- Australia

- /

- Professional Services

- /

- ASX:CPU

Computershare (ASX:CPU) Valuation in Focus After Strong FY25 Results and Dividend Hike

Reviewed by Simply Wall St

Computershare (ASX:CPU) just delivered its full-year earnings results, and the numbers are catching quite a few eyes. Sales climbed compared to last year, but it was the jump in net income that really stood out. In addition, the company announced a higher ordinary dividend for shareholders, a move that tends to reinforce confidence from both income-focused and growth-minded investors.

This latest update comes after a year when Computershare’s share price has moved up by 43%, even as the past month saw some giveback. Over the longer term, the company’s returns are even more striking, but short-term momentum has waned a little, particularly after recent market volatility. Still, the latest annual results and dividend increase indicate that management sees a solid path ahead, supported by improving earnings fundamentals.

With the share price now off its highs, investors are left with a familiar question: is the recent drop hinting at a buying opportunity, or is the market already factoring in all of Computershare’s growth potential?

Most Popular Narrative: 2.8% Overvalued

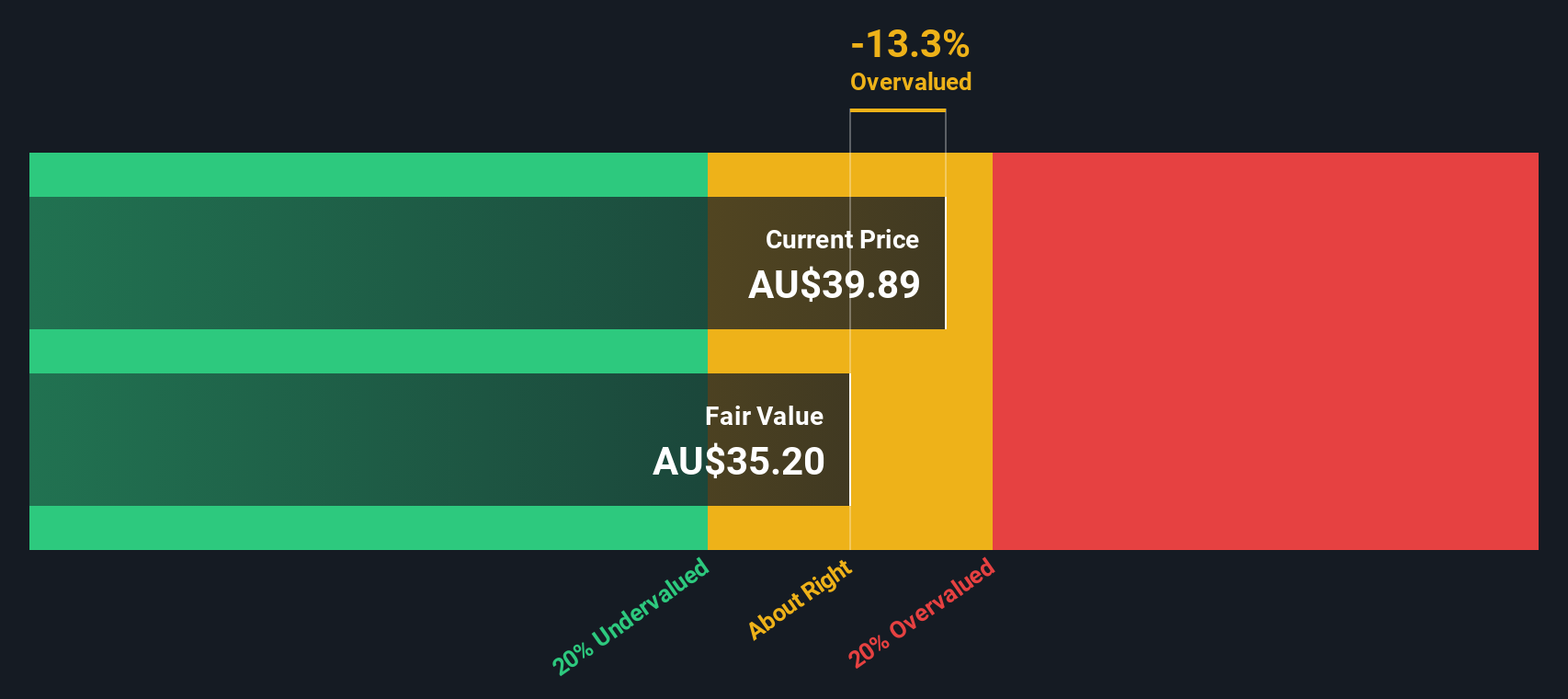

According to the community narrative, Computershare is seen as slightly overvalued based on analyst consensus, with its current price sitting just above calculated fair value using future earnings growth expectations and a discount rate of 6.88%.

Continued investment in digitization and AI technology in Issuer Services is likely to enhance client service offerings and improve operational efficiencies. These improvements can lead to higher net margins over time. Increased corporate action pipelines and expected recovery in debt issuance in Corporate Trust suggest future revenue growth, as the company anticipates benefiting from pending M&A deals and an increasing number of corporate trust deals, which can contribute to revenue expansion.

Curious how a combination of bold technology bets and financial assumptions shape this valuation? Behind the scenes, the analysts’ narrative leans on optimistic profit margins and revenue progress, along with one “future multiple” worthy of a fast-growing disruptor. Want to unlock the calculation at the heart of this valuation and the one key assumption that could swing it all? Keep reading for the full narrative.

Result: Fair Value of $38.41 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as unexpected interest rate cuts or challenges with the execution of new technology could quickly alter Computershare's current outlook and valuation case.

Find out about the key risks to this Computershare narrative.Another View: The SWS DCF Model

Looking at things through our DCF model, a different story emerges. While analyst consensus points to modest overvaluation, our DCF approach suggests the stock may actually be undervalued based on future cash flows. Could the market be underestimating its potential? Or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Computershare Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own Computershare story in just a few minutes and do it your way.

A great starting point for your Computershare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Seeking Even Smarter Opportunities?

Why limit yourself when there are standout investments waiting to be uncovered? Put your money to work in places where quality meets originality. For investors ready to broaden their horizons and capture tomorrow’s winners, check out these handpicked strategies uniquely tailored for thoughtful growth:

- Target sustainable income and reliability as you pick from a select group of dividend stocks with yields > 3% for robust yields and proven performance.

- Spot the companies riding the wave of healthcare innovation by tapping into leaders among healthcare AI stocks who are transforming medicine through artificial intelligence.

- Unlock top value plays and give your portfolio the potential to outperform using our engine to find undervalued stocks based on cash flows with real upside potential based on solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CPU

Computershare

Provides issuer, corporate trust, employee share plans and voucher, communication and utilities, technology and operations, and mortgage and property rental services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives