- Australia

- /

- Food and Staples Retail

- /

- ASX:COL

Coles Group (ASX:COL) Boosts E-Commerce with Ocado Alliance, Reports Strong Earnings and Dividend Increase

Coles Group (ASX:COL) has recently reported robust financial growth, with significant improvements in both EBIT and NPAT from continuing operations, driven by enhanced e-commerce performance and effective cost management initiatives. However, the company faces challenges such as a sluggish liquor segment and economic pressures affecting discretionary spending. In the following discussion, we will delve into Coles Group's core strengths, critical weaknesses, strategic opportunities, and key threats to provide a comprehensive analysis of its current and future performance.

Click here to discover the nuances of Coles Group with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success for Coles Group

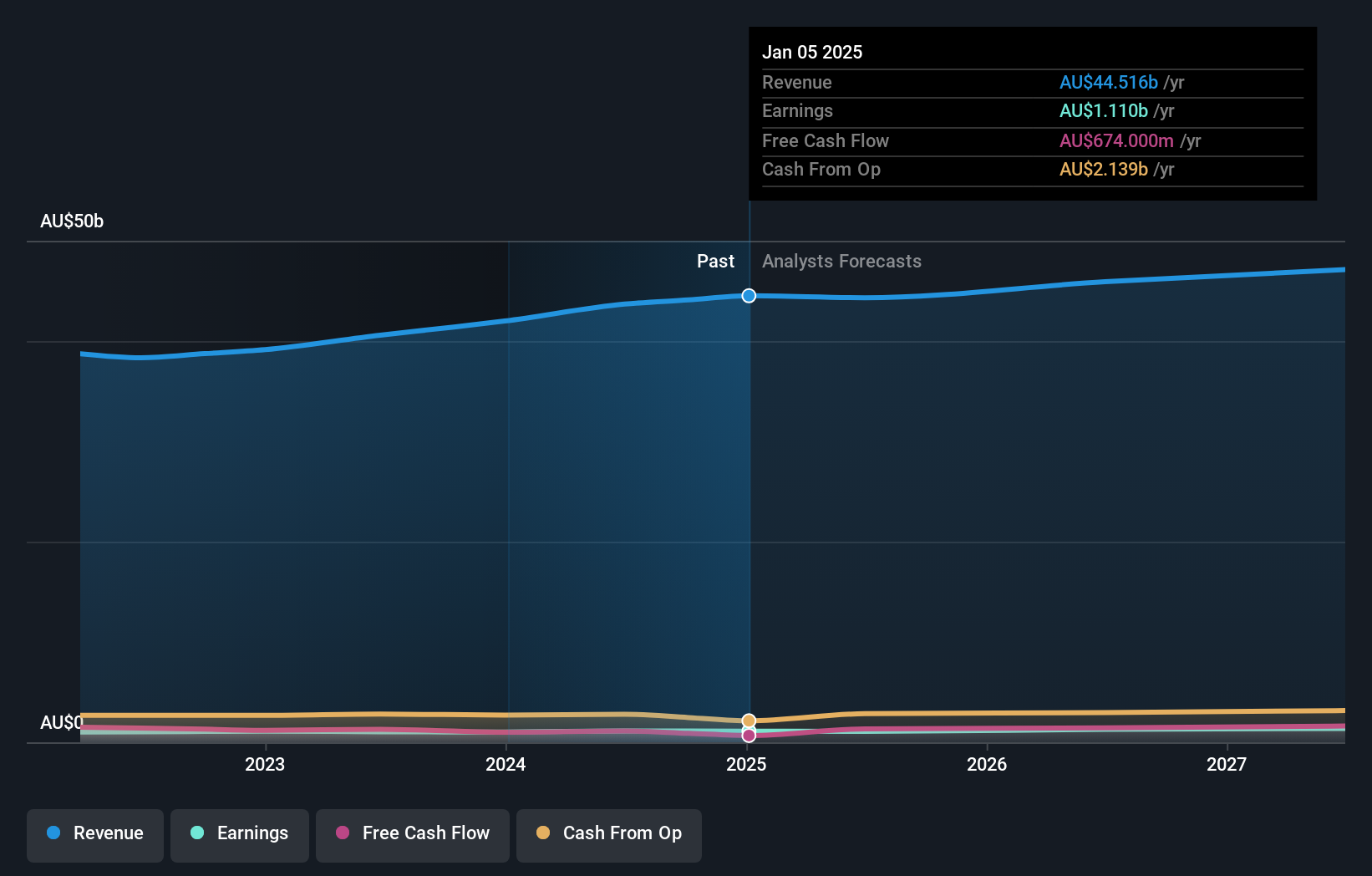

Coles Group has demonstrated robust financial growth, with reported group EBIT from continuing operations increasing by 5.7% to $2.1 billion and NPAT from continuing operations rising by 2.1% to $1.1 billion, as highlighted by CEO Leah Weckert in the latest earnings call. The company has also achieved significant success in its e-commerce segment, driven by an improved customer experience and expanded offerings. Cost management initiatives, like the "Simplify and Save to Invest" program, resulted in $238 million in benefits, showcasing effective operational efficiency. Additionally, Coles has achieved its highest-ever team member engagement score and has seen over 2 million members redeem points for the first time, indicating strong customer loyalty.

Weaknesses: Critical Issues Affecting Coles Group's Performance and Areas for Growth

Coles faces several financial challenges, particularly in its liquor segment, where sales increased by only 0.5%, impacted by reduced discretionary spending due to economic pressures, as noted by CFO Sharbel Elias. The company is also navigating a challenging cost environment marked by cost inflation and wage growth, which has contributed to a 38.9% decline in underlying EBIT for the liquor segment. Additionally, Coles' earnings have declined by 0.5% per year over the past five years, although the past year's earnings growth of 8.3% exceeds this average. The company's Price-To-Earnings Ratio (22.5x) further underscores its expensive valuation compared to industry and peer averages. For a more comprehensive look at how these weaknesses could impact Coles Group's financial stability, explore our section on Coles Group's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Coles is well-positioned to capitalize on several strategic opportunities. The company continues to invest in its digital assets, achieving 13.1% growth in supermarkets and 9.2% growth in liquor on a normalized basis, as highlighted by CEO Leah Weckert. New ventures such as the launch of Swaggle, a specialty pet offering, demonstrate Coles' commitment to innovation and market expansion. Additionally, operational improvements are expected, particularly in ADC volumes and operational leverage, as noted by CFO Sharbel Elias. These initiatives could significantly enhance Coles' market position and capitalize on emerging opportunities. Learn more about how these opportunities could impact Coles Group's future growth by reviewing our analysis of Coles Group's Future Performance.

Threats: Key Risks and Challenges That Could Impact Coles Group's Success

Coles faces several external threats that could impact its growth and market share. Competitive pressures, particularly from major players like Amazon in the non-food space, pose a significant challenge, as mentioned by CEO Leah Weckert. Economic pressures have also led to reduced discretionary spending by customers, affecting overall sales growth. Additionally, regulatory and operational risks remain a concern, with the company needing to continually adapt to shifting market conditions and regulatory landscapes. These factors could potentially undermine Coles' competitive positioning and long-term growth prospects.

Conclusion

In conclusion, Coles Group's robust financial growth, strong customer loyalty, and successful e-commerce initiatives underscore its operational efficiency and market strength. However, the company's financial challenges, particularly in the liquor segment, and the high Price-To-Earnings Ratio of 22.5x relative to industry and peer averages, highlight potential concerns regarding its current valuation and market expectations. Despite these challenges, Coles' strategic investments in digital assets and innovative ventures position it well for future growth, although it must navigate competitive pressures and economic uncertainties to sustain its market position. Investors should weigh these factors carefully, considering both the company's strong performance and the premium at which it is currently trading.

Already own Coles? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:COL

Outstanding track record with limited growth.

Similar Companies

Market Insights

Community Narratives