- Australia

- /

- Hospitality

- /

- ASX:EXP

It's Down 26% But Experience Co Limited (ASX:EXP) Could Be Riskier Than It Looks

Experience Co Limited (ASX:EXP) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

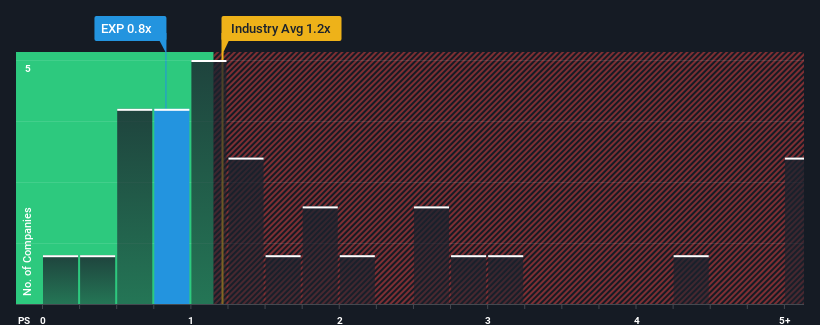

Even after such a large drop in price, there still wouldn't be many who think Experience Co's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Australia's Hospitality industry is similar at about 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Experience Co

What Does Experience Co's P/S Mean For Shareholders?

Recent times have been advantageous for Experience Co as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Experience Co will help you uncover what's on the horizon.How Is Experience Co's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Experience Co's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 35% last year. Pleasingly, revenue has also lifted 152% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 21% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.0%, which is noticeably less attractive.

With this information, we find it interesting that Experience Co is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

With its share price dropping off a cliff, the P/S for Experience Co looks to be in line with the rest of the Hospitality industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Experience Co's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Experience Co you should know about.

If you're unsure about the strength of Experience Co's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Experience Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EXP

Experience Co

Engages in the adventure tourism and leisure business in Australia and New Zealand.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives