- Australia

- /

- Food and Staples Retail

- /

- ASX:WOW

Will Woolworths (ASX:WOW) Prioritize E-Commerce Over Core Categories Amid Performance Hurdles?

Reviewed by Sasha Jovanovic

- Woolworths Group Limited recently reported total group sales of A$18.48 billion for the first quarter of FY26, up 2.7% year-on-year, with e-commerce and B2B segments contributing most of the growth.

- Despite higher sales, CEO Amanda Bardwell noted performance was below the company's expectations due to weaker results in pet and baby products and a large decline in tobacco sales, even as e-commerce sales improved.

- We’ll now examine how management’s cautious tone and focus on category performance could affect Woolworths Group’s investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Woolworths Group Investment Narrative Recap

Woolworths Group shareholders typically believe in the company's ability to deliver stable cash flows through its essential retail presence, e-commerce scaling, and efficiency investments, regardless of short-term volatility. The latest quarterly sales update, showing 2.7% growth and a management tone of caution, does not significantly alter the immediate catalyst, Woolworths' execution on digital and operational improvements, nor does it resolve the key risk of rising competition squeezing margins in an increasingly promotional market.

Of recent announcements, Woolworths' Q1 FY26 sales report is most relevant, highlighting that while pet and baby products and tobacco sales weighed on growth, e-commerce and business-to-business segments continued to expand. These trends keep attention on Woolworths' push for digital efficiencies as a driver for near-term performance, while underscoring ongoing pressure points in traditional categories that could impact profit margins.

However, while revenue resilience suggests operational strengths, it is worth noting the persistent risk that intensifying price competition could further pressure group margins if Woolworths is unable to...

Read the full narrative on Woolworths Group (it's free!)

Woolworths Group's outlook sees revenue reaching A$77.0 billion and earnings of A$1.9 billion by 2028. This projection is based on an annual revenue growth rate of 3.7% and represents a near doubling of earnings, an increase of about A$937 million from current earnings of A$963.0 million.

Uncover how Woolworths Group's forecasts yield a A$30.51 fair value, a 7% upside to its current price.

Exploring Other Perspectives

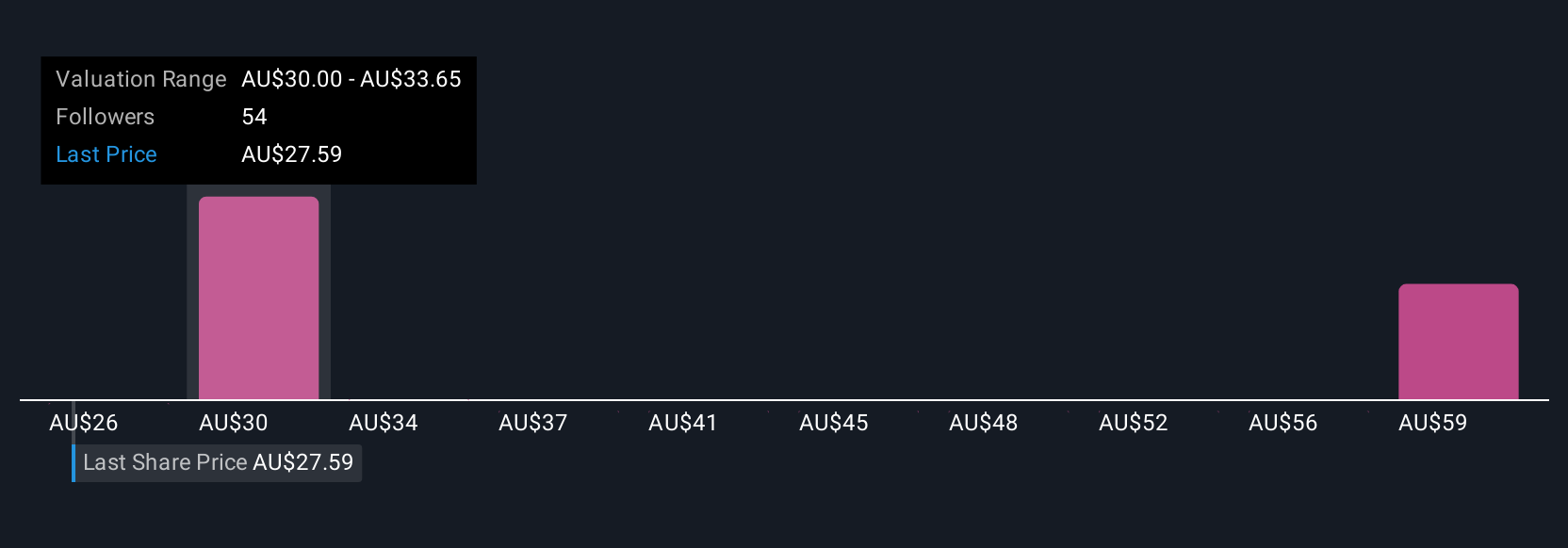

Nine fair value estimates from the Simply Wall St Community span from A$26.35 to A$61.55 per share. In a market where competitive pricing remains a key risk, your view on margin pressure could set your Woolworths outlook apart from others.

Explore 9 other fair value estimates on Woolworths Group - why the stock might be worth 7% less than the current price!

Build Your Own Woolworths Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Woolworths Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Woolworths Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Woolworths Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Woolworths Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WOW

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion