- Australia

- /

- Professional Services

- /

- ASX:IPH

Is IPH Limited's (ASX:IPH) Recent Performance Underpinned By Weak Financials?

With its stock down 17% over the past three months, it is easy to disregard IPH (ASX:IPH). To decide if this trend could continue, we decided to look at its weak fundamentals as they shape the long-term market trends. Particularly, we will be paying attention to IPH's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for IPH

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for IPH is:

9.6% = AU$61m ÷ AU$634m (Based on the trailing twelve months to June 2024).

The 'return' is the yearly profit. So, this means that for every A$1 of its shareholder's investments, the company generates a profit of A$0.10.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of IPH's Earnings Growth And 9.6% ROE

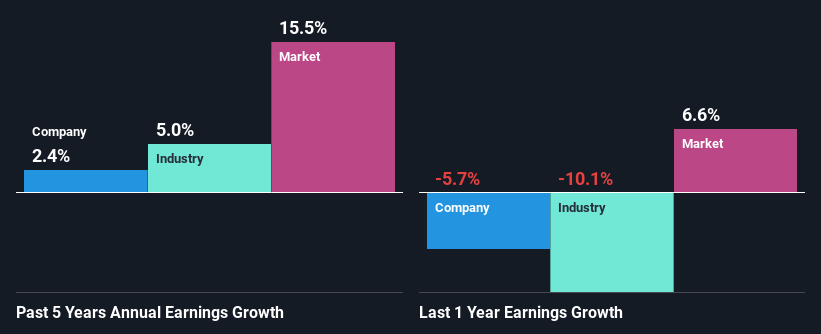

When you first look at it, IPH's ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 16% either. Accordingly, IPH's low net income growth of 2.4% over the past five years can possibly be explained by the low ROE amongst other factors.

We then compared IPH's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 5.0% in the same 5-year period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if IPH is trading on a high P/E or a low P/E, relative to its industry.

Is IPH Efficiently Re-investing Its Profits?

IPH has a very high three-year median payout ratio of 126%, which suggests that the company is dipping into more than just its profits to pay its dividend and that shows in its low earnings growth number. This is quite a risky position to be in. You can see the 3 risks we have identified for IPH by visiting our risks dashboard for free on our platform here.

Moreover, IPH has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 77% over the next three years. The fact that the company's ROE is expected to rise to 20% over the same period is explained by the drop in the payout ratio.

Conclusion

Overall, we would be extremely cautious before making any decision on IPH. Specifically, it has shown quite an unsatisfactory performance as far as earnings growth is concerned, and a poor ROE and an equally poor rate of reinvestment seem to be the reason behind this inadequate performance. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IPH

Very undervalued established dividend payer.

Market Insights

Community Narratives