- Australia

- /

- Hospitality

- /

- ASX:BET

Betmakers Technology Group Ltd (ASX:BET) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Betmakers Technology Group Ltd (ASX:BET) shares have had a horrible month, losing 26% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 72%, which is great even in a bull market.

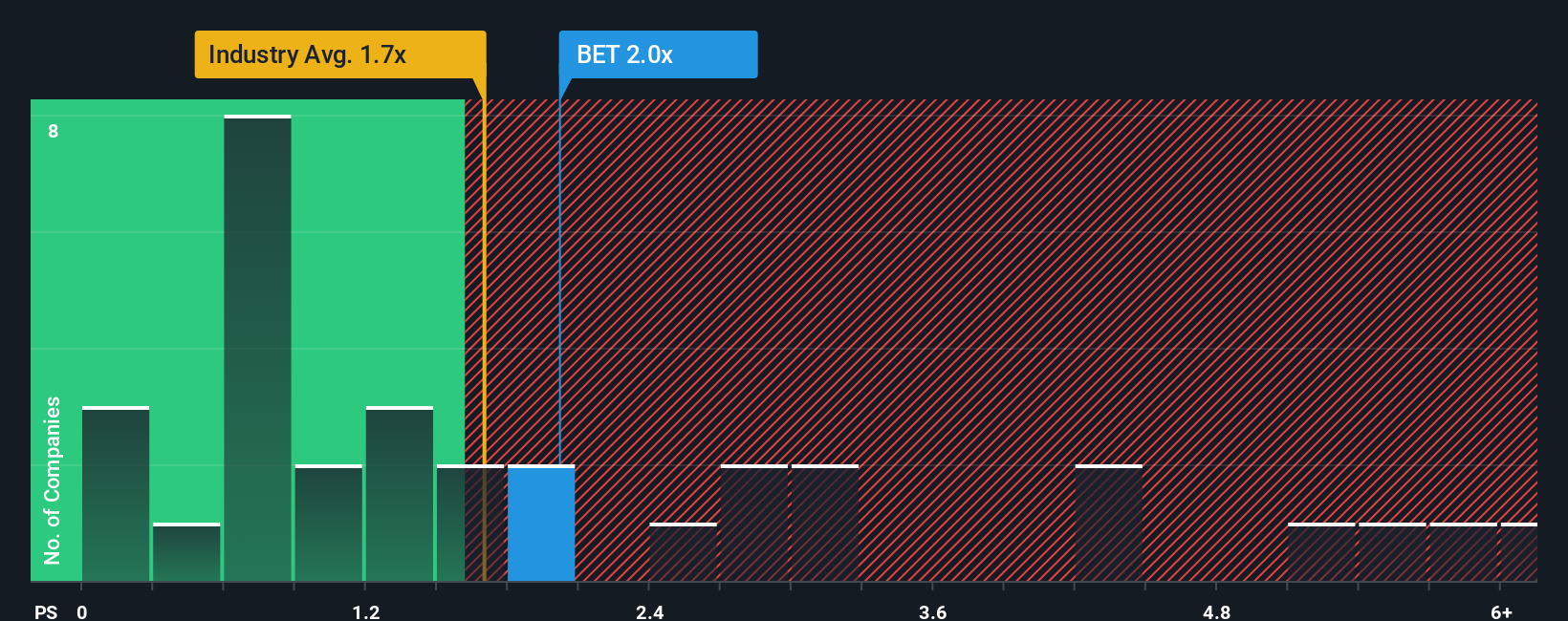

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Betmakers Technology Group's P/S ratio of 2x, since the median price-to-sales (or "P/S") ratio for the Hospitality industry in Australia is also close to 1.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Betmakers Technology Group

What Does Betmakers Technology Group's Recent Performance Look Like?

Betmakers Technology Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Betmakers Technology Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Betmakers Technology Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. The last three years don't look nice either as the company has shrunk revenue by 7.2% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 9.0% per year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.5% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Betmakers Technology Group's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Betmakers Technology Group looks to be in line with the rest of the Hospitality industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Betmakers Technology Group's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Betmakers Technology Group with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Betmakers Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BET

Betmakers Technology Group

Engages in the development and provision of software, data, and analytics products for the B2B wagering market in Australia, New Zealand, the United States, the United Kingdom, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives