Here's What We Like About Globe International's (ASX:GLB) Upcoming Dividend

Globe International Limited (ASX:GLB) stock is about to trade ex-dividend in three days. If you purchase the stock on or after the 11th of March, you won't be eligible to receive this dividend, when it is paid on the 26th of March.

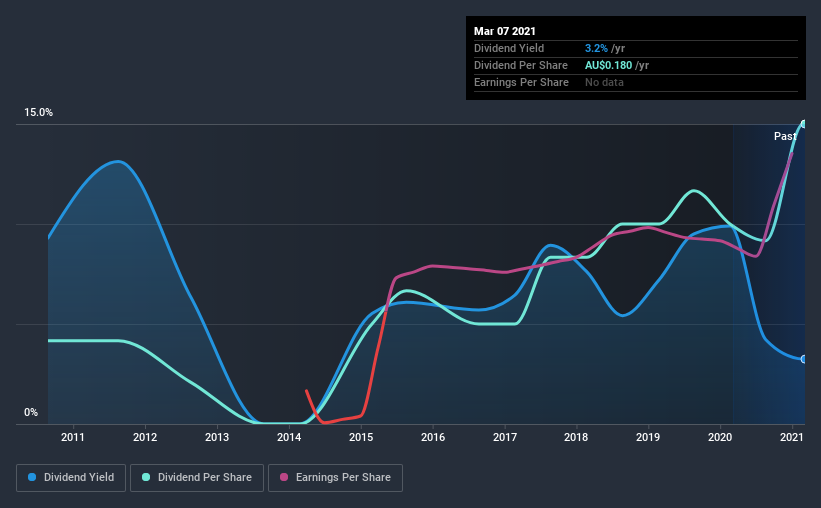

Globe International's next dividend payment will be AU$0.12 per share, on the back of last year when the company paid a total of AU$0.18 to shareholders. Based on the last year's worth of payments, Globe International has a trailing yield of 3.2% on the current stock price of A$5.55. If you buy this business for its dividend, you should have an idea of whether Globe International's dividend is reliable and sustainable. So we need to investigate whether Globe International can afford its dividend, and if the dividend could grow.

View our latest analysis for Globe International

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Globe International's payout ratio is modest, at just 43% of profit. A useful secondary check can be to evaluate whether Globe International generated enough free cash flow to afford its dividend. It paid out 13% of its free cash flow as dividends last year, which is conservatively low.

It's positive to see that Globe International's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Globe International paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Globe International's earnings have been skyrocketing, up 36% per annum for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. Companies with growing earnings and low payout ratios are often the best long-term dividend stocks, as the company can both grow its earnings and increase the percentage of earnings that it pays out, essentially multiplying the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Globe International has delivered an average of 14% per year annual increase in its dividend, based on the past 10 years of dividend payments. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

To Sum It Up

Should investors buy Globe International for the upcoming dividend? Globe International has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. It's a promising combination that should mark this company worthy of closer attention.

In light of that, while Globe International has an appealing dividend, it's worth knowing the risks involved with this stock. For example, we've found 2 warning signs for Globe International that we recommend you consider before investing in the business.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Globe International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:GLB

Globe International

Designs and manufactures apparel, footwear, and hardgoods in Australia, the United States, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.