- Australia

- /

- Hospitality

- /

- ASX:EXP

Experience Co Limited (ASX:EXP) Soars 38% But It's A Story Of Risk Vs Reward

Experience Co Limited (ASX:EXP) shares have continued their recent momentum with a 38% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

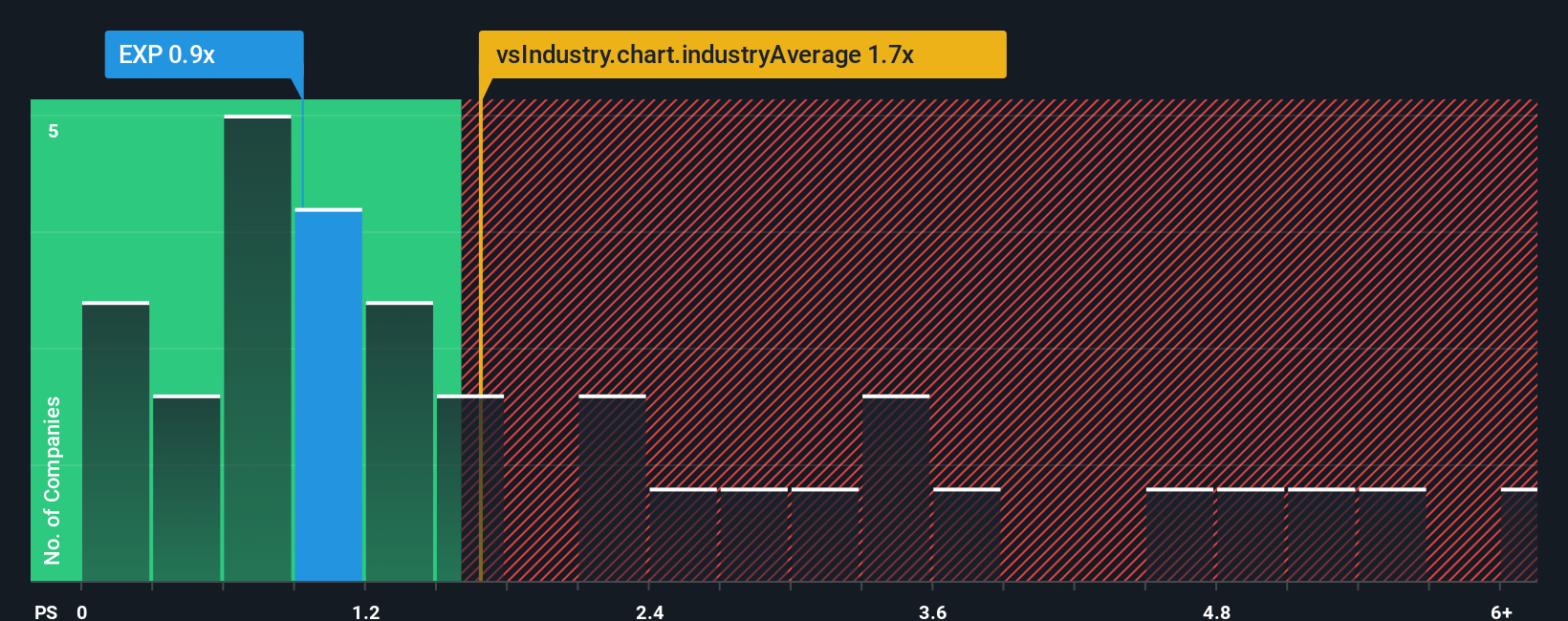

Even after such a large jump in price, Experience Co may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Hospitality industry in Australia have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Experience Co

What Does Experience Co's P/S Mean For Shareholders?

Experience Co could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Experience Co will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Experience Co?

In order to justify its P/S ratio, Experience Co would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.7% last year. Pleasingly, revenue has also lifted 141% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 8.0% per year as estimated by the three analysts watching the company. With the industry only predicted to deliver 4.4% per year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Experience Co is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Experience Co's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Experience Co's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for Experience Co that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Experience Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EXP

Experience Co

Engages in the adventure tourism and leisure business in Australia and New Zealand.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives