Here's Why I Think Globe International (ASX:GLB) Is An Interesting Stock

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Globe International (ASX:GLB). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Globe International

How Quickly Is Globe International Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. I, for one, am blown away by the fact that Globe International has grown EPS by 43% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

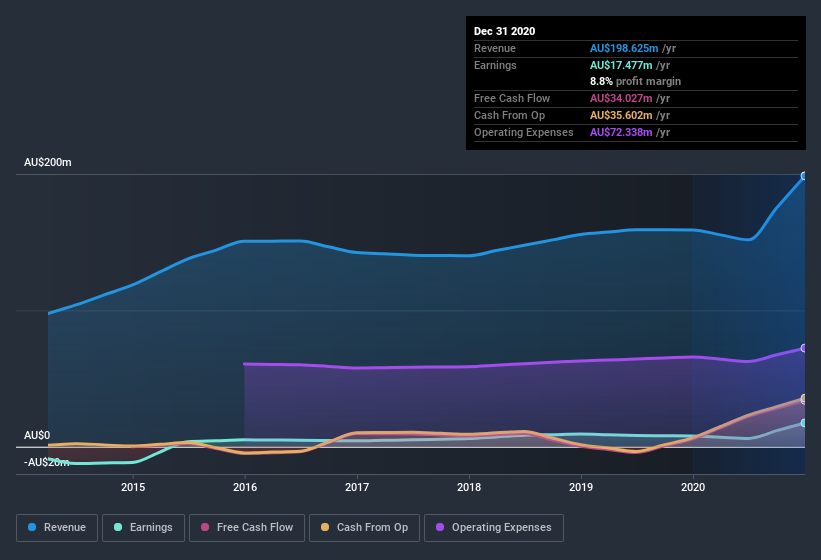

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Globe International shareholders can take confidence from the fact that EBIT margins are up from 2.6% to 12%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Globe International isn't a huge company, given its market capitalization of AU$230m. That makes it extra important to check on its balance sheet strength.

Are Globe International Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Globe International insiders spent AU$79k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by Co-Founder & Executive Director Stephen Hill for AU$23k worth of shares, at about AU$1.71 per share.

On top of the insider buying, we can also see that Globe International insiders own a large chunk of the company. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about AU$170m riding on the stock, at current prices. That's nothing to sneeze at!

Is Globe International Worth Keeping An Eye On?

Globe International's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Globe International deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Globe International , and understanding these should be part of your investment process.

As a growth investor I do like to see insider buying. But Globe International isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Globe International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:GLB

Globe International

Designs and manufactures apparel, footwear, and hardgoods in Australia, the United States, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success