- Australia

- /

- Hospitality

- /

- ASX:BBT

After Leaping 25% BETR Entertainment Limited (ASX:BBT) Shares Are Not Flying Under The Radar

BETR Entertainment Limited (ASX:BBT) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 21% is also fairly reasonable.

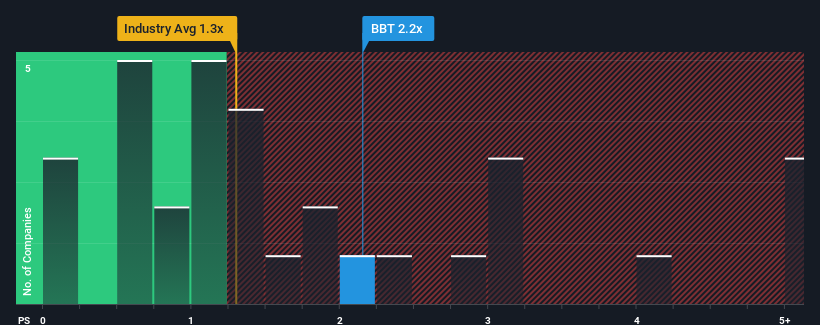

After such a large jump in price, you could be forgiven for thinking BETR Entertainment is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in Australia's Hospitality industry have P/S ratios below 1.3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 1 warning sign investors should be aware of before investing in BETR Entertainment. Read for free now.View our latest analysis for BETR Entertainment

How Has BETR Entertainment Performed Recently?

Recent times have been advantageous for BETR Entertainment as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on BETR Entertainment will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, BETR Entertainment would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 76%. The latest three year period has also seen an excellent 115% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 59% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 0.9%, which is noticeably less attractive.

With this information, we can see why BETR Entertainment is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in BETR Entertainment's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of BETR Entertainment's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - BETR Entertainment has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Betr Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BBT

Betr Entertainment

Provides sports and racing betting products and services to online and telephone clients, via its innovative online wagering platform, and mobile applications in Australia and North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026