- Australia

- /

- Hospitality

- /

- ASX:CEH

Ardent Leisure Group Limited's (ASX:ALG) Shares May Have Run Too Fast Too Soon

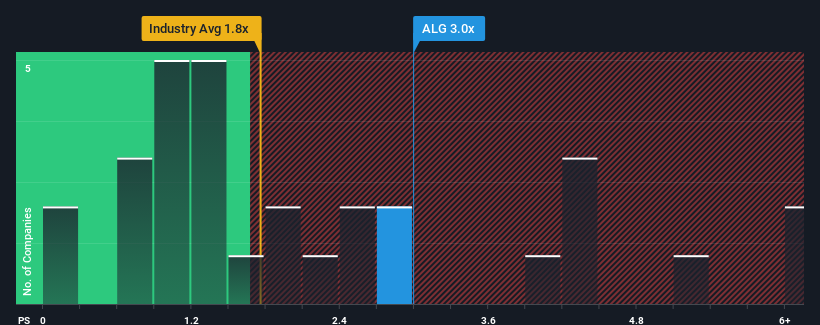

When close to half the companies in the Hospitality industry in Australia have price-to-sales ratios (or "P/S") below 1.8x, you may consider Ardent Leisure Group Limited (ASX:ALG) as a stock to potentially avoid with its 3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Ardent Leisure Group

How Has Ardent Leisure Group Performed Recently?

Recent times have been advantageous for Ardent Leisure Group as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Ardent Leisure Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

Ardent Leisure Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 86% last year. Still, revenue has fallen 77% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 7.3% per annum over the next three years. With the industry predicted to deliver 9.8% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Ardent Leisure Group's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Ardent Leisure Group's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Ardent Leisure Group trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Ardent Leisure Group with six simple checks on some of these key factors.

If you're unsure about the strength of Ardent Leisure Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CEH

Coast Entertainment Holdings

Engages in the investment, ownership, and operation of leisure and entertainment businesses in Australia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives