The Australian market has been relatively flat, with the ASX200 set to trade unchanged for a second consecutive day and European markets showing little movement. In such steady conditions, investors often look for growth companies with high insider ownership as these stocks can indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17.5% | 61.8% |

| AVA Risk Group (ASX:AVA) | 15.6% | 118.8% |

| Acrux (ASX:ACR) | 14.6% | 129.6% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 69.2% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.1% |

We'll examine a selection from our screener results.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited (ASX:FLT) provides travel retailing services for both leisure and corporate sectors across various regions globally, with a market cap of A$4.73 billion.

Operations: The company generates revenue from two main segments: A$1.35 billion from leisure travel services and A$1.11 billion from corporate travel services.

Insider Ownership: 13.5%

Earnings Growth Forecast: 19.7% p.a.

Flight Centre Travel Group (ASX:FLT) demonstrates strong growth potential, supported by high insider ownership. Recently, the company reported a significant rise in net income to A$139 million from A$47 million last year and announced plans for acquisitions to double its Cruise & Touring sales. Despite an unstable dividend track record, FLT's earnings are forecasted to grow at 19.72% annually, outpacing the Australian market's average growth rate of 12.3%.

- Unlock comprehensive insights into our analysis of Flight Centre Travel Group stock in this growth report.

- The valuation report we've compiled suggests that Flight Centre Travel Group's current price could be inflated.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$960.50 million.

Operations: Nanosonics generates revenue primarily from its Healthcare Equipment segment, which totals A$170.01 million.

Insider Ownership: 15.1%

Earnings Growth Forecast: 23.2% p.a.

Nanosonics demonstrates growth potential with high insider ownership, although recent earnings results show a mixed picture. The company reported sales of A$170.01 million for the year ended June 30, 2024, up from A$165.99 million last year, but net income decreased to A$12.97 million from A$19.88 million. Despite this decline in profit margins and significant insider selling over the past three months, earnings are forecasted to grow significantly at 23.15% annually over the next three years.

- Navigate through the intricacies of Nanosonics with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Nanosonics is priced higher than what may be justified by its financials.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$575.89 million.

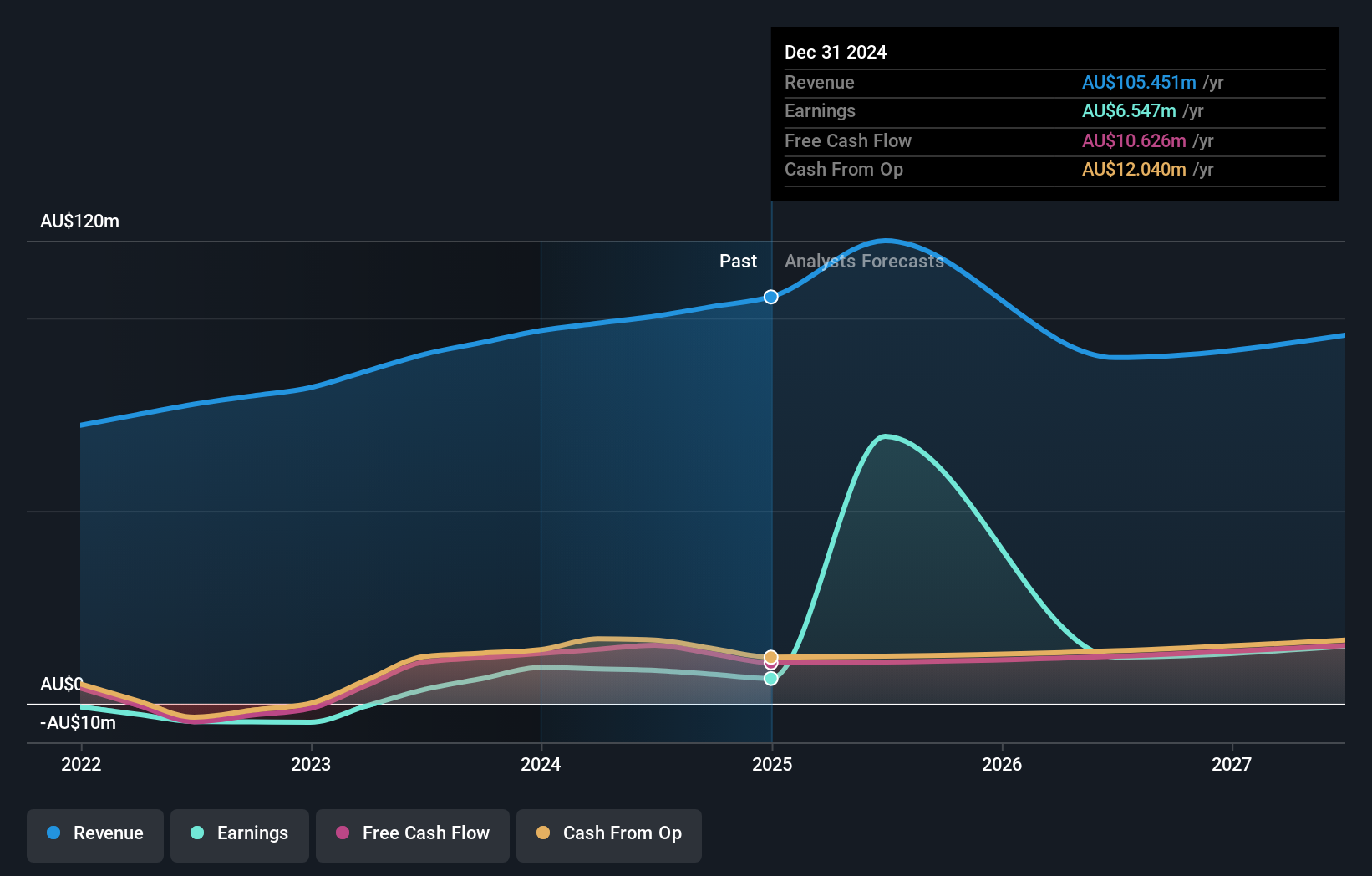

Operations: RPMGlobal Holdings Limited generates revenue from two main segments: Advisory (A$31.41 million) and Software (A$72.67 million).

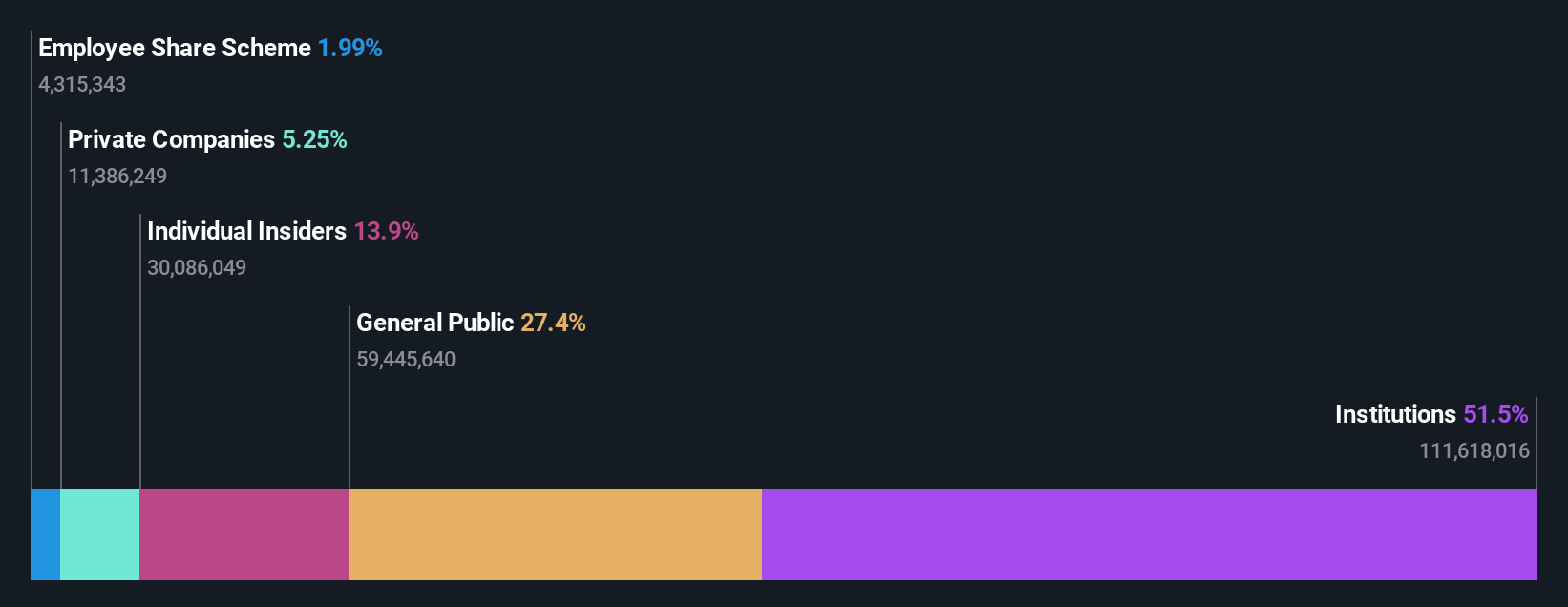

Insider Ownership: 10.6%

Earnings Growth Forecast: 22.6% p.a.

RPMGlobal Holdings showcases strong growth potential with substantial insider ownership. The company reported significant revenue growth to A$104.19 million for the year ended June 30, 2024, up from A$91.56 million last year, and net income more than doubled to A$8.66 million from A$3.69 million. Earnings are forecasted to grow significantly at 22.62% annually over the next three years, outpacing the Australian market's average growth rate of 12.3% per year.

- Click here and access our complete growth analysis report to understand the dynamics of RPMGlobal Holdings.

- Upon reviewing our latest valuation report, RPMGlobal Holdings' share price might be too optimistic.

Seize The Opportunity

- Click this link to deep-dive into the 92 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with solid track record.