- Australia

- /

- Metals and Mining

- /

- ASX:MGX

Three Undiscovered Gems in Australia with Promising Potential

Reviewed by Simply Wall St

The Australian market has recently experienced a mixed performance, with the ASX200 closing down 0.38% and sectors like Real Estate and Utilities facing declines, while Materials and Information Technology showed resilience. Amid these fluctuations, investors are increasingly on the lookout for small-cap opportunities that can withstand broader market volatility and offer promising potential for growth. Identifying such undiscovered gems requires a keen eye for companies with strong fundamentals, innovative projects, or strategic partnerships that align well with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

EQT Holdings (ASX:EQT)

Simply Wall St Value Rating: ★★★★★☆

Overview: EQT Holdings Limited, along with its subsidiaries, offers philanthropic, trustee executor, and investment services in Australia and has a market capitalization of A$840.24 million.

Operations: EQT Holdings generates revenue primarily from its Trustee & Wealth Services, contributing A$99.08 million, and Corporate & Superannuation Trustee Services, adding A$71.51 million. The company also earns A$3.52 million from its operations in the United Kingdom and Ireland under Corporate Trustee Services.

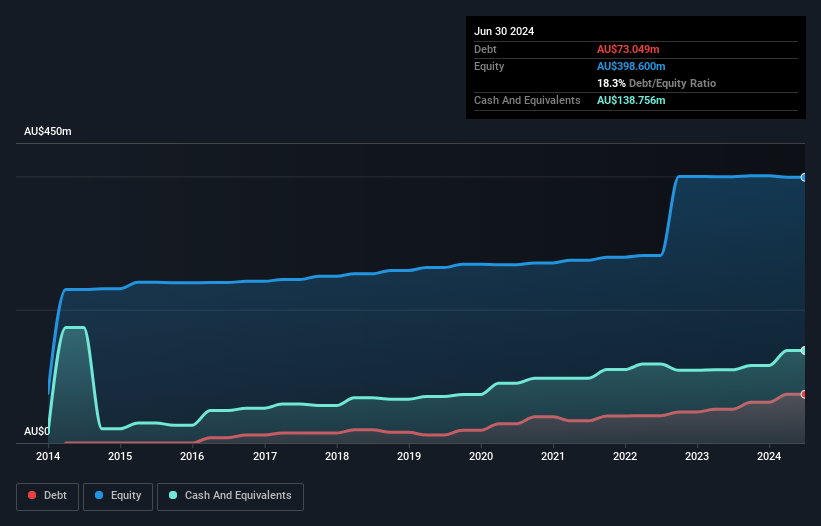

EQT Holdings, a smaller player in the market, showcases some intriguing financial dynamics. Over the past five years, its debt to equity ratio increased from 4.6 to 18.3, yet it comfortably covers interest payments with EBIT at 9.6 times interest obligations. Despite this leverage uptick, EQT holds more cash than total debt and remains free cash flow positive with A$32.54 million as of June 2024. Earnings growth has been modest at 1.2% annually over five years but is projected to accelerate by nearly 22% per year moving forward, indicating potential for future value appreciation in a competitive industry landscape.

- Click here to discover the nuances of EQT Holdings with our detailed analytical health report.

Review our historical performance report to gain insights into EQT Holdings''s past performance.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★★★★

Overview: Mader Group Limited is a contracting company that offers specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of A$1.27 billion.

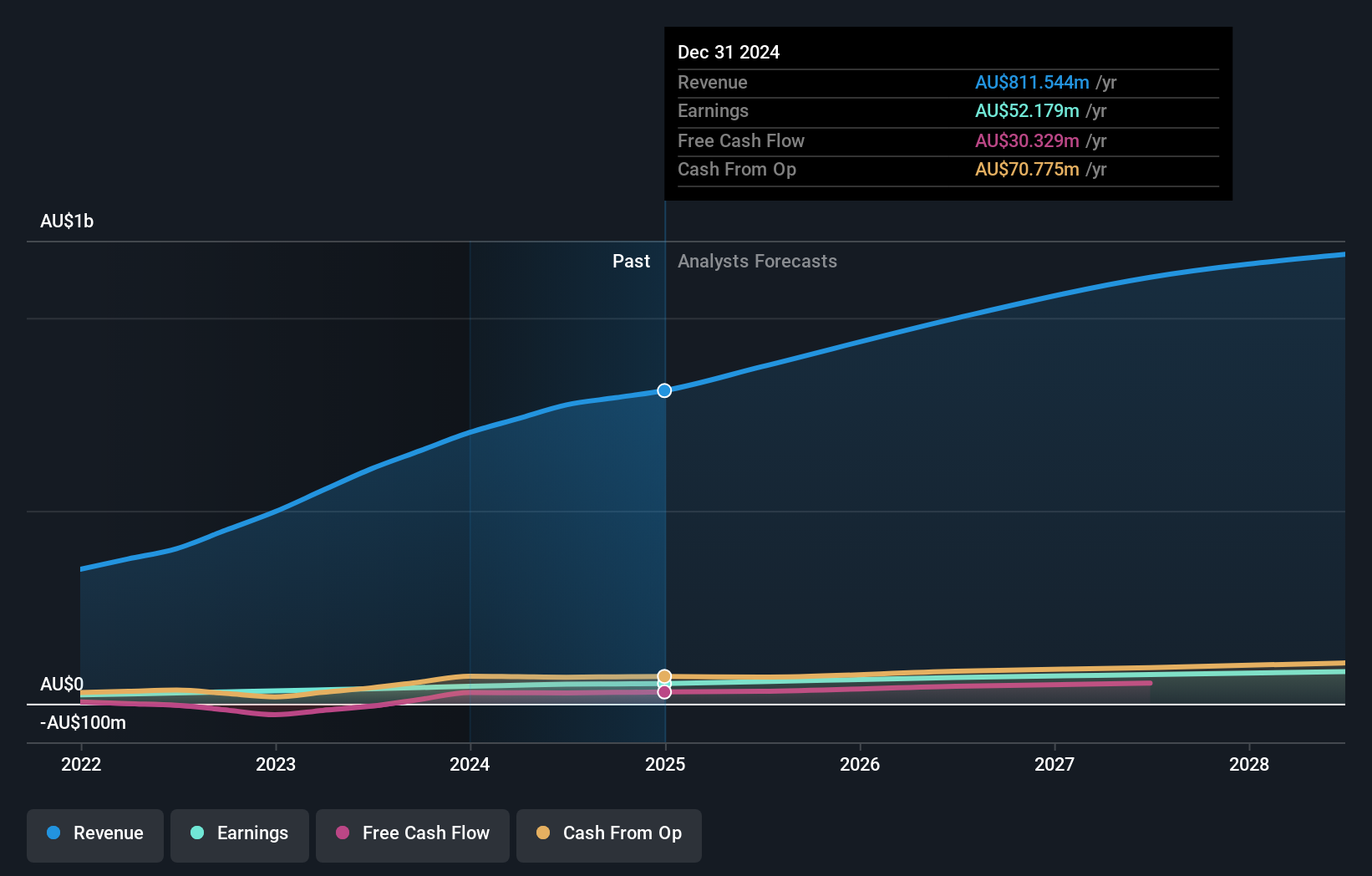

Operations: Mader Group generates revenue primarily through its Staffing & Outsourcing Services segment, which reported A$774.47 million. The company's market capitalization stands at approximately A$1.27 billion.

Mader Group, with its recent inclusion in the S&P Global BMI Index, showcases promising growth potential. Over the past year, earnings surged by 31%, outpacing the Commercial Services industry at 9%. The company's net debt to equity ratio has impressively decreased from 71% to 38% over five years, indicating prudent financial management. Trading at a substantial discount of over 51% below estimated fair value suggests potential upside for investors. However, significant insider selling in recent months may raise some concerns. Mader's interest payments are well-covered by EBIT at nearly 20 times coverage, reflecting robust operational performance.

Mount Gibson Iron (ASX:MGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Mount Gibson Iron Limited is an Australian company involved in the mining, processing, and export of hematite iron ore to markets including China, with a market capitalization of A$387.30 million.

Operations: Mount Gibson Iron generates revenue primarily from its Koolan Island operations, amounting to A$667.68 million.

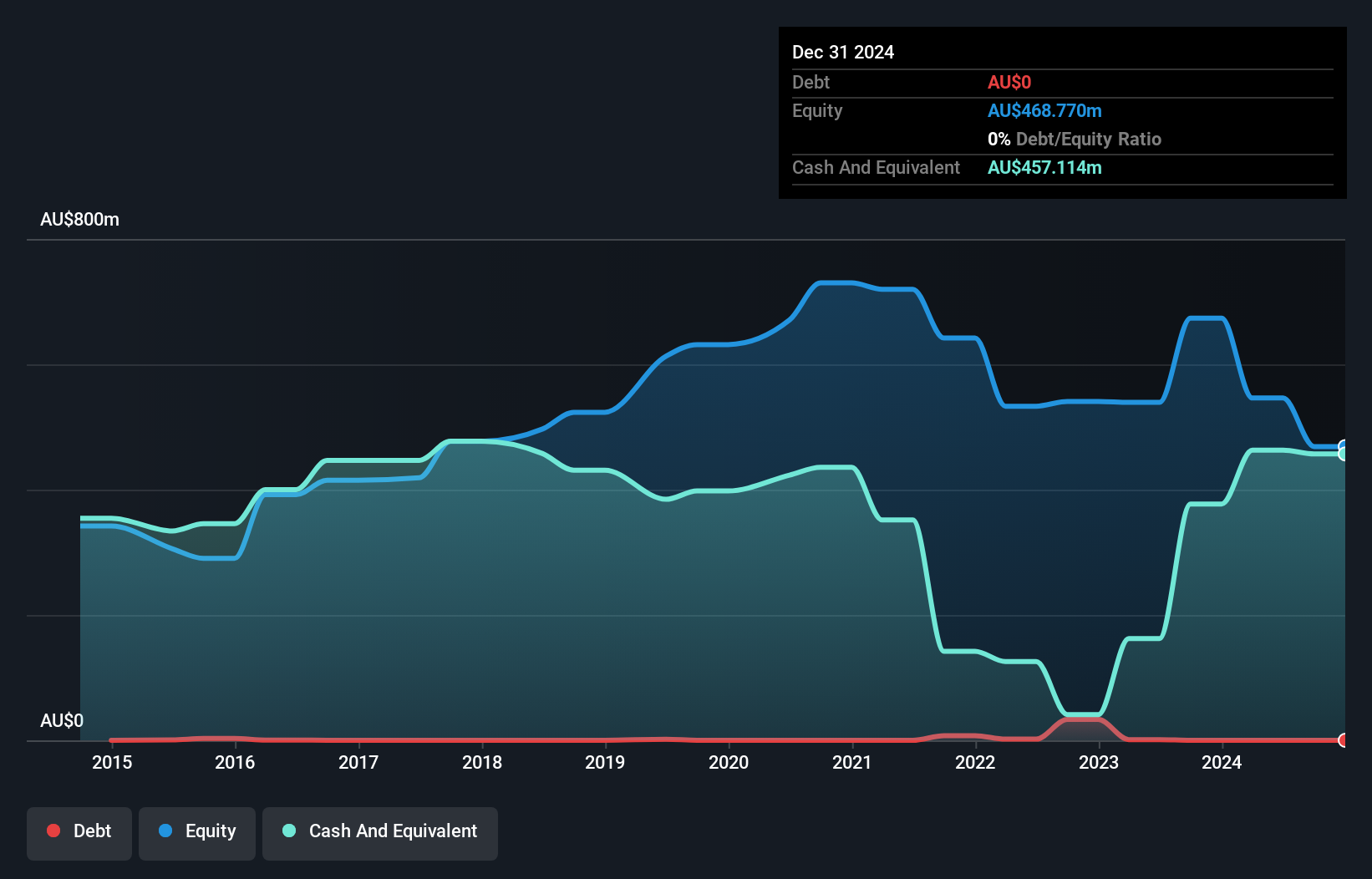

Mount Gibson Iron, a nimble player in the mining sector, has been making waves with its impressive financial performance. Over the past year, earnings surged by 24%, outpacing the industry average of 4%. The company is debt-free and boasts high-quality earnings, which positions it well for future ventures. Trading at nearly 99% below its estimated fair value suggests potential upside. Recent strategic moves include seeking acquisitions in bulk materials or base metals to extend business growth beyond Koolan mine's life. Leadership changes bring seasoned expertise as Brett Smith steps in as an Alternate Director, reinforcing their strategic direction.

- Click here and access our complete health analysis report to understand the dynamics of Mount Gibson Iron.

Examine Mount Gibson Iron's past performance report to understand how it has performed in the past.

Next Steps

- Navigate through the entire inventory of 58 ASX Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MGX

Mount Gibson Iron

Engages in the mining, crushing, processing, shipment, sale, and export of hematite iron ore in Australia and China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives