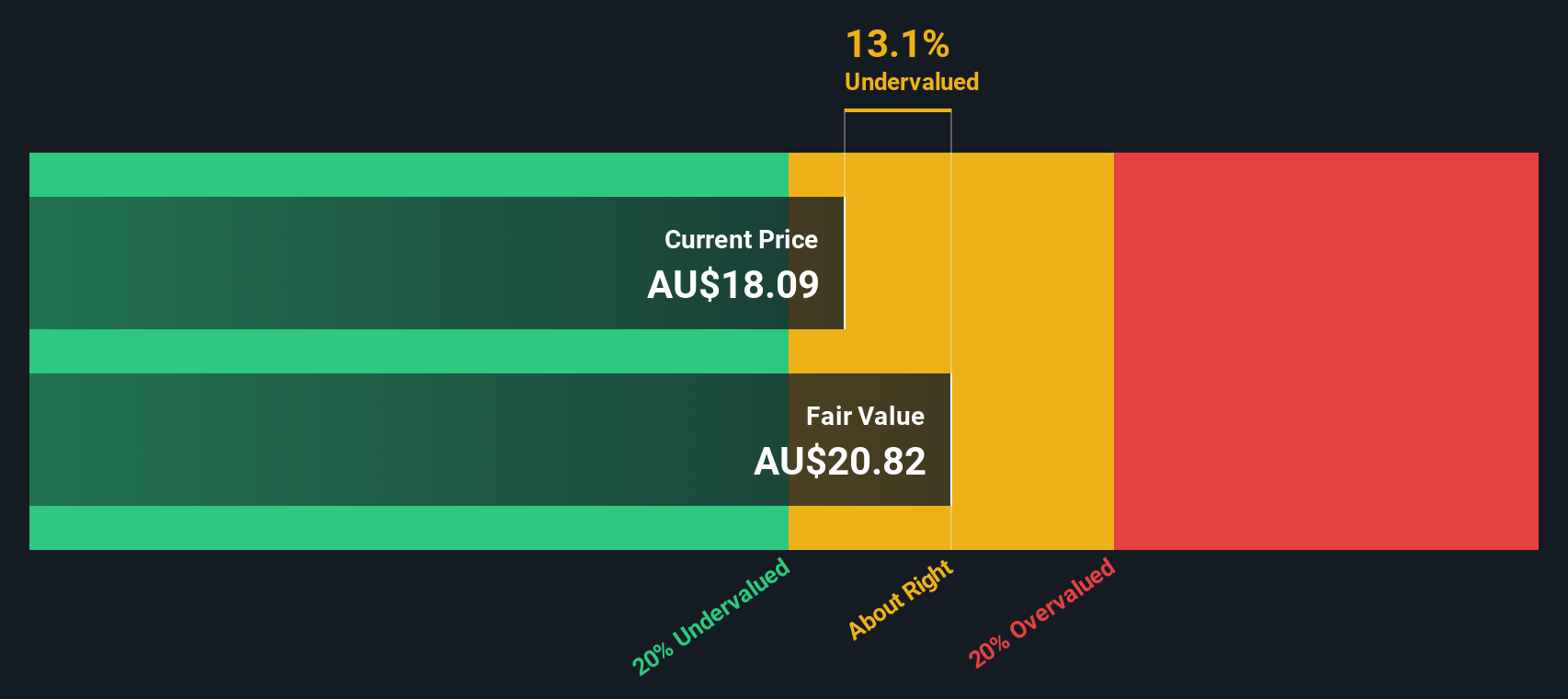

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading Australian automotive retail group primarily engaged in car retailing, with a market cap of A$3.56 billion.

Operations: Car Retailing is the primary revenue stream, generating A$10.50 billion. The company experienced a gross profit margin of 18.17% as of June 2024, with cost of goods sold (COGS) reaching A$8.59 billion and operating expenses totaling A$1.36 billion during the same period.

PE: 10.9x

Eagers Automotive, a small player in Australia's market, recently saw insider confidence with Nicholas Politis purchasing 200,000 shares for A$2.09 million between July and August 2024. Despite facing higher risk due to reliance on external borrowing, the company reported sales of A$5.46 billion for the first half of 2024—up from A$4.82 billion last year—though net income declined to A$116 million from A$138 million. This mixed financial position suggests potential growth opportunities alongside existing challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of Eagers Automotive.

Gain insights into Eagers Automotive's past trends and performance with our Past report.

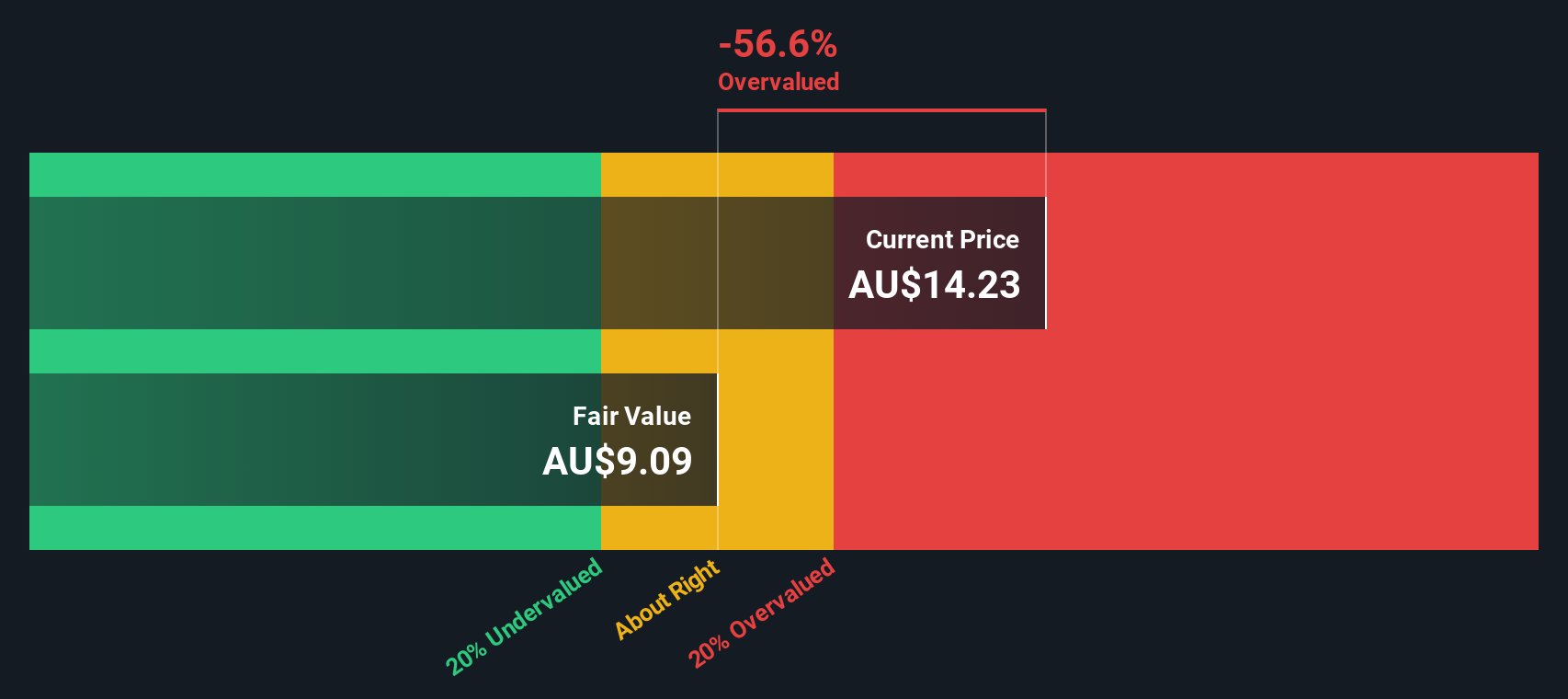

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sims is a company involved in metal recycling and electronic waste management, with operations spanning global trading, North America Metals, Sims Lifecycle Services, and Australia/New Zealand Metals; it has a market capitalization of A$2.77 billion.

Operations: The company's revenue streams are primarily driven by its North America Metals and Australia/New Zealand Metals segments, contributing significantly to the overall revenue. The gross profit margin has shown fluctuations, with a recent figure of 9.40% as of December 2023. Operating expenses have consistently impacted profitability, including notable depreciation and amortization costs.

PE: 1373.2x

Sims, a smaller player in Australia's market, recently experienced insider confidence with share purchases noted from May to August 2024. Despite reporting a net loss of A$57.8 million for the year ending June 30, 2024, compared to a previous net income of A$181.1 million, the company saw sales increase to A$7.22 billion from A$6.66 billion last year. Earnings are forecasted to grow by over 41% annually, indicating potential future growth despite current challenges like lower profit margins and reliance on external borrowing for funding.

- Dive into the specifics of Sims here with our thorough valuation report.

Assess Sims' past performance with our detailed historical performance reports.

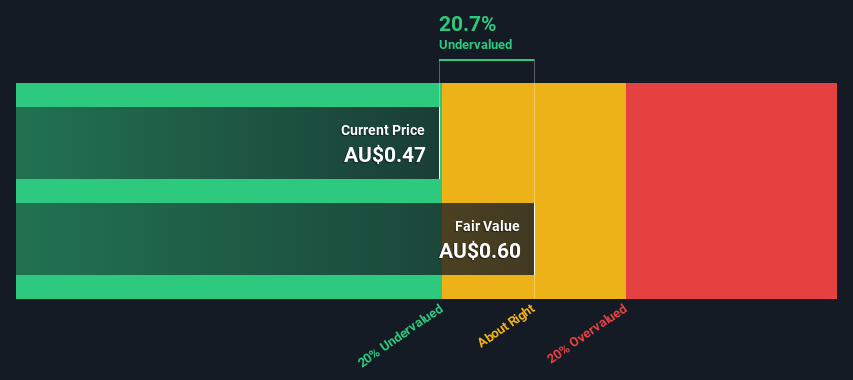

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tabcorp Holdings operates in the gaming services and wagering and media sectors, with a market capitalization of A$5.75 billion.

Operations: The company's primary revenue streams are from Wagering and Media, generating A$2162.80 million, and Gaming Services, contributing A$176.10 million. The gross profit margin has consistently been 100% over several periods, indicating that all reported revenue translates directly into gross profit due to the absence of recorded cost of goods sold (COGS). Operating expenses have been substantial, with significant allocations towards sales and marketing as well as general and administrative costs. Notably, the net income margin has seen fluctuations with recent periods recording negative margins due to high non-operating expenses impacting profitability significantly.

PE: -0.8x

Tabcorp Holdings, a player in the Australian market, recently caught attention with insider confidence as an executive purchased 250,000 shares for A$215,000. Despite reporting a net loss of A$1.36 billion for the year ending June 2024 compared to a previous net income of A$66.5 million, this insider activity suggests optimism about future prospects. The company faces challenges with its funding structure relying on external borrowing and has seen sales dip slightly to A$2.34 billion from A$2.43 billion last year.

- Navigate through the intricacies of Tabcorp Holdings with our comprehensive valuation report here.

Evaluate Tabcorp Holdings' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 21 Undervalued ASX Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagers Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APE

Eagers Automotive

An automotive retail company, owns and operates motor vehicle dealerships in Australia and New Zealand.

Established dividend payer and good value.