- Australia

- /

- Metals and Mining

- /

- ASX:TBR

Atlas Pearls And 2 Other ASX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Australian market experiences a modest rise, reflecting similar trends on Wall Street, investors are keenly observing both local and global economic indicators. In this context, penny stocks—though an outdated term—continue to attract attention for their potential to unlock growth opportunities in smaller or newer companies. By focusing on those with strong financial health and clear growth prospects, investors can uncover hidden value within these often-overlooked stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$99.57M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$292.36M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$334.88M | ★★★★★☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$74.43M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$823.33M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$59.91M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$117.4M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Atlas Pearls (ASX:ATP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlas Pearls Limited is engaged in the production and sale of South Sea pearls in Australia and Indonesia, with a market capitalization of A$59.91 million.

Operations: The company generates revenue from the sale of loose pearls, with A$39.77 million attributed to Australia and A$25.03 million to Indonesia.

Market Cap: A$59.91M

Atlas Pearls Limited has demonstrated strong financial performance, with significant earnings growth of 246.3% over the past year, surpassing its five-year average of 65.8%. The company is debt-free and maintains a robust return on equity at 56.7%, indicating efficient management and profitability. Despite shareholder dilution of 2.6% in the past year, Atlas Pearls' net profit margins have improved to 75.5%. Recent announcements include a special dividend reflecting financial stability and confidence in future prospects, supported by short-term assets exceeding liabilities significantly. However, its dividend track record remains unstable despite current profitability gains.

- Get an in-depth perspective on Atlas Pearls' performance by reading our balance sheet health report here.

- Understand Atlas Pearls' track record by examining our performance history report.

Gale Pacific (ASX:GAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gale Pacific Limited, with a market cap of A$39.76 million, operates in the manufacturing, marketing, distribution, and sale of branded screening, architectural shading, and commercial agricultural/horticultural fabric products.

Operations: The company generates revenue of A$173.98 million from its branded shading, screening, and home improvement products segment.

Market Cap: A$39.76M

Gale Pacific Limited faces challenges as it remains unprofitable, with a negative return on equity of -0.35% and declining earnings over the past five years. The company's recent financial results showed a net loss of A$0.332 million for the year ended June 30, 2024, compared to a net income of A$3.7 million the previous year. Despite these setbacks, Gale Pacific's debt is well covered by operating cash flow and its short-term assets exceed liabilities significantly. Recent leadership changes include Troy Mortleman's appointment as CEO, aiming to drive strategic growth initiatives across global operations.

- Click to explore a detailed breakdown of our findings in Gale Pacific's financial health report.

- Explore historical data to track Gale Pacific's performance over time in our past results report.

Tribune Resources (ASX:TBR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tribune Resources Limited, along with its subsidiaries, focuses on the development, exploration, and production of mineral properties in Australia and has a market cap of A$256.57 million.

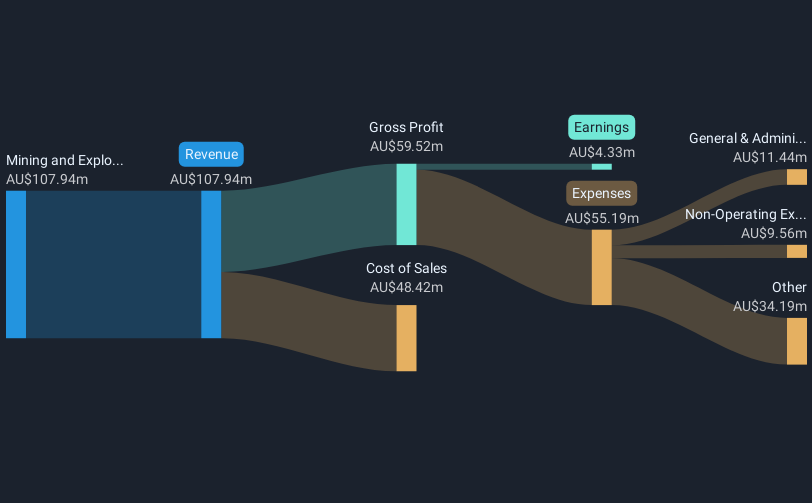

Operations: The company generates revenue of A$107.94 million from its mining and exploration operations.

Market Cap: A$256.57M

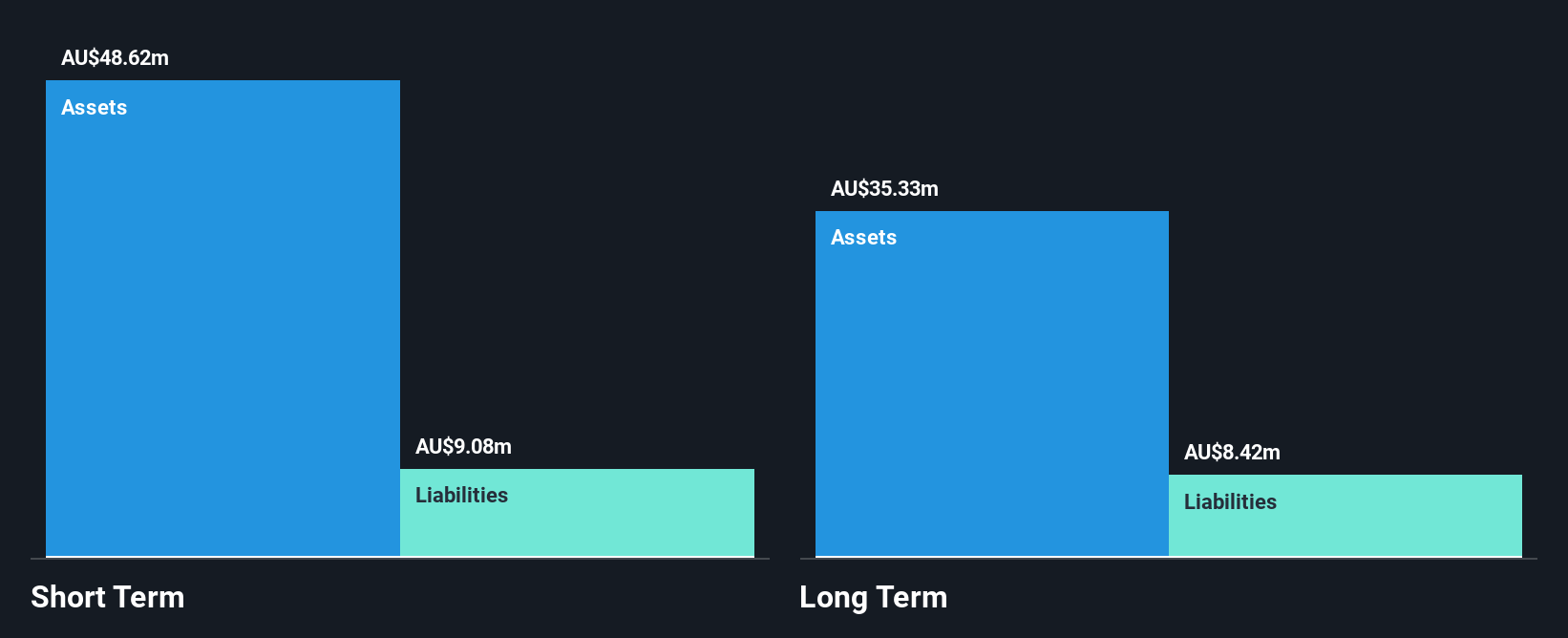

Tribune Resources Limited has demonstrated significant financial improvement, reporting A$107.94 million in sales and a net income of A$4.33 million for the year ended June 30, 2024, up from A$0.52 million the previous year. The company benefits from a robust balance sheet with no debt and short-term assets of A$218.8 million exceeding both short and long-term liabilities significantly. While earnings grew by a very large margin over the past year, its return on equity remains low at 2.8%. Despite improved profit margins and high-quality earnings, dividends are not well covered by current profits.

- Click here and access our complete financial health analysis report to understand the dynamics of Tribune Resources.

- Examine Tribune Resources' past performance report to understand how it has performed in prior years.

Next Steps

- Click here to access our complete index of 1,031 ASX Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tribune Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TBR

Tribune Resources

Engages in the development, exploration, and production of mineral properties in Australia.

Flawless balance sheet with proven track record.