- Australia

- /

- Food and Staples Retail

- /

- ASX:WOW

Woolworths (ASX:WOW) Valuation in Focus After 2025 Share Price Slide and Elevated Dividend Yield

Reviewed by Kshitija Bhandaru

Woolworths Group (ASX:WOW) has seen its share price fall about 13% since the start of 2025, drawing attention from investors. This drop, combined with a higher-than-usual dividend yield, is turning heads regarding the company's future direction.

See our latest analysis for Woolworths Group.

The share price slide for Woolworths Group has made waves this year, coming on the heels of a stronger-than-normal dividend yield and renewed debates over market confidence. Despite moves to maintain its lead in Australian groceries, the company’s momentum has faded in 2025. A year-to-date share price return of -14.6% adds up to a deeper 1-year total shareholder return loss of nearly 20%, reflecting growing caution among investors.

If big shifts in established names caught your attention, now could be the perfect moment to broaden your investing lens and explore fast growing stocks with high insider ownership

This raises a key question for investors: is Woolworths Group now undervalued after its slide, or is the market simply factoring in slower growth ahead, leaving little room for upside?

Most Popular Narrative: 14.7% Undervalued

Looking at the most widely followed narrative, expectations for Woolworths Group’s fair value outpace the last close price. Recent downward revisions in growth forecasts have only slightly narrowed this valuation gap, maintaining an optimistic take on the company’s potential.

The ongoing investment and upgrades in Woolworths' supply chain automation and distribution centers are expected to drive significant operational efficiencies and margin improvement over the next few years. As dual running and commissioning costs roll off and new facilities like Moorebank and Auburn CFCs deliver returns, this is likely to support higher future EBIT and ROIC.

What’s the real reason analysts hold Woolworths Group to such a premium? The narrative’s foundation hinges on game-changing efficiency gains, revamped earnings, and daring assumptions about future profit margins and core retail momentum. The numbers behind this outlook just might surprise you.

Result: Fair Value of $30.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in discretionary retail or intensifying price competition could threaten Woolworths Group’s margin improvement and earnings recovery. This could potentially challenge the optimistic outlook.

Find out about the key risks to this Woolworths Group narrative.

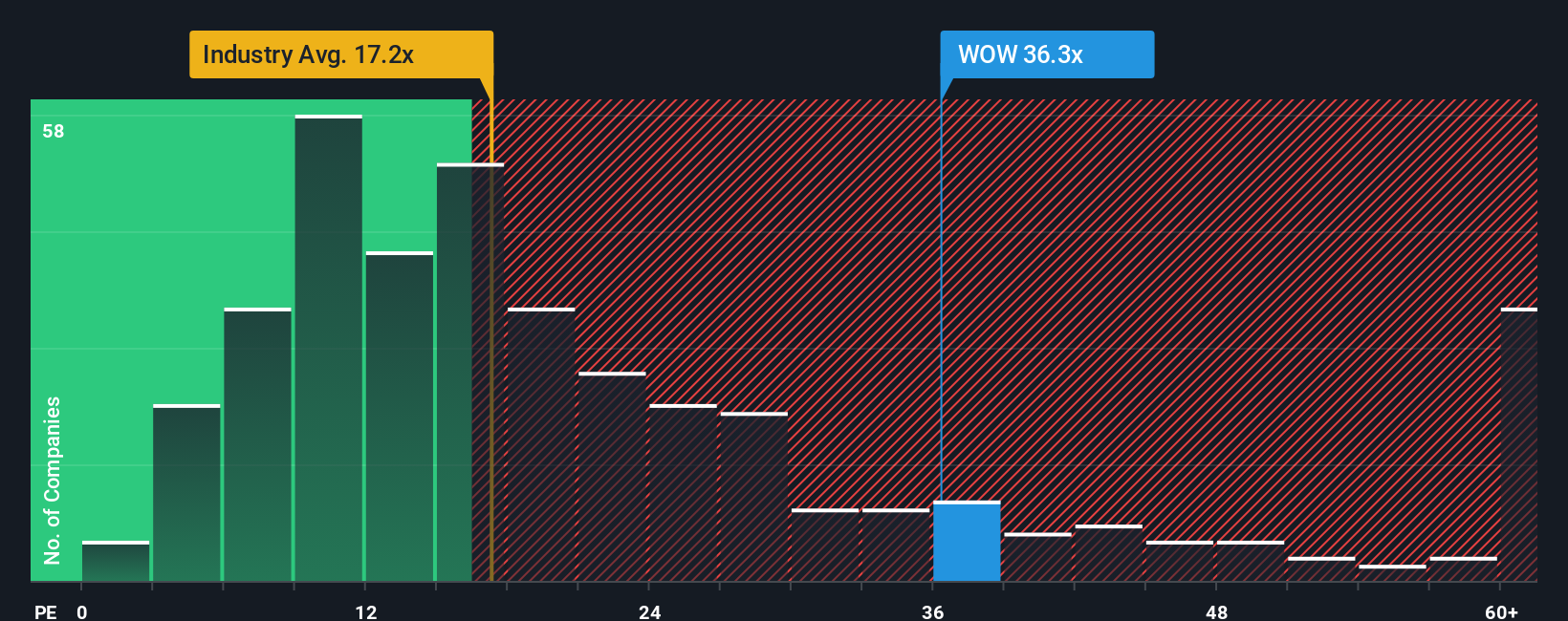

Another View: A Look at Multiples

While fair value estimates suggest Woolworths Group is undervalued, a closer look at its price-to-earnings ratio offers a different story. The company trades at 33x earnings, which is noticeably higher than both the industry average of 17.1x and the peer group’s 23.3x. This gap signals that investors are paying a significant premium compared to rivals and what the fair ratio of 28.9x suggests the market could move toward. Is the optimism justified, or does it set up valuation risk if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Woolworths Group Narrative

If you see things differently or want your own take, you can dive into the numbers and craft a unique perspective in just a few minutes. Do it your way

A great starting point for your Woolworths Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for one opportunity alone. Take control of your next portfolio move by exploring unique stock picks tailored for fresh potential, breakthrough technology, and consistent returns.

- Uncover steady income opportunities with these 19 dividend stocks with yields > 3%, featuring yields above 3% and a strong track record of rewarding shareholders.

- Seize your chance in the digital frontier by targeting innovation-first companies with these 25 AI penny stocks that are poised to transform the markets with artificial intelligence breakthroughs.

- Boost your portfolio's upside potential by acting early on potential bargain buys using these 895 undervalued stocks based on cash flows, focused on companies trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woolworths Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WOW

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026